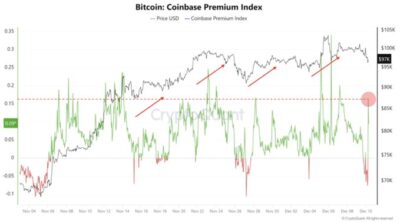

Bitcoin’s price experienced a sharp decline as a wave of selling swept through the crypto market. However, an intriguing development occurred alongside the drop: the Coinbase Premium surged. According to blockchain analytics firm CryptoQuant, this divergence signals a shift in market dynamics as Bitcoin plummets but the Coinbase Premium rises.

Source: CryptoQuant

Also Read: Coinbase CEO Brian Armstrong Criticizes DOJ’s Investigation into Polymarket as FBI Raids CEO’s Home

Coinbase Premium and Its Implications for Market Sentiment

The Coinbase Premium measures the difference in Bitcoin’s price between Coinbase Pro and Binance. A higher premium indicates increased buying demand, particularly from U.S. investors. Coinbase, a popular exchange among U.S. institutional investors, often reflects more significant moves from large players.

Recently, the Coinbase Premium showed negative values, signaling lower demand. However, the premium rebounded after Bitcoin’s price drop, suggesting that institutional investors responded aggressively.

Similar to the behavior of institutional players in a small retail investor base, Binance, institutional players also buy large volumes of Coinbase during a panic sale. This means these Investors see the current downfall as an opportunity in the Coinbase Premium to repurchase it. It also indicates that a foreign institutional interest may have a role in propping up the market when there is volatility.

Crypto Market Faces Major Sell-Off

The broader cryptocurrency market faced a significant sell-off. Bitcoin dropped to $94,220 on Tuesday, down from a high of $104,000 on Dec. 5. This rapid fall triggered liquidations exceeding $1.6 billion over the past 24 hours spurred by leveraged positions being wiped out. The total cryptocurrency market shrunk by over $200 billion, causing a 3.73% drop and a total outlay of $3.47 trillion.

In addition to Bitcoin, major cryptocurrencies like Ethereum and Dogecoin also struggled, failing to gain significant momentum during the downturn. CoinGlass said over $1.39 billion in long positions were liquidated, marking the largest liquidation event since 2021.

Despite the overall downturn, the sharp rebound in the Coinbase Premium signals that U.S. institutional investors remain optimistic about Bitcoin’s potential, possibly preparing to take advantage of lower prices in the coming weeks.

Also Read: Coinbase to End USDC Yield Services in Europe Amid MiCA Regulations