- XRP has gained 2.3%, driven by reduced whale selling and a broader market rebound.

- A sharp decline in whale-to-exchange flows has eased sell pressure, signaling possible price stabilization.

- XRP is approaching a key resistance at $3.37, and a breakout above this level could open the path to $4.00.

XRP has climbed 2.35% in the past 24 hours, regaining bullish traction after a week-long consolidation phase. The price is currently hovering around $3.25, supported by easing whale activity and a broader market surge led by Ethereum’s approach toward the $4,000 milestone.

As the crypto market rebounds from its brief cooling period, XRP is once again drawing investor attention with its steady price action and improving technical outlook.

Whale Distribution Slows, Reducing Sell Pressure

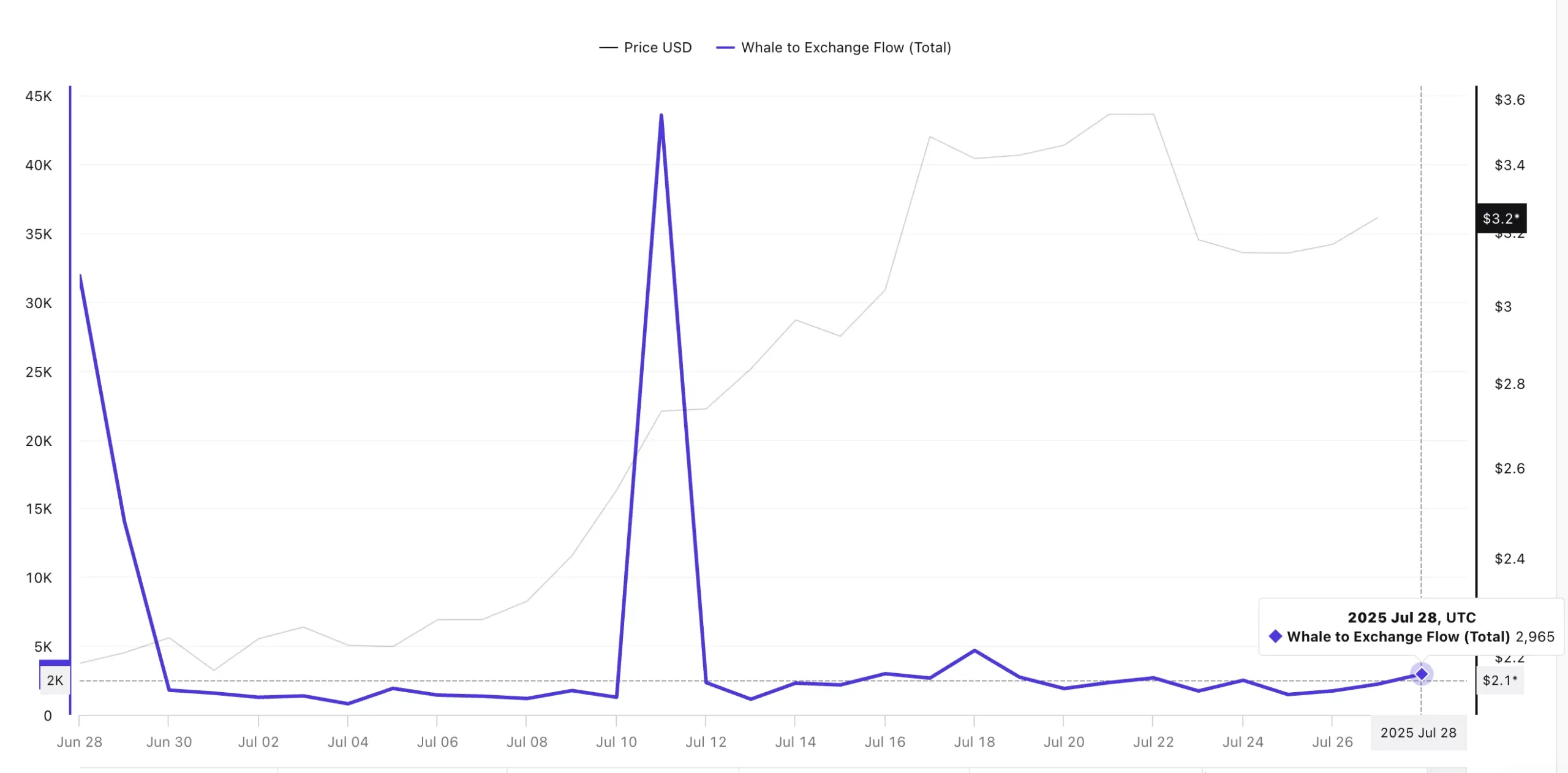

One of the clearest bullish signals emerging for XRP is a significant drop in large wallet outflows to exchanges. These flows, often considered a prelude to institutional selling, have diminished sharply in recent days.

Data shows that on July 11, whale-to-exchange flow spiked to 43,575 XRP. However, by July 28, that figure had plummeted to just 2,965 XRP, a dramatic 93% decrease. This decline indicates a slowdown in selling activity from major holders, a trend often seen before price stabilization and recovery.

Source: CryptoQuant

Also Read: XRP Army Looking Forward to July 30 – Here’s What’s Coming

Although the current outflows are still slightly elevated compared to July 25 levels, the tapering suggests that much of the recent selling pressure may have already been absorbed by the market. This shift opens the door for potential upside, especially if buying volume continues to build.

Price Nears Breakout Zone Amid Strengthening Market

XRP is now approaching a key technical threshold at $3.37. This price level aligns with a critical Fibonacci extension within the current rally structure and represents a resistance point that has remained unbroken throughout the month.

Should XRP convincingly break above $3.37 and establish it as a new support zone, the next major resistance targets sit at $3.62 and $3.83. These milestones would place the asset in a prime position to challenge the $4.00 psychological barrier.

Historical data support the view that when XRP moves past significant resistance clusters with momentum, it often follows through with rapid upward expansion. A clean break above $3.83 would likely mark a new all-time high for the asset.

Risks Remain if Support Levels Are Lost

While the technical structure appears optimistic, analysts caution that the setup could unravel if XRP fails to hold above its lower support levels. Specifically, a breakdown below $2.96, a level identified as the zero Fibonacci extension, would invalidate the current bullish thesis and may trigger a correction phase.

Such a retracement could push XRP back into its previous consolidation range, delaying any attempt at reclaiming record highs.

Outlook

With selling pressure easing and market momentum building, XRP is nearing a critical inflection point. If bulls can push the price above $3.37, the path toward $4.00 becomes significantly clearer.

While downside risks remain, the current trend suggests that XRP may be positioning for a fresh leg higher, particularly if broader market conditions stay favorable.

Investors will be watching closely as XRP tests key resistance levels in the days ahead, with many anticipating a breakout that could reshape the coin’s long-term trajectory.

Also Read: Rumor: Power Struggle Within Ripple Between Garlinghouse and Chris Larsen? Here’s What’s Trending