- XRP outpaces Ethereum in Coinbase revenue despite lower trading volume.

- Coinbase earnings reveal XRP’s rising dominance in transaction contributions.

- XRP secures second spot in Coinbase’s Q2 2025 revenue chart.

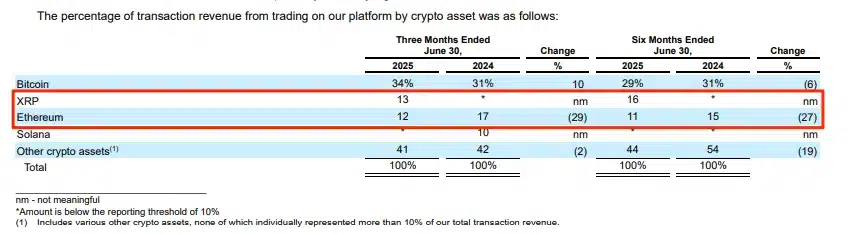

The XRP community was renewed in excitement following Coinbase’s latest earnings report, which revealed a surprising shift in revenue rankings on the exchange. Despite recording a smaller share of trading volume, XRP brought in more transaction revenue for the platform than Ethereum.

This rather severe unforeseen twist placed the XRP in the second position on the list of revenue generators on Coinbase in the second quarter of 2025, lagging only the largest cryptocurrency, Bitcoin.

According to the report, XRP accounted for 13 percent of transaction revenue, while Ethereum secured 12 percent despite handling 15 percent of the total trading volume.

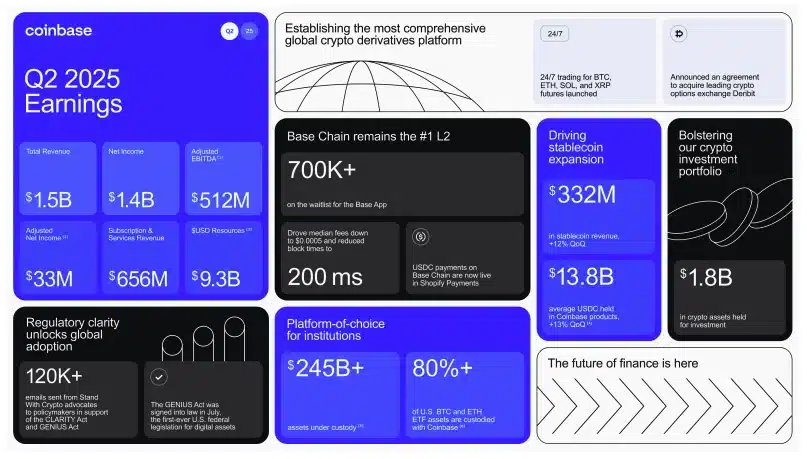

The quarterly total revenue was $1.5 billion, a 26 percent decrease from the previous quarter. Revenue from the transaction services line slipped to $764 million, below analysts’ expectations, due to significantly stalled trading activity.

Source: Coinbase

Also Read: Here’s Why XRP Is Down Today, Crashing Below $3

Overall trading volume fell to $237 billion, down 40 percent, mainly due to reduced activity in stablecoin pairs. Coinbase attributed this decrease to price changes such as those implemented in March 2019, which altered trade dynamics across the platform.

Retail user traffic also decreased, with consumer trading volume falling by 45 percent to $43 billion. Revenue from this segment reached $650 million, marking a 41 percent drop.

Institutional trading was also hurt, as the volume declined by a third and the associated revenue by 15 percent, or $61 million.

Source: Coinbase report

XRP Strengthens Revenue Share Over Six-Month Period

Additional data revealed a growing gap between XRP and Ethereum in long-term revenue contribution. In six months, XRP contributed 16 percent of transaction revenue to Coinbase, compared to Ethereum’s 11 percent.

Context-wise, XRP’s shares were lower than those reported a year ago, which indicates the magnitude of its current growth. In mid-2023, Coinbase relisted XRP after a favorable court ruling, followed shortly afterward by the introduction of XRP futures contracts, which were regulated by the CFTC.

The token has become the third most traded asset on Coinbase, and the interest in the coin continues without pause despite general market losses. Revenue efficiency has emerged as a showcase in XRP’s performance.

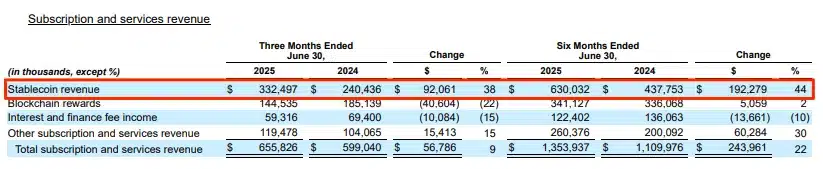

Coinbase’s Crypto Holdings and Stablecoin Revenue Outlook

Coinbase remains one of the largest corporate holders of Bitcoin, with $1.3 billion worth of BTC in its treasury. Ethereum comes next with $300 million, with other crypto assets such as XRP amounting to another $200 million.

In the meantime, revenue connected to stablecoin has grown by 44 percent so far this year, although the Federal Reserve implemented rate cuts. This increase shows stamina in terms of using stablecoins in the Coinbase services.

Source: Coinbase report

Enthusiasm among the XRP community has sprouted as the Q2 2025 earnings report shows that the token managed to leapfrog over Ethereum in transaction revenues. With growing activity and expanded utility on the platform, XRP’s role within Coinbase’s ecosystem continues to strengthen.

Also Read: Solana ETF Filings Updated as SEC Signals Shift Toward Crypto Approval