Last updated on November 4th, 2024 at 04:49 am

While halving is dominating the industry, April still has a few trump cards to play. Discovering the important changes set to occur this month. April is poised to become a month for monumental changes in crypto. Here is what to expect apart from Bitcoin’s halving.

SEC vs Coinbase Development

One of the pivotal cases in the regulatory spotlight promises to seek its proceeding. SEC and Coinbase mitigation is heating up as the two entities are to agree on case arrangements by April 19.

Source: The Wall Street Journal | Shannon Stapleton/Reuters

This development is followed by the court’s ruling against Coinbase’s motion to dismiss an SEC lawsuit, allowing the Commission to move forward with suing the crypto exchange for operating as an unregistered intermediary of securities.

Notably, U.S. District Judge Katherine Polk Failla agreed to dismiss SEC’s claim that Coinbase acted as an unregistered broker through its crypto wallet.

The silver lining amidst heating tensions marks the significance of the case, the developments of which may go beyond the United States and affect the whole industry.

The case stresses the importance of coining a sound regulatory framework for cryptocurrency assets, which is being pursued by economic watchdogs across the globe.

As Volodymyr Nosov, the CEO at WhiteBIT exchange, believes, the lack of regulatory frameworks makes it challenging for crypto enthusiasts to operate with ease, marking its importance.

CZ’s Sentencing

On November 21, 2023, Changpeng “CZ” Zhao pleaded guilty to a charge of failure to maintain an effective anti-money laundering program at Binance while leaving the chair of the exchange’s CEO and remaining free on a $175 million release bond in the U.S.

The story is not over for CZ as he is facing a maximum sentence of 18 months in prison, while prosecutors reportedly have considered asking for a harsher sentence. The sentencing, initially set for March 30, has been postponed to April 30 and is set to solve the dispute about CZ’s involvement in Binance’s AML drawbacks.

Zhao’s case has sent ripples through the crypto market, highlighting the legal challenges facing industry leaders. The outcome of the litigation is eagerly expected due to the recent sentence of Sam Bankman-Fried, a founder and CEO of the notorious FTX crypto exchange.

March CPI Rate

The US Consumer Price Index (CPI) for March is set to be released on April 10. But why is it crucial? CPI remains a critical economic indicator that could sway market sentiment, as it is one of the most commonly used tools for inflation and deflation measurement. But pivotally, the CPI rate defies the urgency to cut or increase interest rates.

The anticipation of March CPI is catalyzed amidst the recent updates on the US interest rates. In the latest Federal Reserve meeting, Chair Jerome Powell stressed that the body is “not far” from cutting interest rates.

“We’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction,” he stated.

Crucially, February’s CPI increase has kept investors on their toes, marking economic trends to be indirectly impacting the crypto market.

Paris Blockchain Week

One of the main blockchain events – Paris Blockchain Week – is set to take place from April 9 to 11, gathering the key personalities from crypto, institutional investment, and government under one roof.

The significance of the event is marked by bringing together the brightest minds and the top companies – all for pushing forward progress and stressing the cruciality of Web3 mass adoption.

Among the top participants of the event are investors and developers at VanEck, Mastercard, Goldman Sachs, and other leaders of the DeFi sector. Not mentioning the members of the UK Parliament, the Dutch Ministry of Finance, and journalists at the leading crypto media.

Such initiatives tend to spur attention toward the Web3 sector, thus it is sponsored by the dominant entities in the industry, i.e. Stellar, XRP Ledger, Amazon Web Services (AWS), and WhiteBIT. The CEO of WhiteBIT, Volodymyr Nosov, commented on the event:

“WhiteBIT’s presence at the Paris Blockchain Week Summit and Token2049 Dubai underlines our commitment to innovation and development in the field of blockchain. We believe that real progress is achieved through joint efforts and sharing experiences, and this is one of our ways to contribute to the future of blockchain and cryptocurrencies.”

Block Reward Halvings

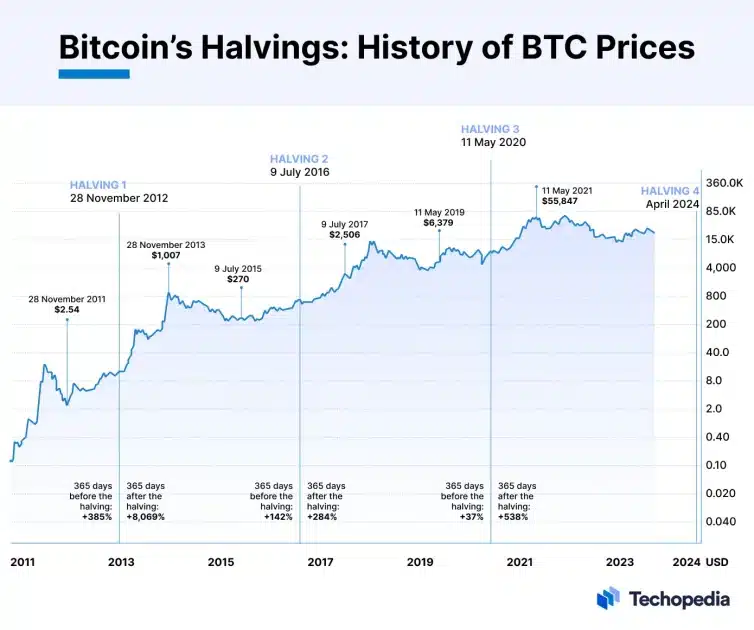

Ultimately, block reward halving for two major cryptocurrencies – Bitcoin (BTC) and Bitcoin Cash (BCH) – remains the top April occurrence for the industry.

BCH halving is expected to take place this week, cutting the mining rewards from 6.25 to 3.125 BCH. Such an event is crucial for controlling the coin’s inflation and supply dynamics and spurs speculative interest due to the reduced rate of new coins entering circulation.

By the end of the month, Bitcoin halving is taking place. It will cut the reward for mining a block from 6.25 BTC to 3.12 BTC, causing extra scarcity of the currency.

Historically, Bitcoin halvings have always been considered significant events, as they underwent alongside bullish market trends and the increase of BTC price specifically. While their factual effect is questioned, halvings have always fueled interest in crypto, providing for its greater adoption.

Bitcoin’s halvings’ history. Source: Techopedia

April may not bring a change in the game, but the month’s events are set to create a monumental impact on all vectors of the crypto industry development, marking its potential adoption at the full-fledged level.