- XRP fees drop more than 80%, signaling potential price decline ahead.

- Transaction fee decrease correlates with XRP’s recent price downturn.

- Major decline in XRP fees raises concerns about network activity.

In a concerning development for XRP, the total transaction fees on its network have experienced a dramatic decline of over 80%, raising important questions about the cryptocurrency’s future price and overall network activity.

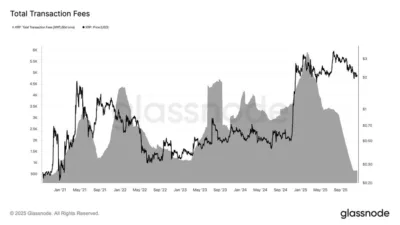

According to Glassnode, XRP’s Total Transaction Fees (90D-SMA) have dropped significantly from a high of 5.9K XRP per day in early February 2025 to just 650 XRP per day — a staggering 89% decrease, marking the lowest point since December 2020.

A Sharp Decline in Fees

Glassnode data shows that there has been a sharp downturn in XRP’s network fees, reflecting a steep decline in the demand for XRP transactions. Since February 2025, the daily fees on the XRP network have plummeted, indicating a slowdown in user activity.

This sharp decline follows a period of relatively high transaction fees in 2021 and 2023, suggesting that XRP’s network may now be experiencing a drop in usage or overall interest.

XRP’s Price: A Direct Correlation?

What’s particularly striking about this decline in fees is its direct correlation with XRP’s price. As seen in the chart, the peaks in XRP’s transaction fees closely mirrored price surges in the past, notably in 2021, 2023, and 2024. However, as the XRP price has taken a downturn in 2025, so have the transaction fees, further underscoring the relationship between network activity and price movements.

Also Read: ChartNerd: XRP in Second Wyckoff Accumulation Range Before a ‘Blow-Off Top’ – Details

Source: Glassnode

This 89% drop in fees comes at a time when XRP’s price has also shown significant weakness, dropping from its highs earlier in the year. As the market grapples with both reduced fees and lower prices, questions are arising about whether this is a temporary correction or a signal of a longer-term trend.

What Does This Mean for XRP’s Future?

The substantial drop in XRP transaction fees could be a sign of waning demand on the XRP network, which is often viewed as a key indicator of blockchain health. Lower fees may suggest reduced network congestion, but it could also point to less activity in the broader XRP ecosystem.

If the decline in fees continues, it could lead to further downward pressure on XRP’s price as demand for transactions on the network decreases. Moreover, XRP’s role in cross-border payments and decentralized finance (DeFi) could be at risk if the drop in network fees reflects a broader loss of utility for the token.

As a result, market participants and analysts are watching closely to see if XRP can recover from this downturn or if it signals a longer-term bearish trend.

A Critical Moment for XRP

XRP’s 89% drop in transaction fees is a significant development that cannot be ignored. The decline in fees and its correlation with the falling price of XRP highlight the ongoing challenges for the cryptocurrency in 2025.

While it remains to be seen whether this drop is a temporary fluctuation or a more fundamental issue, XRP investors and enthusiasts will need to closely monitor future trends to understand where the cryptocurrency may be heading.

As XRP grapples with lower fees and price reductions, the coming months could be critical in determining whether this is a temporary market correction or the beginning of a prolonged downturn. With key metrics pointing to reduced network activity, the pressure is mounting for XRP to regain its momentum and show signs of recovery.

Also Read: World Liberty Financial Faces Pressure as Price Drops 4.12%