Lido DAO’s price momentum has stalled sharply after an aggressive rally that briefly pushed the token to the $1.00 level. The rejection of this psychological resistance has led to increased market caution as short-term signals begin to flash signs of a possible pullback.

The bullish breakout that started on June 9 lifted LDO nearly 20 percent within 48 hours, pushing it from the $0.88 range to an intraday peak of $0.999. A breakout out of a descending wedge pattern and an increase in buying volume supported this rally. Nevertheless, the failure to break and sustain above the $1.00 resistance has brought short-term weaknesses in the market structure.

LDO has declined to about $0.958, which is below the 0.5 Fibonacci retracement level of $0.961. This area had been a key swing point between the April high and the May low and is now considered a stress level to bulls attempting to retake control. This rejection in this time frame, along with lost momentum, is indicative of the possibility of the recent bullish leg wearing out.

Source: Tradingview

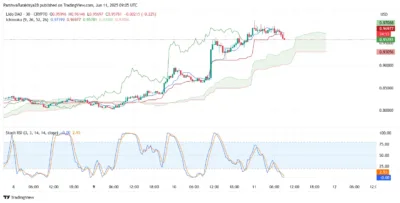

The 30m chart shows an emerging double top formation near the $0.999 region, further confirming a bearish attitude. The momentum indicators are rolling over, as the RSI has dropped to 44, and the MACD has crossed bearishly. The Chande Momentum Oscillator has declined steeply to -60.47, indicating a weakening of the trend.

Source: Tradingview

Also Read: The Sandbox Price Breaks Key Level—Is a Surge to $0.36 Now Imminent?

Key Support Levels Will Determine Next LDO Move

Support now lies between $0.95 and $0.93, with any break below this region likely to attract stronger selling pressure. If this zone fails, a retest of the $0.91 level remains possible, especially with the 0.382 Fibonacci level and dynamic EMA cluster also aligning at that mark.

Source: Tradingview

Despite the cooling price action, the broader trend has not yet flipped bearish. LDO is currently having a price above the Ichimoku cloud on the 4-hour chart and is still trading above the Tenkan-Sen and Kijun-Sen lines. There is the Kijun-Sen at $0.93, which may provide the following significant test of support should the price keep falling.

Source: Tradingview

Traders have now turned attention to price behaviour in the narrow range of $0.95 to 1.00. A recovery above $0.999 would restore the bullish momentum and open the doors to $1.012 and $1.064. Conversely, a prolonged weakness outside $0.95 exposes the risk of a more substantial correction to the areas of $0.91 and $0.88.

The Lido DAO breakout rally has run into a ceiling at the $1.00 handle, which has produced indications of short-term exhaustion. As momentum indicators roll over to the downside and key support areas get tested, the token is at risk of more volatility in the sessions ahead. The bulls have to regain the lost territory in a short period. Otherwise, a more significant correction can take place.

Also Read: XRP Positioned as SWIFT’s Successor After 47-Year Cycle, Expert Claims