Former Binance CEO Changpeng Zhao has issued a cautionary message to crypto investors. According to Zhao, only a small number of cryptocurrencies with strong fundamentals will survive and reach new all-time highs.

He expressed such an opinion in his new publication on the social network X, where he wrote that the current fall of the market is temporary. Zhao stressed that even though the market might be uncertain at this point, powerful projects will probably pull out of it and take off as the market rebounds.

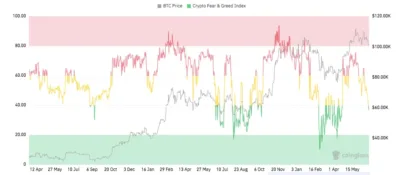

Investor feelings are slowly stabilizing, although heavy precaution prevails, with the Crypto Fear & Greed Index now at a neutral measure of 49. It is a better performance compared to its recent score of 37, indicating a state of fear in the market.

Remember, by definition, everything before the next ATH is a dip.

— CZ 🔶 BNB (@cz_binance) June 23, 2025

Also Read: Solana Price Recovers From Recent Dip, Faces Critical Resistance Near $138

The index, which ranges from 0 to 100, tracks investor emotions and overall sentiment. Scores below 40 signal fear, while scores above 60 indicate greed. The lower the score, the higher the fear, and the higher the score, the higher the greed.

The new reading indicates that risk aversion has reduced, but investors are still reluctant.

Data from Coinglass reveals that fear and neutral sentiment have been the most common across crypto history. About 30.75 percent of trading days have occurred during fear, while 26.94 percent fall under neutral conditions.

Survival Likely for Only Select Projects

Market data also shows that shifts in sentiment closely align with Bitcoin’s price activity. When the index enters high greed levels, price peaks often follow. Conversely, fear usually coincides with corrections or pullbacks in Bitcoin’s value.

When fear dominates the market, the price of Bitcoin is usually between $40000 and $60000. Prices have been observed to rise as greed continues to escalate. These trends indicate that there exists a significant correlation between emotional feelings and price movement.

Zhao’s warning emphasizes the significance of project fundamentals. He is convinced that not all tokens will be able to revert to or exceed their old highs. The assets that will succeed are only those with solid technology, use cases, and community support.

As investor sentiment steadies, Zhao’s remarks remind that only fundamentally strong cryptocurrencies may survive this phase. Market watchers now look to see which projects will prove resilient on the path to the next all-time high.

Also Read: XRP Holds Steady Above Key Support as Analysts Eye Potential July Breakout