- Dogecoin jumps 4%, but derivatives data signals waning momentum ahead.

- Dogecoin faces resistance levels, warning signs of potential downside risk.

- Institutional interest in Dogecoin rises despite sharp decline in trading.

Dogecoin (DOGE) surged 4% on Friday, defying broader market trends as major indices like the S&P 500 remained largely flat. Despite the turbulent macroeconomic environment and ongoing concerns over Federal Reserve policies, DOGE outperformed many assets, closing higher than Thursday’s levels. While the meme coin has managed to capture investor attention with this short-term gain, there are emerging signals that could pose a challenge to its rally.

However, beneath this rise, some concerning trends in the derivatives market suggest that Dogecoin’s momentum might not last. According to CoinGlass, both open interest and trading volume for DOGE futures have plummeted sharply. Open interest has dropped by over 65%, falling from $5.03 billion on October 7 to just $1.70 billion by November 1. Similarly, trading volume has plunged by 74% since mid-October, signaling a decline in market activity and investor confidence.

Institutional interest in Dogecoin remains, however, providing a glimmer of hope for the future. With growing demand for crypto exchange-traded funds (ETFs), companies like 21Shares are reportedly planning to launch a spot Dogecoin ETF. This could spur additional institutional investment and push the meme coin into the mainstream, despite the current market pullbacks.

Also Read: Bittensor (TAO) Skyrockets 21% as Major ETP Launch Fuels Bullish Momentum!

Warning Signs and Technical Indicators Point to Uncertainty for DOGE

While Dogecoin’s price increase is encouraging, technical indicators show a more cautious picture. The Relative Strength Index (RSI) is currently hovering around 52, suggesting that the market is neither overbought nor oversold. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a mild positive divergence, but it’s far from a clear bullish signal.

Source: CoinMarketCap

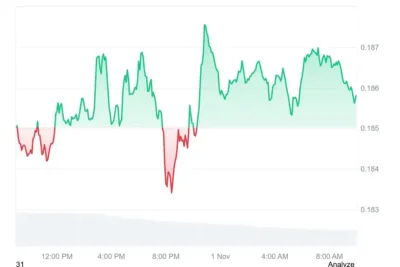

Additionally, DOGE continues to face resistance levels around its 100-day and 200-day exponential moving averages (EMA), which have turned into barriers following the recent correction in October. A breakdown below the $0.18 price point could lead to further losses, potentially dragging DOGE back to the $0.16–$0.15 range, wiping out most of its recent gains.

Despite the short-term rally, Dogecoin’s outlook remains uncertain. The cryptocurrency is caught between brief periods of upward movement and substantial challenges that could lead to another downturn. As the market navigates these tensions, it remains to be seen whether Dogecoin’s rise is the start of a more sustained recovery or just a temporary blip in an ongoing struggle.

Also Read: Financial Expert Warns of Imminent Global Crash – Bitcoin, Gold, and Ethereum to Soar!