- XRP price drops sharply after touching $3.6.

- Fool analyst reveals XRP’s future depends on Ripple’s real-world use.

- Ripple’s payment system could drive XRP’s long-term institutional adoption.

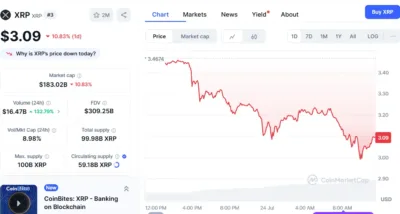

XRP briefly reached a new all-time high of $3.6 before experiencing a sharp decline of 10.83 percent within 24 hours. However, while many traders are focused on price swings and technical patterns, The Motley Fool urges the market to pay attention to something entirely different.

According to The Motley Fool, investors expecting Ripple’s payment expansion or a possible ETF approval to drive XRP’s long-term price higher may need to adjust their expectations. The analyst pointed out that although the price rallies are newsworthy, Ripple will be a force to reckon with in the future because it can be used in worldwide finance.

After a partial legal victory in 2023 and eased regulatory pressure during the tenure of President Donald Trump, Ripple seems to be entering a new stage of strategic orientation.

At the time of writing, XRP was trading at $3.09, a notable decline from yesterday’s price of $3.2, triggered by intensive purchases. This caused its 24-hour trading volume to increase by 132.79 percent up to $16.47 billion.

While the market cap also reduced marginally by 10.83 percent to $183.02 billion, the fact that the trading volume has orchestrated an 83.33 percent increase points to continued interest.

The corrective indicators are evidence of pessimistic investor behavior, yet the analysts say that this temporary tendency does not affect XRP’s behavior.

Also Read: Ripple CEO Releases Important Message to XRP Holders Amid Price Hike

Source: CoinMarketCap

Ripple’s Financial Infrastructure in Focus

Ripple continues to strengthen its position through Ripple Payments, a system designed to enable instant cross-border transactions. Unlike traditional banking approaches, which involve intermediaries and cannot settle quickly, the Ripple network allows direct settlement using XRP.

This structure also shortens the time of transaction and the cost of foreign exchange. XRP is also a bridge currency, meaning that a European bank could transfer value to a Korean institution, for example, without necessarily exchanging currency.

Every cross-border transaction takes only 0.00001 XRP in fees to complete. Ripple currently holds approximately 41 billion tokens, which it gradually releases into circulation alongside the actively traded 59.18 billion XRP tokens.

This model was cited in the 2020 lawsuit filed by the SEC, noting that XRP should be regulated like stocks, bonds, and other securities since it is largely controlled by Ripple. However, a United States judge in 2023 ruled that sales of XRP on the public exchange did not constitute a security.

Nevertheless, The Motley Fool clarifies that despite increasing interest in the use of Ripple technology and crypto-friendly regulations, the success of XRP is unlikely to be reflected in its price in the near future.

The analyst suggests that XRP could see slower, more measured growth instead of dramatic price jumps, contrary to what many in the community expect. As legal risks decline and financial institutions explore blockchain-based solutions, XRP may find its lasting value through utility rather than market speculation.

Also Read: Arthur Hayes Says CryptoPunks Will Outperform Ethereum This Cycle