XRP has been gaining significant attention as its Price approaches key resistance levels. With growing anticipation in the crypto market, analysts closely watch XRP’s movements to determine whether it will break out toward new highs or face a short-term correction.

The broader cryptocurrency market remains bullish, and XRP’s strong fundamentals, coupled with increasing adoption, position it as a key asset for the coming months.

Analysts predict that XRP could soon test $3.85, with a potential upside toward $8 if momentum sustains. However, failure to hold crucial support levels could trigger a retracement to $3.00 or even $2.85.

Also Read: Onyxcoin (XCN) Price Prediction 2025-2029: Will XCN Price Hit $1.25 Soon?

Key Resistance and Support Levels

Currently, XRP trades around $3.06-$3.11, showing signs of consolidation near key price levels. Resistance has formed at $3.13, where selling pressure has emerged, and a stronger resistance stands at $3.15.

If XRP can break past this point, it could trigger a rapid rally toward $3.85. However, if XRP fails to break through, support at $3.00 may come into play, with a potential deeper retracement to $2.85 before resuming an uptrend.

A decisive move above $3.15 with strong volume would confirm bullish momentum, while rejection at this level may indicate a short-term pullback.

MACD Analysis and Market Momentum

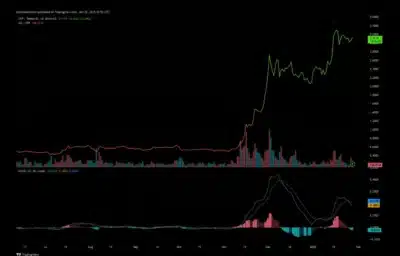

The Moving Average Convergence Divergence (MACD) indicator provides further insight into XRP’s momentum. On the four-hour chart, the MACD line crosses below the signal line, signaling a weakening bullish momentum.

The histogram also shows declining buying pressure, suggesting XRP may consolidate or face a short-term pullback before resuming its upward movement. On the daily chart, MACD previously indicated strong bullish momentum but has since started to cool off.

A bullish crossover is needed to confirm continued upward movement toward $3.85 and beyond. If the MACD turns upward again, it will reinforce the likelihood of a breakout. Conversely, prolonged weakness in MACD could result in a deeper pullback.

RSI Analysis and Market Strength

The Relative Strength Index (RSI) is another crucial indicator that suggests XRP’s strength in the current market. With RSI currently standing at 48.47, XRP remains neutral, neither overbought nor oversold.

If RSI climbs above 60, it would signal increased buying pressure and strengthen the bullish case for a move beyond $3.15. However, if RSI drops below 40, bearish momentum could intensify, leading to a potential retest of lower support zones.

Source: Tradingview | MACD | RSI

Analyst Predictions and Market Outlook

Market analysts have been actively predicting XRP’s trajectory and Armando Pantoja (@_TallGuyTycoon) believes that if XRP successfully breaks above $3.15, it could quickly ascend to $3.85, with a potential longer-term target of $8.

Other analysts maintain a bullish outlook, expecting significant price appreciation in the coming years. However, if XRP fails to clear $3.15, it could face a pullback toward $3.00 or even as low as $2.85, offering investors a chance to buy at lower levels before the next rally.

Also Read: DeXe (DEXE) Price Prediction 2025-2029: Will DEXE Price Hit $50 Soon?

Source: @_TallGuyTycoon

XRP Price Predictions (2025-2029)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 2.50 | 3.85 | 5.25 |

| 2026 | 4.00 | 5.75 | 7.50 |

| 2027 | 6.50 | 8.00 | 10.00 |

| 2028 | 9.00 | 12.50 | 15.00 |

| 2029 | 15.00 | 20.00 | 25.00 |

2025

XRP’s price movements for the coming years can be forecasted based on its past performance, market trends, and projected adoption. In 2025, XRP is expected to gain significant momentum, driven by increasing adoption and favorable market conditions.

The maximum price prediction for 2025 is $5.25, while the minimum projected Price is $2.50, with an average price settling around $3.85. As institutional investors and enterprise blockchain solutions continue integrating XRP, demand for it will rise steadily.

2026

In 2026, XRP may experience a period of consolidation as investors take profits and the market stabilizes. Historically, assets that witness rapid growth tend to undergo brief corrections before resuming their uptrend.

During this period, XRP could trade between $4.00 and $7.50, allowing long-term investors to accumulate more at strategic levels. Despite the short-term cooling, institutional interest in XRP and its use cases in financial settlements and cross-border transactions will likely sustain demand.

2027

By 2027, XRP is projected to regain upward momentum, potentially reaching a high of $10.00. As confidence in XRP’s utility grows, more investors are expected to enter the market, increasing liquidity and price stability.

Integrating XRP in financial institutions and blockchain-based payments will further solidify its position as a top digital asset. With demand continuing to outpace supply, XRP could witness substantial appreciation in its valuation.

2028

2028 is expected to bring another bullish cycle for XRP, particularly as the Bitcoin halving event catalyzes the entire crypto market. Historically, Bitcoin halvings have triggered increased demand for altcoins, and XRP is likely to benefit from this trend.

Investor sentiment will likely push XRP’s Price higher, with forecasts suggesting a peak of $15.00. As XRP’s adoption expands across financial networks and enterprise partnerships, its role in cross-border settlements and institutional finance will become even more critical.

2029

By 2029, XRP could achieve new all-time highs, with projections indicating a potential rise to $25.00. Institutional investment and widespread integration of XRP in financial services are expected to drive its Price to unprecedented levels.

If XRP continues its upward trajectory, supported by broader adoption and regulatory clarity, it could establish itself as one of the leading assets in the blockchain space. Long-term investors who have held through the market fluctuations may find this period particularly rewarding as XRP cements its position as a dominant digital asset in global finance.

Conclusion

XRP remains one of the most closely watched assets in the crypto market, with its technical indicators suggesting either a significant breakout or a short-term correction in the coming days.

Traders should monitor resistance at $3.15 and support at $3.00 to determine XRP’s next move. A breakout could lead to $3.85 and beyond, while a rejection at key levels may offer better entry points for long-term investors.

The long-term outlook remains bullish, with XRP expected to reach new highs in the next five years as its ecosystem expands.

FAQs

Is XRP a good long-term investment?

XRP has strong fundamentals, increasing adoption, and institutional interest, making it a promising long-term investment.

What factors could drive XRP’s Price to be higher?

Key drivers include regulatory clarity, institutional adoption, Bitcoin halvings, and growing use in cross-border payments.

Can XRP reach $10 in the next five years?

Based on historical trends and adoption, XRP has the potential to reach $10 by 2027, provided bullish market conditions persist.

Is XRP better than Bitcoin for transactions?

XRP is faster and cheaper for transactions, with an average settlement time of 3-5 seconds, compared to Bitcoin’s 10-30 minutes.

What are the risks of investing in XRP?

Risks include regulatory uncertainty, market volatility, and competition from other blockchain-based payment solutions.

Also Read: Tezos (XTZ) Price Predictions (2025-2029): Will Tezos (XTZ) Hit $2 Soon?