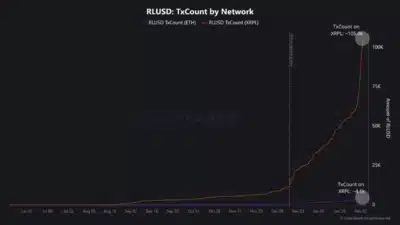

Ripple’s RLUSD stablecoin is gaining momentum in the digital asset space as it achieves a new milestone, showing strong user adoption and market confidence. Since its launch two months ago, the stablecoin has processed over 105,000 transactions on the XRP Ledger (XRPL).

Meanwhile, Ethereum has recorded only 4,109 RLUSD transactions, reinforcing XRPL’s dominance in facilitating the stablecoin’s activity. The substantial preference for XRPL is attributed to its efficiency, speed, and low transaction fees, making it a preferred blockchain for financial transactions.

According to CryptoQuant data, the rapid adoption of RLUSD signals growing trust and highlights its potential in digital payments. As Ripple continues to push for mainstream adoption, the stablecoin is being positioned as a key player in blockchain-based financial solutions.

Also Read: XRP’s Crash Was Manipulated, Expert Reveals How

Ripple Expands RLUSD’s Role in the Financial Ecosystem

Ripple introduced RLUSD to the market in December after receiving regulatory approval from the New York Department of Financial Services (NYDFS).

As a next step, Ripple will strive to increase RLUSD’s operational capabilities as it ventures into decentralized finance (DeFi) networks. RLUSD has gained essential status as a vital resource to facilitate lending and borrowing operations and trading across various blockchain systems.

Designed to be pegged 1:1 to the US dollar, RLUSD is intended to enhance global financial transactions by providing a secure and stable digital currency.

Chainlink Partnership Strengthens RLUSD’s Use Case

Ripple has teamed up with Chainlink to improve RLUSD’s reliability in DeFi. RLUSD price feeds on both XRPL and Ethereum will receive accurate and secure access through Chainlink’s decentralized oracle network, ensuring both reliability and stability of transactions.

Chainlink’s expansive transaction security network that safely handles over $18 trillion in operations will bolster institutional users’ confidence in RLUSD following this integration.

Jack McDonald, Ripple’s Senior Vice President of Stablecoin, emphasized the importance of price accuracy in decentralized markets. During supply shortages, Ripple’s Chief Technology Officer David Schwartz confirmed that RLUSD might briefly exceed its dollar-pegged value.

Also Read: Top 5 Must Buy Crypto in 2025; Do Not Miss Out on This

However, Ripple remains committed to regulatory compliance and ensuring the stablecoin maintains its 1:1 dollar backing.

Regulatory Shifts Present New Market Opportunities

The removal of USDT from European exchanges because of MiCA rules is an opportunity for RLUSD to take hold of new market share in this space. The regulatory-approved stablecoin from Ripple creates excellent opportunities to attract institutions invested in legal digital assets that require absolute transparency.

The competitive edge of RLUSD for stable digital transactions stems from Ripple’s commitment to compliance and transparency alongside its DeFi expansion efforts. Hence, the stablecoin market receives RLUSD as a viable and efficient choice because of its growing adoption rates and regulatory support.

What This Means for Ripple

Ripple’s rapid expansion of RLUSD reflects its growing ambition to dominate the stablecoin sector. With increasing regulatory scrutiny on existing stablecoins, RLUSD presents itself as a viable alternative due to its compliance-first approach.

Financial institutions would find RLUSD appealing since its regulatory stability creates an opportunity to use blockchain-based payments amid the legal uncertainties facing alternative stablecoins.

RLUSD now positions itself properly in the crypto market thanks to its success on the XRP Ledger and its collaboration with Chainlink. The establishment of Ripple as a leading global stablecoin depends on its successful partnership building and expanded application development for RLUSD.

Providing fast, low-cost transactions gives it a distinct advantage over traditional stablecoins that primarily rely on Ethereum, where congestion and fees remain a concern.

Also Read: Brad Garlinghouse Addresses Concerns Over Crypto Regulation Meeting