According to Cryptopedia — if you buy any amount of crypto and want to store it yourself, you have to choose between holding your cryptocurrency in a hot wallet, a cold wallet, or using a combination of the two.

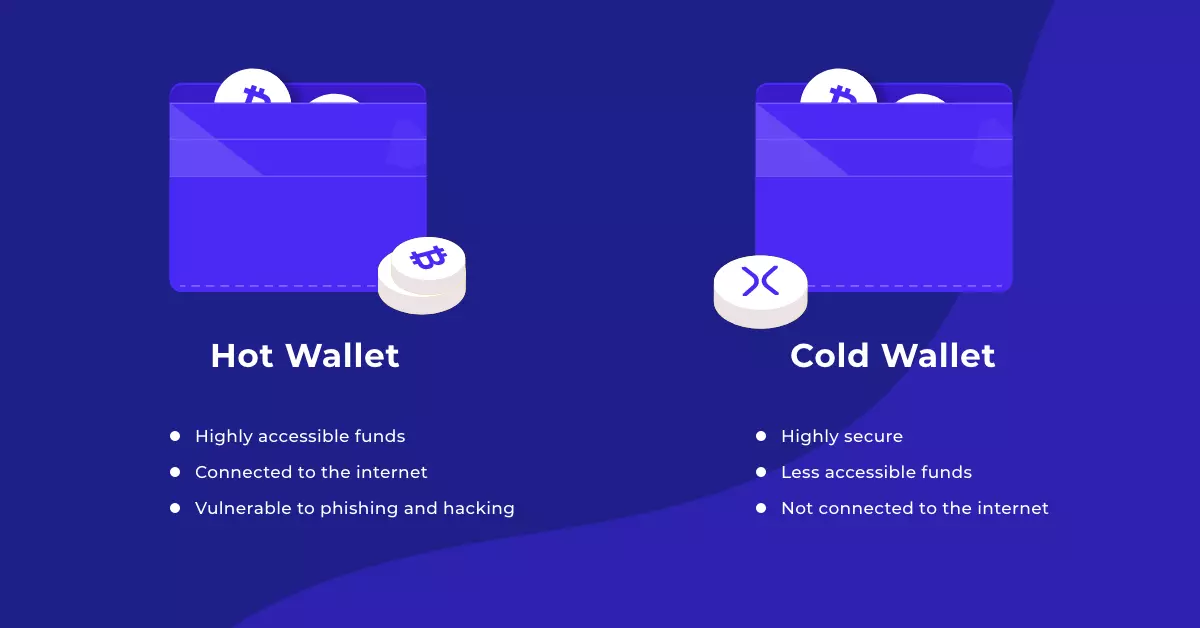

A hot wallet is connected to the internet and could be vulnerable to online attacks. This could lead to stolen funds, but it’s faster and makes it easier to trade or spend crypto. On the other hand, a cold wallet is typically not connected to the internet. While it may be more secure, it’s less convenient.

Cold storage wallets are generally very secure. A cold wallet is usually not accessible to anyone without the necessary security information. Furthermore, these devices are usually relatively small. Crypto users should have no trouble carrying those around in their pockets.

According to the level of privacy, wallets are divided into:

- Custodial Wallets

- Non-custodial Wallets

Custodial Wallets

A custodial wallet is an application for storing and transferring cryptocurrency. The addresses of which are managed by a custodian (third party). Such an operator has private keys for wallet addresses and secures customers’ money. The users, in turn, must pass an identity verification procedure to make the interaction as transparent as possible.

The custodial wallet is used by centralized exchanges to optimize financial transactions. Each client of the exchange has its own balance and account, but the funds are stored at separate addresses owned by the exchange.

The main point for criticism of custodial wallets is the possibility for a third party to have access to customer funds. On the one hand, the exchange provides strong protection of client funds, and on the other — at the request of regulatory authorities, the exchange has the right to provide personal information about its clients or, in rare cases, to freeze their accounts.

Non-custodial Wallets

A non-custodial wallet is cryptocurrency storage and management software that is wholly owned by the user, including private and public keys. Such an application cannot freeze users’ funds but is not responsible for their safety.

This application can be installed on a personal computer or smartphone and create addresses for cryptocurrency without the user’s identity identification. The disadvantage of this type of wallet is the lack of professional protection by a professional operator and the possibility of losing access to funds in case of password loss.

All crypto wallets are divided into:

- Cold wallet

- Hot wallet

Hot Wallet

For the most part, a hot wallet is designed to help you easily store and access your crypto assets. If you buy or mine digital currencies, you can have the coins easily delivered to your online storage. Additionally, if you want to buy something and pay with cryptocurrency, using your hot wallet is fairly straightforward.

With a hot wallet, both the private and public keys are stored on the internet or on a device connected to the internet (such as your computer or smartphone). This means that the keys are vulnerable to hackers. Like it was in a story with Solana. If you aren’t careful about guarding your information, the information can be stolen.

It makes sense to have a hot wallet if you know that you will have a lot of transactions with individuals or exchanges. However, you should be aware that keeping a large number of assets in your hot wallet makes it a target for thieves. As a result, it makes sense to keep only a portion of your crypto assets in a hot wallet and store the bulk of your coins in a cold wallet.

Benefits

One benefit of hot wallets is the ease of use. Because they are always online, there’s no need to transition between offline and online to make a cryptocurrency transaction.

For example, many people use mobile hot wallets to trade or make purchases with cryptocurrency. To do so with a cold wallet would be inconvenient. You would need to find a device (typically a computer) into which to plug your cold wallet. Then you will move the requisite amount of cryptocurrency to a hot wallet, and then make your purchase.

Users who hold large amounts of cryptocurrencies typically won’t keep significant amounts of crypto in hot wallets. Although a hot mobile wallet isn’t the same as a traditional analog wallet. One similarity holds true: It’s generally a bad idea to keep a lot of money on your person. Just like you can withdraw cash from an ATM, you can send more crypto to your hot wallet when the balance gets low.

Cold Wallet

A cold wallet, otherwise known as a hardware wallet or cold storage, is a physical device that keeps your cryptocurrency completely offline. Many look like USB drives.

Cold wallets are ideal for those who want to store a large number of crypto assets in a more secure environment. For example, I have a cold wallet and a hot wallet. I keep some of my coins in a hot wallet for easy use online. My hot wallet makes it easy to buy coins. However, the bulk of my crypto assets is transferred to a cold wallet, where they are kept offline.

Taking your holdings offline helps protect you from hacking and online attacks, but you can also risk losing your holdings. There is no backup to this form of storage; if you misplace your wallet, you lose access to your investments. Cold wallets also can cost up to $200 (though there are definitely cheaper options).

While a cold wallet makes hacking much more difficult, it’s still a possibility. Make sure you buy your hardware wallet directly from a manufacturer instead of secondhand, as the device may have been tampered with in a way that leaves it vulnerable.

Cold storage can make more sense if you plan to buy and hold cryptocurrency for a long period of time. But if you’re looking to buy and trade, or are not totally sold on cryptocurrency and think you might want to cash out your holding after a little while, then a hot wallet, or even leaving it on an exchange can make more sense.

Conclusion

Hardware wallets are designed to be immune to hacking. Even when a hardware wallet is plugged into your computer or connected via Bluetooth, depending on the storage method, the funds stored on the drive are difficult or even impossible to steal.

While technically connected to the internet, the signing of transactions is done “in-device,” and only subsequently broadcast to the network via your computer’s internet connection. This “signature” allows you to assign ownership to the recipient of a cryptocurrency transaction.

Because your private keys never leave the device, however, even if devious malware on your computer tried to steal your funds by maliciously “signing” a transaction initiated in your hardware wallet it would not be the correct signature so the transaction would not go through.

Hardware wallets are less convenient than hot wallets. This is because they must be powered on and then connected to the internet. In addition, while hot wallets are usually free, hardware wallets can cost you between $50 and $200.

If you have more than a few hundred dollars in crypto, you may want to invest in a hardware wallet before purchasing more. It’s a small price to pay to protect yourself from the threat of losing your funds. A good example is the situation with Solana.

So, a cryptocurrency wallet is a mandatory attribute of a crypto user. Both cold and hot wallets, as well as their subtypes, have a number of characteristics that can be useful to consider when choosing the wallet. To choose a suitable wallet, you should take into account the frequency of use, the type of cryptocurrency transactions, as well as your own preferences and beliefs.