Last updated on March 25th, 2025 at 09:17 am

Fundamental analysis of Ethereum and XRP – the only altcoins who held their ground in the face of last week’s volatility

While the market entered into the recovery zone, following Bitcoin’s $70K rebound, the attention switched back to altcoins. A great deal of it envisages Ether (ETH) and Ripple (XRP) as the potential leaders for the altcoin rally. Are there any hints for it?

Why Altcoin Rally Is Brought Up

The last few weeks’ downtrend for Bitcoin forced the entire market into a correction zone, with a majority of altcoins shedding their value.

Despite this, altcoins managed to maintain their positions. According to the data by RektCapital, despite Bitcoin’s 18% pre-halving retrace, the altcoin market cap continued to hold on to the $315 billion level as support.

The Altcoin Market Cap retest was successful

The recent -18% Bitcoin Pre-Halving Retrace wasn't able to force Altcoin Market Cap to lose this red $315bn level as support#BTC #Crypto #Bitcoin https://t.co/jWLlZAzCk0 pic.twitter.com/S63WiIg6JV

— Rekt Capital (@rektcapital) March 25, 2024

Among the altcoins, Ether (ETH) and Ripple (XRP) showed the best consistency throughout the period, indicating steady daily volume.

At the same time, the correction trend did not sharply impact WhiteBIT Coin (WBT – the centerpiece of Whitechain), Near Protocol (NEAR), and other altcoins.

Ether (ETH): Confidence Amidst Sellover

It is apparent from the Santiment data that Ether (ETH) has been undergoing high selling pressure. This is evidenced by the increased supply of tokens on the exchanges.

The infographic also points out the rise of Ether supply held by top addresses. Regardless of the sellover and price drops, the metric indicates whales’ confidence in the coin.

Ether supply on exchanges and supply held by top addresses. Source: Santiment

Whales’ confidence contrasts with Ether’s 1-day chart as the metrics indicate the bearish advantage. While the long-term EMAs (50 and 200) hint at the uptick, and the RSI rate counts slightly above 50, MACD is suggesting a downtrend and leaning toward a selling action at 21.0.

ETH/USDT 1D chart. Source: WhiteBIT Trading View

Notably, the exponential moving average 21 exhibits a split decision between sell and buy signals, marking the dichotomy between short-term skepticism and long-term optimism of the investors.

How Is XRP Performing?

Amid the market recovery, XRP indicated 2% growth in the last seven days. At press time, the coin was trading at $0.6921 with a market cap of over $34 billion.

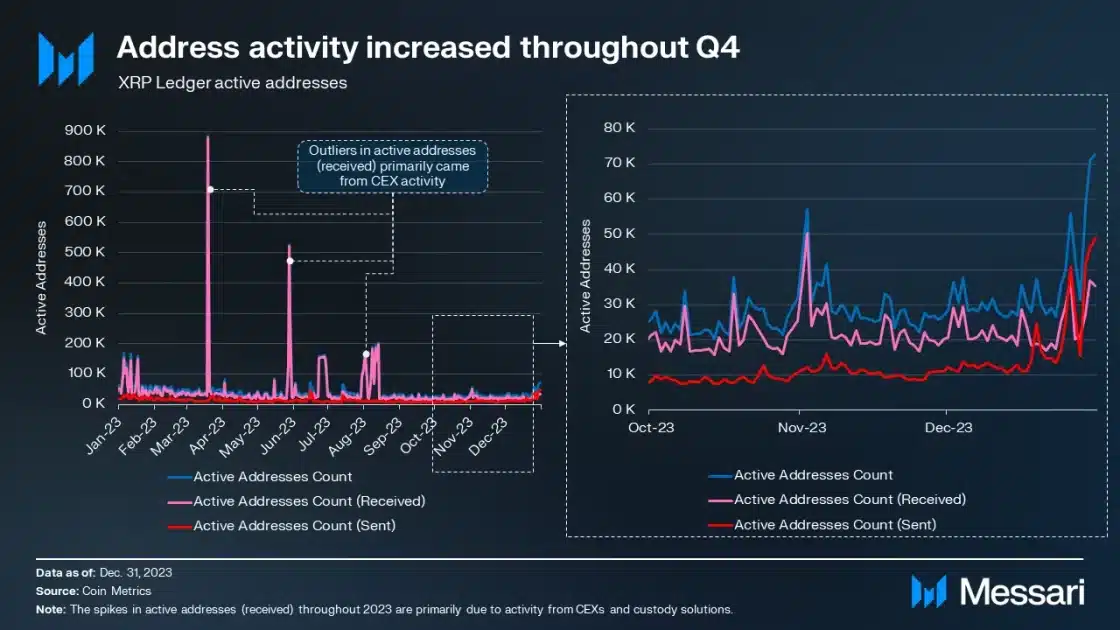

The bullish potential may be concluded as per XRP Ledger addresses’ activity that demonstrated a significant boost in the fourth quarter of 2023.

XRP Ledger active addresses. Source: Messari

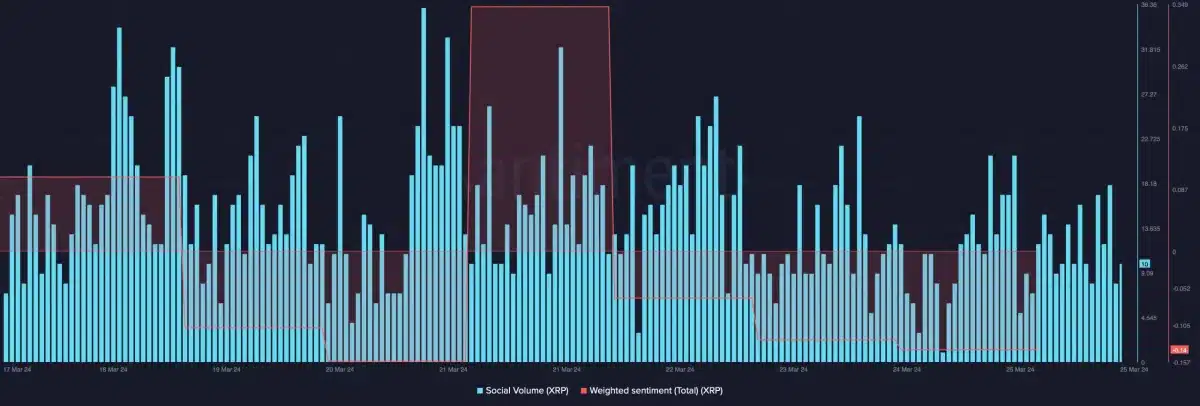

Despite the price rise, XRP underwent a drop in the Social Volume and Weighted Sentiment metrics. This brings an inclination towards the coin’s bearish perspective.

XRP Ledger social volume and weighted sentiment (total). Source: Santiment

The chart tells a similar story, as both long-term and short-term SMAs signal a clear downtrend.

XRP/USDT 1D chart. Source: WhiteBIT Trading View

Moving Average Convergence Divergence and Relative Strength Index prove the aforementioned findings by pointing out the bearish outlooks.

Still, many share the optimistic view of the XRP’s moves. One of them – an investor nicknamed Mikybull – sees a bullish flag pattern in the chart. According to him, XRP has concluded its retest and is about to set an upward movement to the $1-$6 range.

It has concluded its retest and it's now preparing for an explosive upward move🚀

🎯Targets: $1-$6 https://t.co/3Vsr67s32z pic.twitter.com/Dbdu2kVhpa

— Mikybull 🐂Crypto (@MikybullCrypto) March 25, 2024

Such optimism may be the foremost source that is fueling settlement on the altcoin rally. Still, it does not overshadow the possibility of the crypto market’s future thriving. There is a great chance that altcoins will follow Bitcoin’s (BTC) post-halving performance – if one takes place.

Read more: