Last updated on August 1st, 2022 at 10:26 am

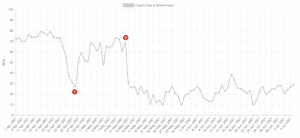

With the recent cryptocurrency market movement, many crypto traders especially the newbies are having a rollercoaster of emotions as their once evergreen portfolio is dancing on a seismic wave of the red sea. It doesn’t call for a panic reaction that may lead to selling off one’s crypto assets in loss, rather it serves as an opportunity to learn. This situation calls for in-depth knowledge of a critical tool (Crypto fear and greed index) that most investors make use of when deciding on their investment choices.

Crypto fear and greed index enables traders measure the market’s levels of instability, so they can know when to buy or sell their assets.

There are multiple methods deployed to understand market pattern, such as technical analysis, fundamental analysis, and sentimental analysis. The crypto fear and greed index belongs to the third, which is a common method to determine the emotion of investors.

In this article, 36crypto has come up with a detailed explanation of the crypto fear and greed index for beginners to understand.

What is the Crypto Fear and Greed Index?

The Fear and Greed Index is a market analysis tool that is deployed to gauge the sentiments and likewise emotions of investors towards the emerging crypto market. The fear and greed index was first introduced by CNNMoney for the stock market.

CNN Money created a fear and greed index for traditional trading markets, featuring the following indicators: Stock Price Breadth, Stock Price Momentum, Safe Haven Demand, Put and Call Options, Stock Price Strength, Market Volatility, and Junk Bond Demand. These indicators are assigned in a balanced proportion with each indicator having a 14.2% weight and measuring different elements of how the stock market is behaving at the present moment.

Following the development of the stock market fear and greed index, the Alternative.me platform developed the crypto fear and greed index in relation to that of CNNMoney but focuses on cryptocurrency market sentiment.

As with traditional trading markets, the crypto greed and fear index ranges from zero to 100, indicating when investors may be too greedy or fearful.

Related: What is cryptocurrency?

There are 5 measurement ranks: Extreme fear, Fear, Neutral, Greed, and Extreme greed. Which have scores varying from 0 to 30, 31 to 49, 50, 51 to 75, and 76 to 100, respectively.

The index’s developers combined large data sources from different backgrounds and considered the following factors when calculating numbers:

Market volume: Market volume assigned 25% of the weighted average determines greed levels rise as buying volumes undergo significant growth. With high market volume, the index gives off a greed sentiment of investors, whereas low market volume and momentum indicates fear.

Volatility: Volatility makes up a quarter(25%) of the index. Huge fluctuations in volatility are taken as an indicator of fear.

Dominance: Dominance accounts for 10% of the weighted average. As Bitcoin’s dominance increases, this is viewed as an indication of a growing greed level; when dominance reduces, investors are scared to put their money into Bitcoin rather they invest hugely in alt-coins.

Trends: Trends also account for 10% of the factors that are combined to make up the fear and greed index. As investors both old and new engage in relative searches on topics related to crypto, these volumes of data are collected, the numbers crunched and we use that for our index.

Social media: Posts on specific hashtags are monitored, collated and counted to track the number of interactions they gain across specific periods. An unusually high interaction rate results in a grown public interest in a coin and relation, corresponding to greedy market behavior. Social media data collection accounts for 15% of the factors needed to develop the fear and greed index.