- Early crypto emails and academic ties reignite questions around Ripple’s SEC lawsuit.

- Epstein’s proximity to Ripple critics resurfaces amid renewed scrutiny of XRP regulation.

- A timeline of influence fuels speculation over whether Ripple’s lawsuit was deliberate.

A long-running debate within the XRP community has questioned whether the SEC’s lawsuit against Ripple was intentional. Members have always argued and speculated that the case was designed to suppress Ripple and weaken XRP’s role in global payments.

This debate has appeared repeatedly on X and various social platforms, especially during regulatory developments or market downturns. Until recently, the discussion relied largely on circumstantial arguments and fragmented historical references.

The release of emails within the Epstein Files has added new material to that long-running debate. While the documents do not prove orchestration, they have encouraged closer examination of a timeline that critics believe suggests intent. The speculation rests on how early industry hostility toward Ripple evolved alongside institutional overlap and later regulatory action.

The first point in that timeline dates back to 2014, during crypto’s most fragile development stage. Bitcoin faced funding instability, internal governance disputes, and concerns about long-term legitimacy. At the same time, alternative payment networks began gaining attention.

Also Read: ‘Don’t Get Deceived,’ Here’s When The Next Major XRP Pump Will Come: Analyst

Early Crypto Emails That Labeled Ripple A Threat

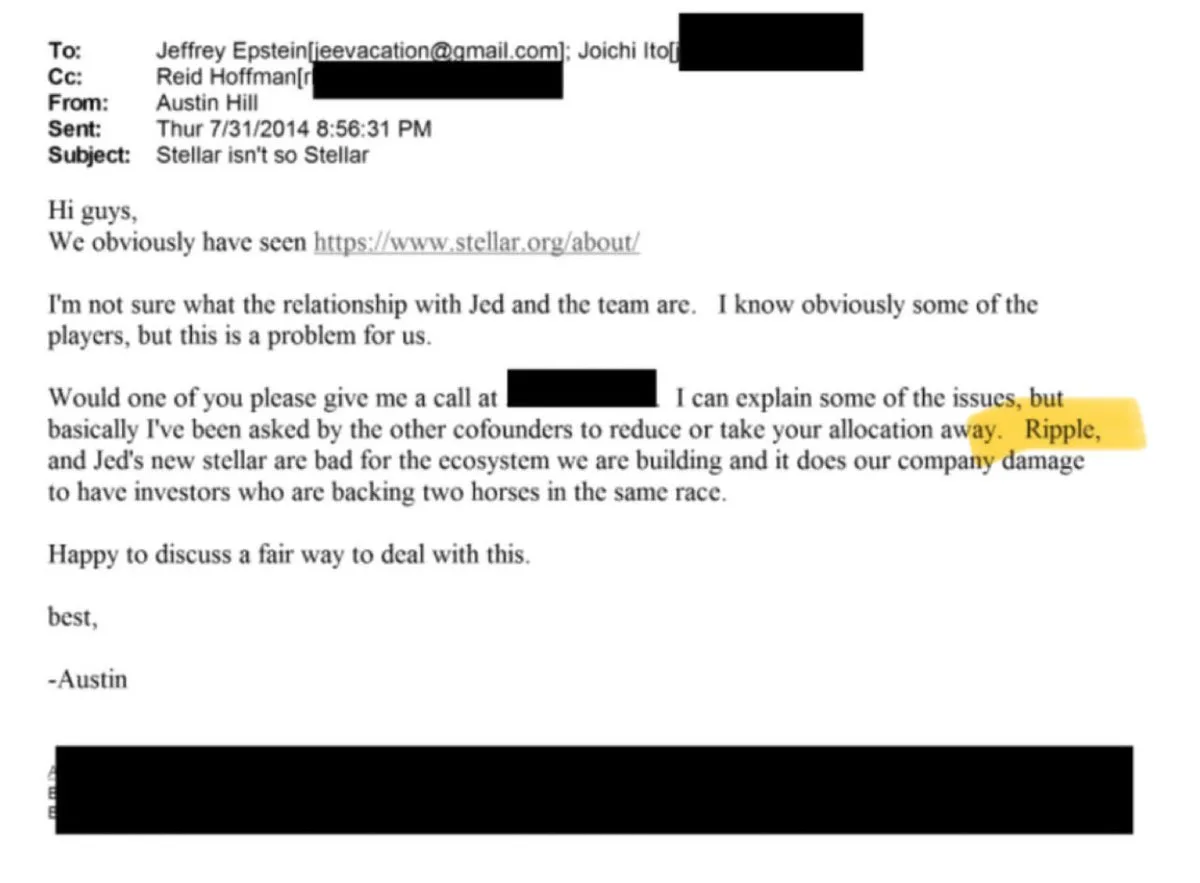

The Epstein files disclosed that in July 2014, internal emails circulated among early crypto infrastructure figures discussing competition within the industry. One of the most circulated emails was a message from Austin Hill, a co-founder of Blockstream, to recipients including Jeffrey Epstein and Reid Hoffman, the co-founder of LinkedIn.

According to the email, Ripple and Stellar were described as “bad for the [Bitcoin] ecosystem,” with the message arguing that investors backing rival networks created strategic and reputational “damage” to the company.

This early characterization matters because narratives formed during crypto’s infancy often carried lasting influence. Besides technical debates, investor alignment shaped perceptions of legitimacy. Hence, projects labeled as ecosystem threats faced skepticism long before government involvement.

Source: US Department of Justice

Academic Overlap And The Gary Gensler Timeline

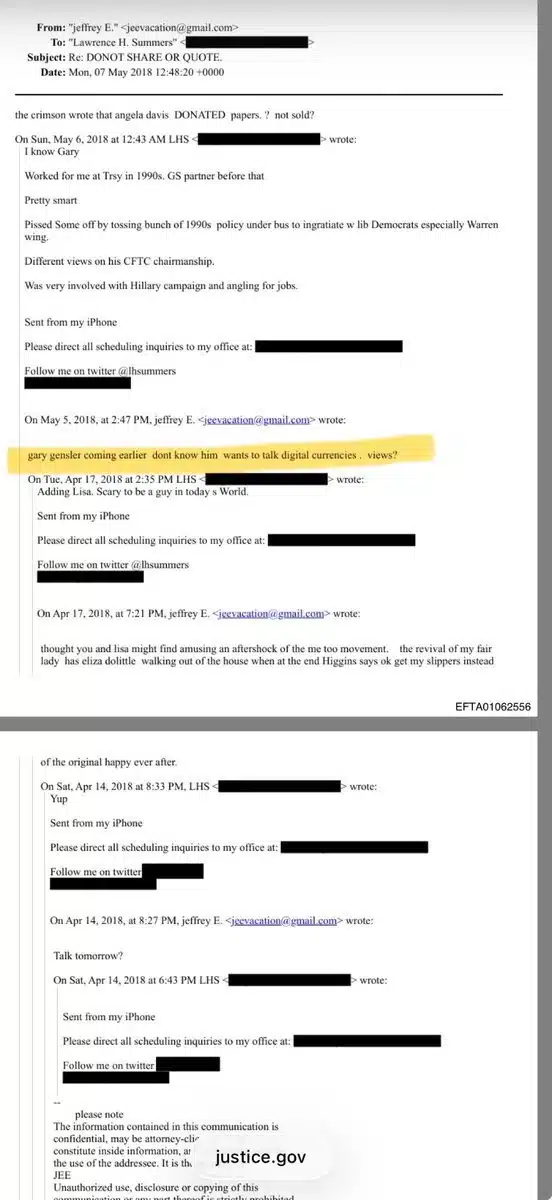

The timeline continues through Epstein’s involvement with academic institutions. According to more released files, Epstein donated to MIT Media Lab during a period when blockchain research expanded rapidly. The lab later became a hub for digital currency discussion and education.

During this period, Gary Gensler taught blockchain and digital currency courses at MIT. In a private email released within the Epstein Files, Epstein asked contacts about Gensler’s views on digital currencies. The correspondence did not confirm a meeting or collaboration. Still, critics note the overlap between academic influence and later regulatory authority.

Years later, Gensler became Chair of the SEC, and under his leadership, the agency filed a lawsuit against Ripple alleging XRP qualified as an unregistered security. For skeptics, the sequence from early hostility to later enforcement appeared more than coincidental.

Source: US Department of Justice

Why The Timeline Continues To Raise Questions

According to Patrick Riley, a pundit and entrepreneur, the resurfaced emails reinforced concerns he raised earlier about institutional proximity shaping crypto outcomes. His commentary reframed the documents as connected events rather than isolated moments.

“I told you all 31 Dec 2022 that Gary Gensler was directed through Epstein and Mossad to go after Ripple and XRP. Meanwhile, the Bitcoin Foundation was backed by Epstein. Now you know it is true,” Riley wrote in a widely circulated post on X.

Meanwhile, Former Ripple chief technology officer, David Schwartz, reacted to the circulating document, explaining how the individuals in the email conversation labeled early investors who invested in Bitcoin infrastructure and in Ripple and Stellar as opponents and enemies.

The widely publicized lawsuit, which ran from December 2020 until August 2024, focused largely on securities law interpretation, which many interpreted as a deliberate attempt to subdue Ripple’s (XRP) growth.

U.S. Judge Analisa Torres later limited several SEC arguments, and ultimately ended the case with a ground-breaking ruling that declared XRP as non-security. Even so, the Epstein Files have exposed historical proximity that many investors and observers had not previously considered.

The timeline between the Ripple-Stellar conversation, the Gary Gensler mention and eventual appointment as SEC chair, and the Ripple lawsuit continues to raise speculations about a possible orchestration.

Although the emails do not prove the lawsuit was orchestrated, they continue to raise speculation. For critics, the timeline highlights how early narratives, elite access, and later regulatory authority intersected. That perceived pattern explains why the debate remains active within the XRP community.

Also Read: HKMA Chief Signals Imminent Stablecoin License Approvals as Review Nears Completion