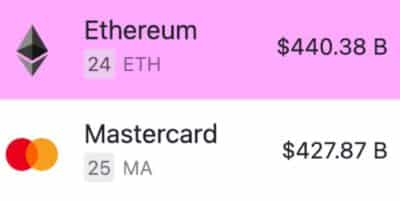

The second largest cryptocurrency in the global market, Ethereum, has witnessed a boost in its total market value. Over the previous 24 hours, the Ethereum price surged by more than 16 percent to a market cap of $440 billion. This push enabled Ethereum to go ahead with Mastercard, which is presently valued at $427 billion.

Read Also: Bitcoin Surges Past $70,973 Mark with 6% Increase Amid Market Optimism

This market movement could be due to the possible change of heart of the United States Securities and Exchange Commission (SEC) on the approval of spot Ethereum exchange-traded fund (ETF) applications. Recently, Bloomberg analysts have boosted the approval probability from 25% to 75%, indicating a dramatic shift in the attitude of the SEC. At first, it was widely believed that VanEck’s ETF filing stood no chance of being approved due to the SEC’s inactivity, but recent rumors about the SEC’s positive shift have prompted this positive update.

SEC’s Swift Actions Propel Market Confidence

Eric Balchunas, the senior ETF analyst at Bloomberg, was the first to report that the exchanges were asked to update their 19b-4 filings as soon as possible. This update might make the path to the approval of an Ethereum ETF as early as this Wednesday smoother. In the current case, Alex Thorn, the head of research at Galaxy Digital, opines that while Ether might be seen as a non-security by the SEC, staked Ether would be a security. Such differentiation is consistent with the SEC’s various court cases and investigations and offers a theoretical possibility of approving Ethereum ETFs without going against its previous statements.

Bitcoin reflected the drastic hike in Ethereum prices, where Bitcoin broke higher again by 6% after touching as high as $71,650 earlier today. Nonetheless, Ethereum is still 25% lower than it was in the recent past, trading at $16, 4% below its record high of $4,878 set in mid-2007.

The cryptocurrency market has had major changes, as we have seen Ethereum surpass Mastercard in terms of market capitalization. This is likely due to the probable approval of Ethereum ETFs by the SEC, which will create greater confidence in the market and, therefore, more growth.

Read Also: Ethereum Founder Vitalik Buterin Discusses What’s Next for the Blockchain.