- XRP has broken out of a long consolidation range, forming a bullish flag pattern reminiscent of past cycles.

- Market analyst EGRAG Crypto highlights Fibonacci-based price targets for XRP at $6.50, $20, and a potential cycle top of $35.

- Rising institutional interest, regulatory clarity, and surging trading volume are fueling optimism around XRP.

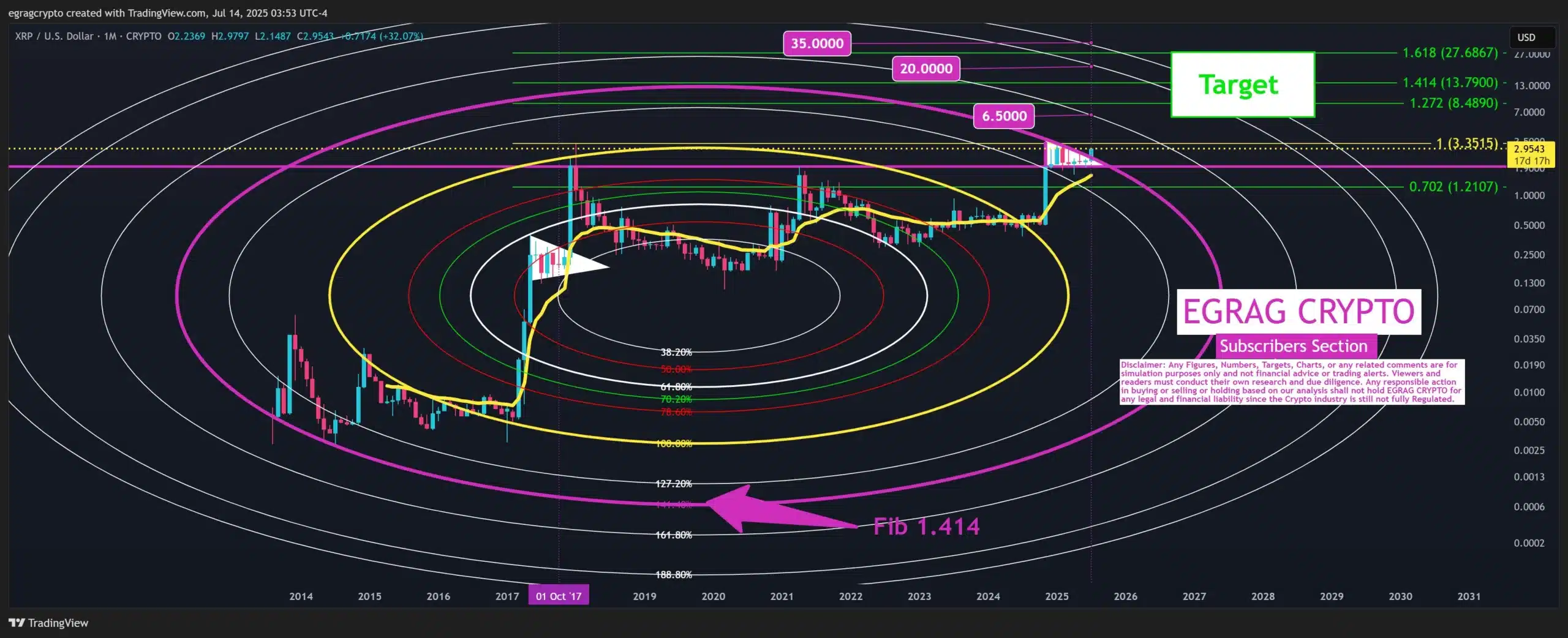

Prominent market analyst EGRAG Crypto has unveiled a set of bullish XRP price targets, highlighting key Fibonacci levels that could define the token’s next rally phase. The analysis comes as XRP breaks out of a months-long consolidation range, driven by renewed market momentum.

XRP Breaks Out After Prolonged Consolidation

XRP recently saw a breakout from its tight consolidation zone between $2.20 and $2.50, a range it had been confined to since March 2025. The rally, fueled by broader crypto market strength, propelled XRP to a high of $3.60 earlier this month, its highest price since early 2018.

Following the breakout, the asset experienced a pullback and is now trading around $3.12 at the time of writing. Despite this retracement, EGRAG suggests the move is part of a larger bull flag formation that could signal a more substantial breakout ahead.

#XRP – Fib Circle Targets ($6.5, $20 & $35) | Measured Move: $17 🎯:

The most crucial move is breaking above the Fib Circle 1.414, which has been a major resistance since December 2024. Now, it’s clear the breakout to the upside is happening! 💥📈

Let’s consider a speculative… pic.twitter.com/6AC9uOSMTO

— EGRAG CRYPTO (@egragcrypto) July 14, 2025

Also Read: The XRP Institutional Takeover They Don’t Want You To See – Pundit Explains

Bull Flag Formation Echoes Past Market Cycles

EGRAG’s technical outlook traces XRP’s current trajectory to a bull flag pattern formed after a dramatic 580% rally between November 2024 and January 2025.

This structure mirrors the pattern observed during XRP’s historic 2017-2018 bull run, where the price surged over 7,000% before consolidating in a flag formation and ultimately hitting an all-time high of $3.45.

According to the analyst, the bull flag represents a pause in the uptrend, where buyers temporarily step back to consolidate gains before another potential leg up. “Now, it’s clear the breakout to the upside is happening!” he wrote.

Fibonacci Levels Point to Ambitious Upside Targets

The centerpiece of EGRAG’s latest analysis is a set of Fibonacci circle targets, which he uses to project future price milestones for XRP. The key resistance lies at the 1.414 Fibonacci extension level, a zone that has acted as a ceiling since December 2024. A successful break above this level could clear the path for XRP to retest and surpass previous highs.

EGRAG identifies three major upside targets based on Fibonacci extensions. The first target sits at $6.50, aligning with the 1.618 level. A more ambitious target at $20 reflects the 1.888 extension, while the final level, considered the top of the current cycle, is projected at $35 based on the Fib 2.0 extension.

Source: Egrag Crypto/X

In contrast to these Fibonacci projections, EGRAG has also outlined a “measured move” target, averaging around $17. He emphasized that while the higher Fibonacci targets represent long-term potential, traders should consider a more strategic approach.

Dollar Sell Averaging Strategy Recommended

To navigate potential volatility, EGRAG advises investors to adopt a Dollar Sell Average (DSA) strategy. Rather than aiming for a single price target, DSA involves gradually exiting positions at various milestones. This approach allows traders to secure profits while minimizing the risk of missing a peak or holding through major reversals.

XRP’s current momentum is part of a broader resurgence in the crypto market. Recent institutional inflows, renewed altcoin interest, and clarity from U.S. regulatory bodies have added fuel to the ongoing rally.

BlackRock’s recent commentary on tokenized assets and Ripple’s expanding partnership in cross-border payments have also contributed to optimism around XRP.

According to data from Coinmarketcap, XRP trading volume has surged over 20% in the past week, while active wallet addresses on the network have climbed to impressive heights.

As Bitcoin hovers below the $120,000 mark, altcoins like XRP are capturing more attention, especially as traders seek out assets with breakout potential in the second half of the year.

Conclusion

XRP’s breakout above its multi-month range, combined with the formation of a bullish flag and clear Fibonacci targets, has set the stage for what could be its most aggressive rally since 2018.

While short-term resistance remains a challenge, analysts like EGRAG believe the token is well-positioned for upside, provided key levels are broken and confirmed.

Also Read: The Next Week Could be Crucial For XRP – Here’s What’s Coming