CoinGecko warns its subscribers about a fake airdrop, and Binance is back in the spotlight due to a class action lawsuit. Read about this and much more in today’s industry news digest.

New Lawsuit Against Binance and CZ

Three investors have filed a class action lawsuit against crypto exchange Binance and its former CEO, CZ. The lawsuit claims that the investors were unable to recover their stolen assets because the exchange failed to prevent money laundering.

According to the lawsuit, the victims claim that their cryptocurrency was stolen, and the funds were sent by the attackers directly to Binance to remove the connection between the ledger and their digital assets,”, making them untraceable. They emphasize that a key feature of cryptocurrency transactions is the “a permanent record of those transactions” on the blockchain, making them “permanently and accurately traceable.”

Read Also: Crypto Analysis: XRP is Ready to Hit $0.60 Mark When the Market Environment Is Strong

“Therefore, without a place to launder crypto, such as Binance.com, if a bad actor steals someone else’s crypto, there is a risk the authorities would eventually track them down by retracing their steps on the blockchain” the lawsuit states.

The lawsuit accuses Binance of playing a key role in a money laundering scheme, thus violating the US Racketeer Influenced and Corrupt Organisations Act (RICO). It targets criminal organizations that engage in a variety of illegal activities, including money laundering.

CoinGecko Warns of Fraudsters Promoting Fake GECKO Airdrops

On 21 August, cryptocurrency data aggregator CoinGecko published a post on social network X warning its followers about fake airdrops. In it, they urge users to be careful as fraudulent schemes targeting their community are becoming increasingly popular.

CoinGecko claims that misleading claims are being made online about the distribution of $GECKO, which is allegedly their token. The company noted that this is not true, emphasizing that it has no plans to launch such an initiative.

“This is NOT true. CoinGecko does not have any tokens or airdrop plans at the moment. Always stay vigilant and double-check your sources before clicking any links.” CoinGecko wrote.

Such cases are typical tricks used by fraudsters to implement their schemes. They often use the reputation of well-known platforms to deceive unsuspecting users.

Earlier this year, CoinGecko published a Discord screenshot in which a fraudster posed as an author working for the firm and contacted various projects promoting fake airfields. At the time, the company advised users to join their Discord page only through a link on the website to ensure their safety.

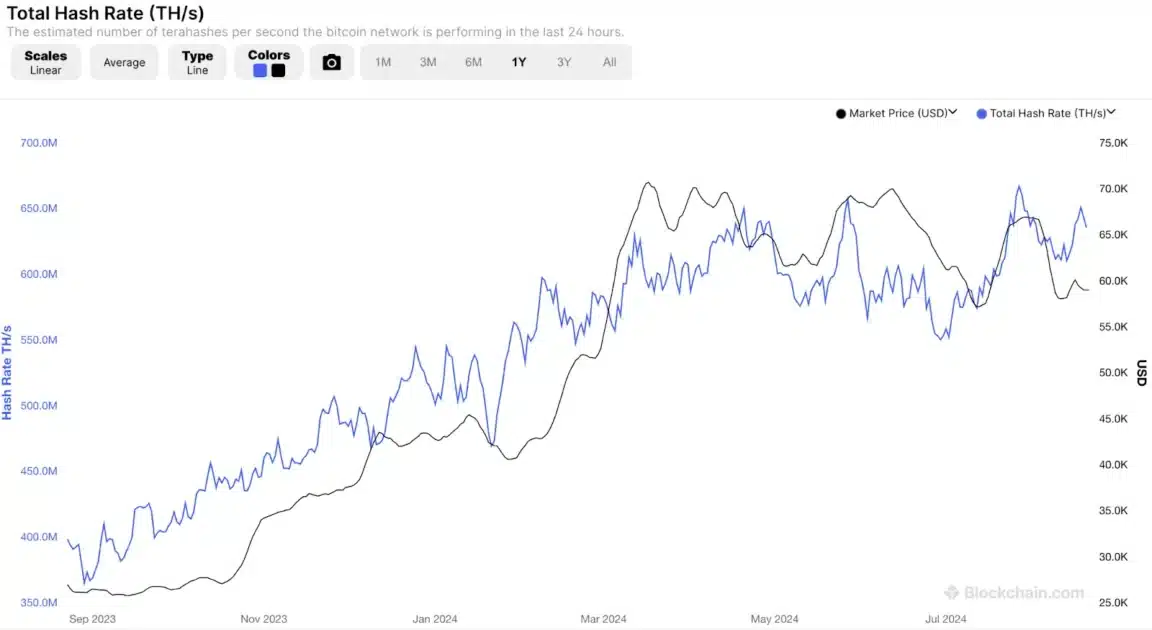

Bitcoin Mining Hashrate Has Rebounded From Its Recent Lows

On-chain data shows that the Bitcoin Mining Hashrate has increased recently, indicating that miners are likely to resume building new capacity. ‘Mining Hashrate is a metric that tracks the computing power that Bitcoin miners currently have connected to the network. When the value of the indicator increases, it means that existing miners are increasing their capacity and new miners are joining the network. This pattern indicates that miners are attracted to the network.

The value of the metric appears to have been going up in recent days. Source: Blockchain.com

Read Also: Germany’s BaFin Clamped Down on Unregistered Crypto ATMs, Seized $28M in Cash

The seven-day average daily hashrate of bitcoin mining, as seen in the chart above, peaked at 667 million THB/s in late July and fell to 610 million THB/s at the beginning of the month. This trend is usually the result of the bearish momentum that Bitcoin experienced at the time.

Miners receive most of their income from the block grant, which is issued at a fixed BTC rate and a fixed time interval. Therefore, the only variable associated with these rewards is the price of the cryptocurrency in US dollars. The previous decline in the asset’s price had a significant impact on miners’ finances.

It is worth noting that the 7-day MA Mining Hashrate has risen significantly over the past week, reaching 650 TH/s two days ago, despite insufficient recovery. It seems that some miners may be betting on this asset, expecting a better result shortly.

In particular, BitFuFu, a cloud mining company affiliated with Bitmain, recently published its unaudited financial and operating report for the second quarter of 2024. It shows a significant increase in the cost of mining Bitcoin amid the challenges and growth the firm has experienced over the past 12 months. Along with the increase in cost, the report also notes an increase in mining capacity under the company’s management, which grew ‘by 62.5% to 24.7 EH/s, compared to 15.2 EH/s in the same period in 2023’.

Despite certain challenges, the Bitcoin mining landscape is evolving, opening up new opportunities that make it an attractive prospect once again. In particular, it is worth noting that this area continues to develop actively, as evidenced by the launch of new mining pools that have taken place recently. Among them is WhitePool by WhiteBIT, which has the highest level of security, one of the lowest fees, competitive rewards, and a Loka mining pool for institutional investors, etc.

Defiance Launches MicroStrategy ETF

On 21 August, Defiance ETFs, a leader in innovative exchange-traded funds, announced that it intends to launch a new long-only leveraged exchange-traded fund (ETF), the MicroStrategy ‘MSTX’ ETF. According to the publication, MSTX aims to provide 175% long daily target exposure to Nasdaq-listed MicroStrategy, which already trades under the ticker symbol MSTR. Defiance said its single-stock ETFs provide access to leveraged funds to invest in disruptive companies without the need for a margin account.

Sylvia Jablonski, CEO of Defiance ETFs, commented on the launch: “Following the tremendous success of the Defiance Daily 1.75X Long MicroStrategy ETF (MSTX), one of the most successful ETF launches to date, we’re thrilled to introduce SMST. SMST offers a strategic tool for investors to manage risk or capitalize on downward trends in Bitcoin. Whether you’re looking to hedge or to profit from short-term downturns, SMST is a powerful tool in your investment arsenal.”

State Street Announces Digital Asset Platform for Institutional Clients

State Street, a global custodian bank, announced on 20 August plans to create a digital asset platform for institutional clients. The company will partner with Taurus, a Swiss-based digital asset infrastructure provider, to offer tokenization, node management, and custody services to institutional clients.

As part of the partnership, State Street will custody clients’ crypto assets and help them create tokenized assets such as funds and other securities. Donna Milrod, chief product officer at State Street and head of digital asset solutions, said the new service is aimed at asset management clients looking for partners who can help them tokenize their funds.

“We need to provide our clients the ability to deal with both traditional finance as well as (digital assets) side by side,” she said.

After the announcement was made, Lamine Brahimi, co-founder and managing partner of Taurus SA, told Cointelegraph: “We believe custody and tokenization are the two faces of the same coin, especially when it comes to performing asset servicing of tokenized securities.”

Read Also: Today in Crypto: Bitcoin Set For a Squeeze As Mt. Gox Moves $850 Million In BTC