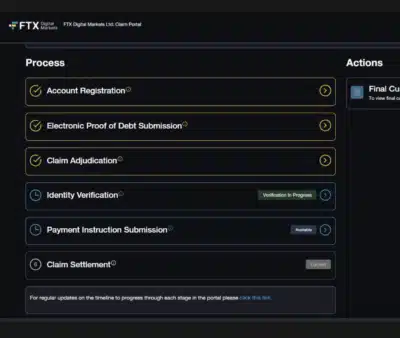

FTX creditors are under immense pressure as the claims deadline approaches January 20, 2025. This critical deadline requires creditors to complete multiple steps, including identity verification (KYC), tax submissions, and payment preferences. Those who miss this date risk facing delays or, in some cases, losing their right to claim distributions entirely.

Source: @sunil_trades

Also Read: Gemini Agrees to $5 Million Settlement Over Alleged CFTC Bitcoin Futures Misrepresentation

Essential Steps for FTX Creditors to Secure Payments

Users are expected to verify their identity through KYC, document inclusion of tax papers, and choice of payment option, among others. This process is mainly helpful for creditors’ claims of less than fifty thousand dollars, and it is crucial to meet these requirements before the prescribed cutoff dates to ensure inclusion in the first distribution phase.

The process was initiated by a record date set for January 3, 2025, whereby SharedPreferences related to KYC verification was necessary. This verification has been confirmed to be a major constraint to many creditors, especially those obtaining Bahamian claims.

Creditors have experienced problems, including administrative delays and confusion over the definition of the relationship between various jurisdictions.

Risks of Missing the Deadline and the Long-Term Consequences

Creditors who fail to meet the January 20 deadline will not receive payments during the initial distribution phase. FTX has assured the public that latency will not lock out arbitrary individuals, for they will, in the future, get their payments.

However, a critical condition exists that is indicated in section 7.8 of the Plan. Creditors who fail to meet pre-distribution conditions within six months from the first distribution stand to be locked out of further distributions altogether.

This stipulation has created a sense of urgency among creditors to act swiftly. This becomes even more problematic when those connected to the Bahamas process are concerned since it remains unclear whether these deadlines can be extended in all jurisdictions.

Mounting Concerns Over the Claims Process

Many creditors have voiced frustration over delays and administrative hurdles. The inability to progress past the KYC stage has prevented some from completing subsequent steps, such as selecting payment instructions.

The lack of transparency regarding the distinction between U.S. and Bahamas claims has heightened concerns. These unresolved issues risk leaving many creditors excluded from the first distribution phase.

Conclusion

As the January 20 deadline approaches, creditors must navigate a complex process to secure their claims. Meeting these requirements is crucial to ensure timely payouts and avoid potential forfeiture of future distributions. With lingering challenges, the pressure continues to mount for those involved in the FTX claims process.

Also Read: MicroStrategy Acquires Additional 1,070 BTC for $101 Million