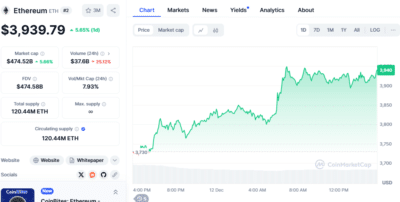

Ethereum has seen a significant price rise recently. From $3,730.41 last week, ETH has climbed to $3,939.79, marking an impressive 5.62% increase. In just the past 24 hours, Ethereum surged by 5.65%, reflecting strong bullish market sentiment.

As Ethereum’s ecosystem continues to grow, especially in decentralized finance (DeFi) and blockchain applications, expectations of continued price appreciation remain high. The total circulating supply of Ethereum is 120,444,000 ETH, with a current market capitalization of $474.52 billion.

Source: CoinMarketCap

Also Read: Just a Chill Guy Price Prediction: Strong Short-Term Momentum, Promising Long-Term Outlook

Short-Term Ethereum Price Prediction (December 2024)

Ethereum’s short-term forecast for December 2024 suggests a continued upward trend. Below is the predicted price range for ETH in December:

| Date | Average Price ($) | Lowest Price ($) | Highest Price ($) |

|---|---|---|---|

| 12 December 2024 | 3,746.75 | 3,484.48 | 4,009.03 |

| 13 December 2024 | 3,768.93 | 3,505.10 | 4,032.76 |

| 14 December 2024 | 3,790.34 | 3,525.02 | 4,055.67 |

| 15 December 2024 | 3,812.50 | 3,545.63 | 4,079.38 |

Ethereum’s price is expected to stay within the predicted range, maintaining a solid upward trajectory as confidence in the cryptocurrency strengthens. With Ethereum’s expanding role in blockchain technology and finance, prices may continue to rise steadily.

Long-Term Ethereum Price Predictions (2025 to 2028)

The long-term outlook for Ethereum remains positive, driven by continuous network upgrades and increasing adoption across various sectors. Below are the projected price levels for Ethereum in the coming years:

| Year | Average Price ($) | Lowest Price ($) | Highest Price ($) |

|---|---|---|---|

| 2025 | 5,026.31 | 4,021.05 | 6,031.58 |

| 2026 | 5,706.90 | 4,565.52 | 6,848.28 |

| 2027 | 6,502.59 | 5,202.07 | 7,803.11 |

| 2028 | 6,570.10 | 5,256.08 | 7,884.12 |

Ethereum is expected to see steady growth, with the average price rising from around $5,026 in 2025 to approximately $6,570 by 2028. The highest predicted price by 2028 could reach nearly $7,900. Continued development, Ethereum 2.0 upgrades, and growing interest in decentralized finance applications are all likely factors contributing to these price projections.

FAQs:

1. What is the price of Ethereum as of December 2024?

Ethereum is currently trading at $3,939.79, marking a significant increase of 5.62% over the past week.

2. What is Ethereum’s long-term price forecast for 2025?

Ethereum is predicted to reach an average price of $5,026.31 by 2025, with potential highs of up to $6,031.58.

3. How high could Ethereum’s price go in 2028?

Ethereum’s price could climb to an average of $6,570.10, with a potential high of $7,884.12 by 2028.

4. What are the support and resistance levels for Ethereum?

Based on recent analysis, Ethereum’s support level stands at $1,554, while its resistance level is around $3,950.

5. How much will Ethereum be worth in 2026?

By 2026, Ethereum is projected to have an average price of $5,706.90, with a high of $6,848.28.

The outlook for Ethereum remains strong, with continued growth expected both in the short term and the long term. As Ethereum’s ecosystem continues to expand, the price is likely to appreciate, supported by both technological advancements and increasing adoption.

Also Read: Why Memecoins Are Surging Up Today? Top Memecoins to Watch