- Ripple has applied for a national bank charter with the OCC and a Federal Reserve master account through its subsidiary.

- Analysts suggest these approvals could legitimize Ripple alongside major banks and significantly boost XRP’s adoption.

- Valuation models estimate XRP could reach between $10 and $22 if Ripple captures even a fraction of SWIFT’s volume, stablecoin flows, or tokenized asset markets.

Ripple Labs has taken a bold step toward deeper integration into the global financial system by officially applying for a national bank charter with the U.S. Office of the Comptroller of the Currency (OCC).

The announcement came directly from CEO Brad Garlinghouse, who underscored the company’s long-standing commitment to regulatory compliance.

Ripple already holds a coveted BitLicense from the New York Department of Financial Services (NYDFS), allowing it to legally operate within one of the world’s toughest crypto jurisdictions.

Approval of a federal banking charter would mean Ripple is subject to both state and federal oversight, a rare feat for a crypto-native firm.

Despite the bullish narrative, XRP’s market response has so far been muted. To assess how the banking license could influence XRP’s valuation, we reviewed four models presented by ChatGPT, which explored scenarios based on institutional adoption, stablecoin growth, asset tokenization, and network utility.

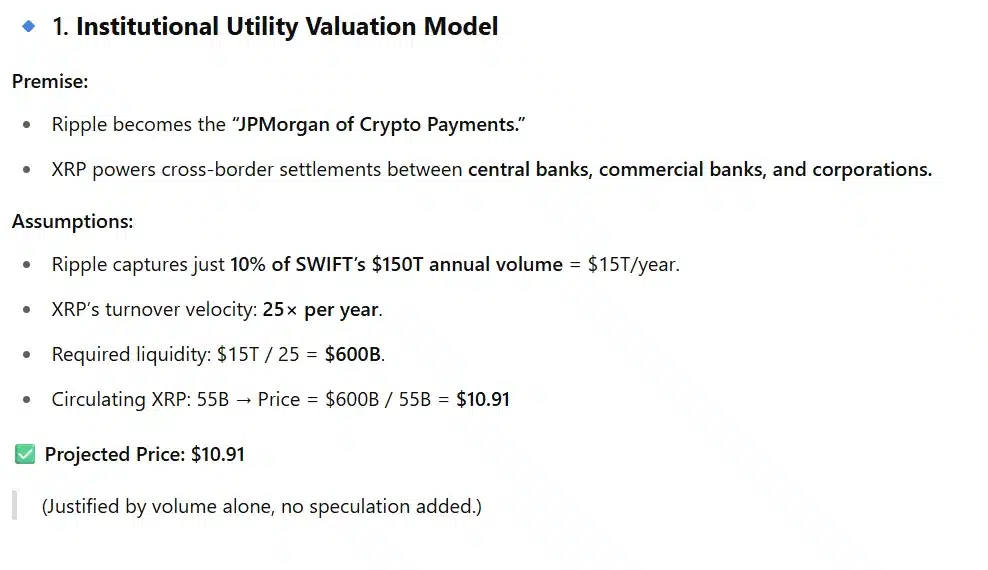

Institutional Utility Model Sees $10+ XRP on SWIFT Displacement

The first model assumes Ripple captures one-tenth of SWIFT’s estimated $150 trillion annual transaction volume.

Accounting for a velocity factor, a measure of how often capital cycles through the network, the model concludes that $600 billion worth of XRP liquidity would be needed, implying a potential price near $10.91 per token. This projection does not include speculative buying, making it a conservative baseline.

Source: ChatGPT

Also Read: Here Are The Price Targets if XRP Captures 10% of SWIFT Volume — Analyst Breaks it Down

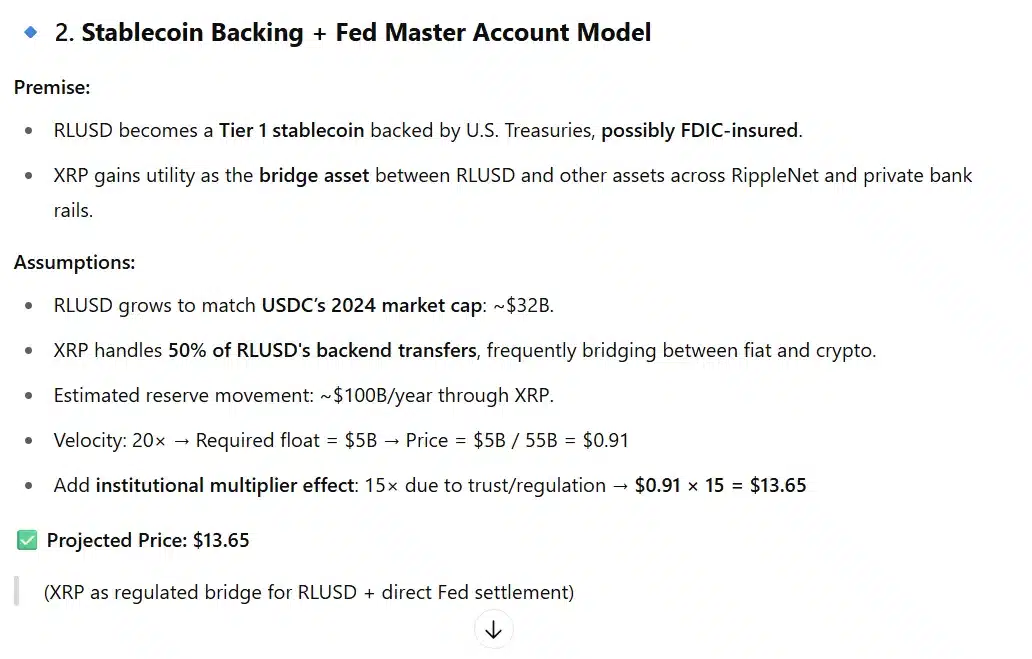

RLUSD and Fed Access Model Projects Up to $13 XRP

In the RLUSD + Fed Access scenario, Ripple’s stablecoin adoption mirrors USDC’s market cap of around $32 billion.

Assuming XRP bridges half of RLUSD’s annual transactions, approximately $100 billion, and layering in a regulatory trust premium, the analysis suggests a price of roughly $13.65.

Source: ChatGPT

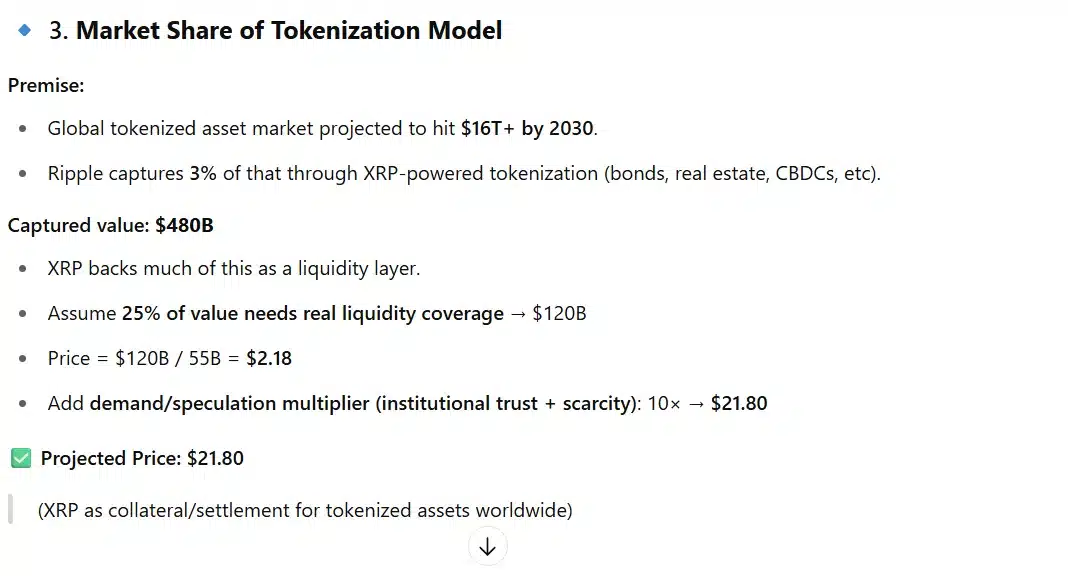

Tokenization Could Push XRP Above $20

The Tokenization Market-Share Model considers the booming market for tokenized real-world assets, expected to exceed $16 trillion by 2030.

Capturing even a 3% slice and leveraging on-chain settlement could see XRP need to support $120 billion of liquidity, and with institutional demand factored in, price estimates approach $21.80.

Source: ChatGPT

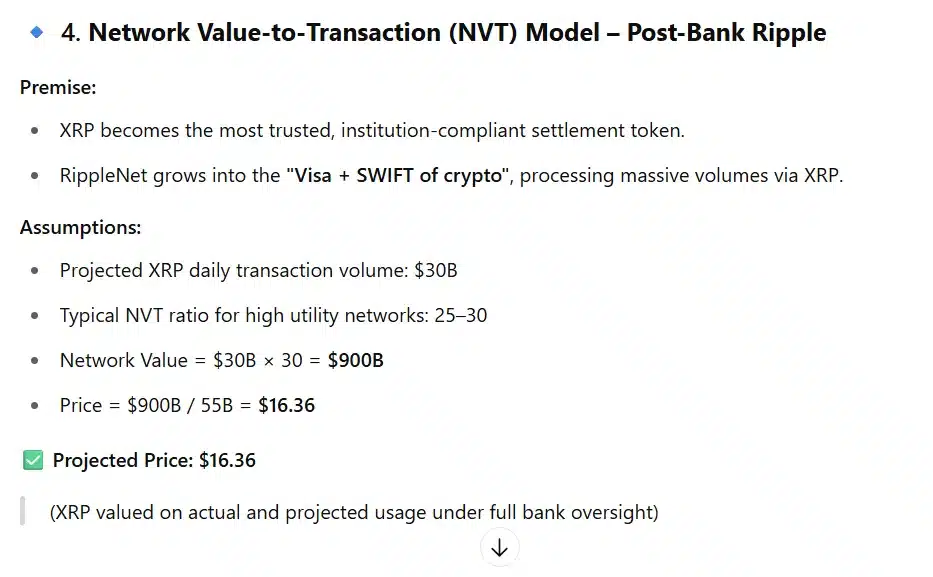

NVT Model Estimates XRP Around $16

Finally, the Network-Value-to-Transaction (NVT) Model ties market capitalization directly to projected daily settlement volumes on RippleNet, assuming $30 billion of daily flows once banks adopt XRP at scale.

Using a typical NVT ratio of 25-30, this model forecasts a total network value near $900 billion, translating to an XRP price of about $16.36.

Source: ChatGPT

Broader Context: Ripple’s Strategy Aligns With Industry Trends

Ripple’s regulatory efforts come as global banks and regulators intensify discussions around central bank digital currencies (CBDCs) and tokenized assets.

Analysts at Citi and HSBC have recently highlighted that fully compliant, regulated stablecoins could become the preferred means for cross-border settlements, potentially reducing reliance on SWIFT and correspondent banking relationships.

Meanwhile, the Bank for International Settlements has urged closer oversight of stablecoins to prevent systemic risks, reinforcing the importance of Ripple’s strategy to secure federal approval and direct Fed access.

Conclusion

Ripple’s pursuit of a national bank charter and a Federal Reserve master account represents one of the most ambitious efforts yet by a crypto firm to embed itself within the U.S. banking system.

While XRP’s price has yet to reflect the long-term potential, institutional-grade infrastructure and regulatory clarity could ultimately transform Ripple’s role in the global financial ecosystem, paving the way for broader XRP adoption and a reimagined landscape for stablecoins.

Also Read: Ripple Distances Itself From Embattled Firm Linqto Amid Share Price Manipulation Scandal