- Epstein’s 2014 Coinbase investment raises new questions within the XRP community.

- XRP’s Coinbase listing delay linked to Epstein’s investment? Speculation grows.

- Ripple’s legal battle ends, but Epstein revelations spark fresh concerns.

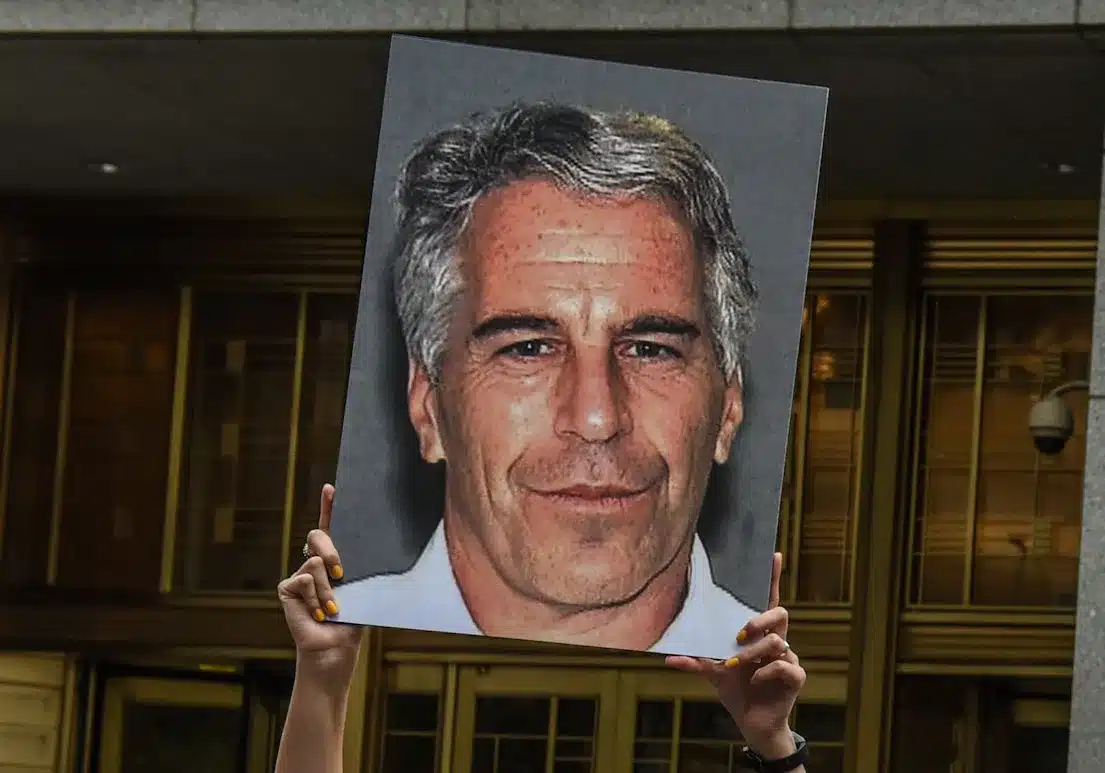

The release of the Epstein files has sparked renewed questions about XRP, a cryptocurrency that was at the center of legal battles, including the high-profile lawsuit with Ripple Labs. The recent email revelations regarding Epstein’s involvement in Coinbase have added fuel to the ongoing discussions within the XRP community.

A part of the released Epstein files disclosed that Jeffrey Epstein invested $3 million in the Coinbase exchange in 2014, a deal that has now raised new questions about the crypto exchange’s ties to controversial figures.

According to newly released emails from the U.S. Justice Department, Epstein’s investment came through Blockchain Capital, led by Brock Pierce, with the knowledge of Coinbase’s co-founder Fred Ehrsam. The emails reveal that Epstein’s assistant managed the transaction through IGO Company LLC, yet the deal was never formally finalized by Blockchain Capital.

What stood out to the XRP community is the timeline, particularly because it came in the same year as the infamous Austin Hill’s email to Epstein, which declared XRP and Stellar as “bad for the [Bitcoin] ecosystem.”

Also Read: XRP’s Price Struggles: Is the Worst Selling Pressure Behind Us?

Coinbase’s Investment: More Questions for the XRP Community

The disclosure of Epstein’s investment in Coinbase has now sparked fresh questions within the XRP community about the role this might have played in XRP’s delayed listing on Coinbase.

Crypto commentator Cobb echoed this sentiment on X, asking whether this investment might have influenced Coinbase’s earlier decision not to list XRP, even though it was publicly reported that the delay was linked to regulatory uncertainties surrounding the coin at the time.

While Coinbase consistently cited concerns over XRP’s regulatory status, many in the XRP community are now questioning whether Epstein’s involvement played a role behind the scenes as part of a broader strategy to suppress Ripple and its token.

It is important to note, however, that the emails released do not provide definitive evidence linking Epstein’s investment to Coinbase’s refusal to list XRP. The details remain speculative at this stage, with no direct link established between the investment and Coinbase’s decision. It’s crucial to note that the emails focus on the financial transaction, and there is no concrete evidence to suggest Epstein’s involvement had any bearing on Coinbase’s policies toward XRP.

The speculation arises from the timing of Epstein’s investment and Coinbase’s eventual stance on XRP. The involvement of figures like Brock Pierce and the controversial nature of Epstein’s financial dealings have led to growing questions among XRP community members, who wonder whether other undisclosed factors contributed to Coinbase’s hesitations.

Ripple-SEC Lawsuit and Possible Epstein Connection

Meanwhile, the Epstein files have fueled more speculation about Epstein’s possible role in the Ripple-SEC lawsuit. While the case officially concluded in August 2025 with Ripple securing a victory, Epstein’s revealed connections to key figures in the crypto space, such as Gary Gensler, have raised questions about whether there was a coordinated effort to suppress Ripple’s influence.

The case, which centered on the classification of XRP as a security, was a landmark legal battle. Although Ripple emerged victorious, many in the XRP community now believe Epstein’s proximity to influential players in the industry at the time may have influenced the SEC’s decision to target Ripple. The resurfacing of emails and ties between Epstein and Ripple critics has further fueled suspicions that the lawsuit may have been strategically orchestrated to undermine XRP’s position in the market.

Conclusion

The Epstein files have opened up new questions for the XRP community, with many wondering about the potential influence of Epstein’s investment in Coinbase on the exchange’s refusal to list XRP for long. While the emails do not provide definitive proof of any connection, the speculation surrounding the Coinbase investment has only added to the uncertainty that has defined XRP’s journey.

As the legal battle between Ripple and the SEC is now in the rearview, the XRP community now looks ahead, seeking clarity and transparency in an industry still marked by questions about fairness, influence, and accountability.

Also Read: Top Analyst: ‘XRP Relief Looks Due Any Minute Now’ – Here’s Why