- SEC explores new rule to boost tokenized trading and innovation.

- Innovation exception could reshape crypto regulations and attract institutions.

- GENIUS Act passage sparks major shift in U.S. crypto strategy.

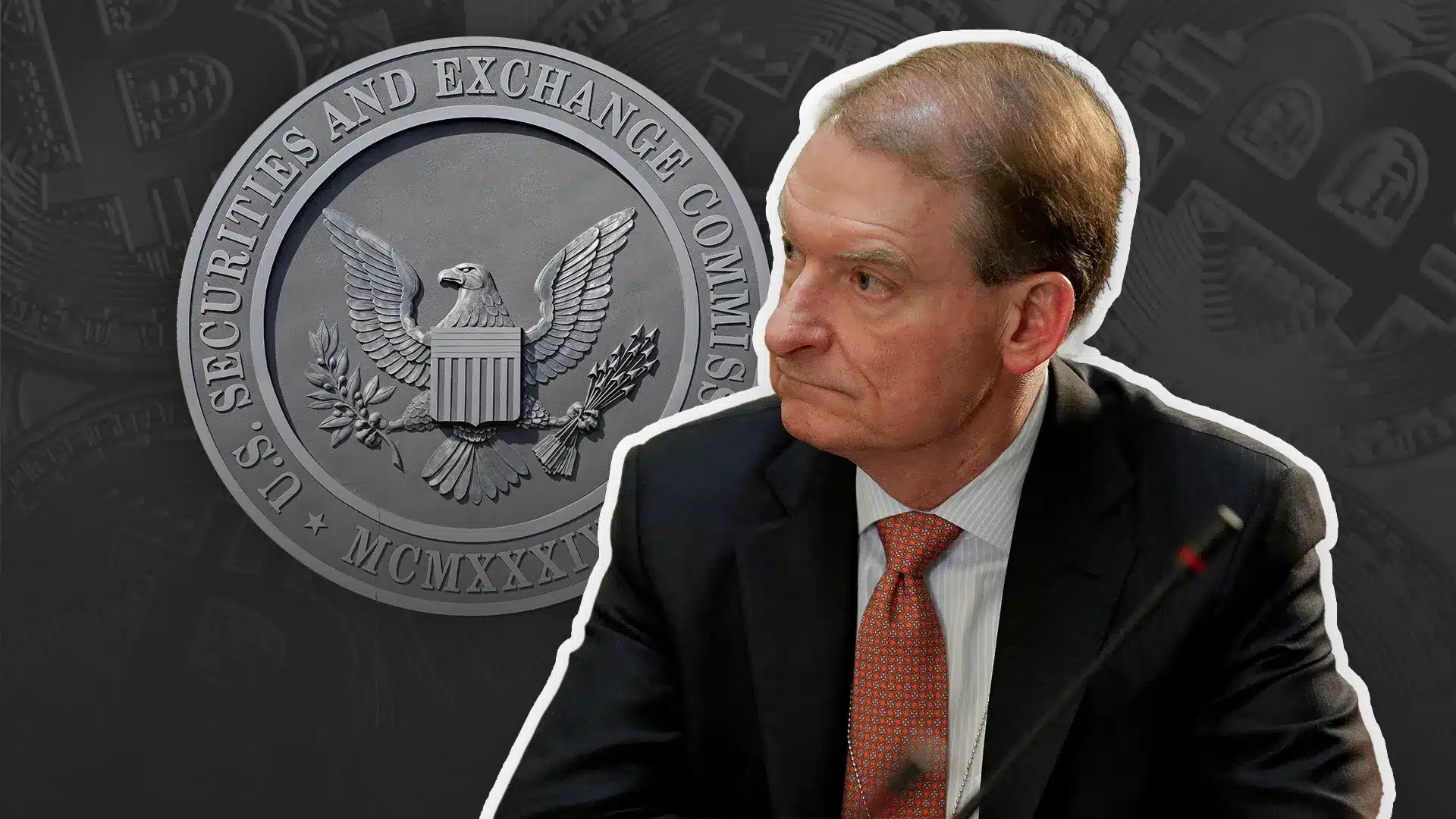

A significant development is underway in the U.S. crypto sector as SEC Chairman Paul Atkins revealed the agency is preparing to introduce a potential “innovation exception” aimed at encouraging tokenization in the financial markets.

This follows the recent passage of the GENIUS Act by the U.S. House of Representatives, which marked a new chapter for stablecoin legislation in the country.

Atkins described the legislative move as a historic milestone and emphasized the SEC’s growing commitment to digital assets. During a press conference, he said the agency is examining the existing rules to accommodate tokenized securities and new ways of trading.

Also Read: Bitcoin on the Brink: $120,000 Struggle Could Trigger Massive Price Shakeup

According to Atkins, the proposed innovation exception would provide narrowly tailored regulatory relief for emerging blockchain-based models. It would allow the emergence of tokenization processes while maintaining the necessary regulation.

He stated that the SEC staff is actively examining how the exception can fit within existing laws.

The suggestion is regarded as an answer to a growing need in the digital asset industry for clarity and flexibility. As traditional institutions explore blockchain applications, regulatory uncertainty has remained a significant obstacle. The program at the SEC might provide an organized route of innovation without loss of protection to investors.

Tokenisation Push Aims to Attract Institutional Participation

Atkins also pointed out that the innovation exception could accelerate the adoption of tokenized financial products by allowing controlled experimentation.

The roadmap will enable technology companies and economic developers to experiment with new models for issuing, trading, and custody of tokenised assets.

Specifically, the SEC has yet to specify the time or how the innovation exception will be implemented, but the public announcement indicates a significant policy departure. It also correlates with the general drive to make the United States a focal point of crypto innovation.

The SEC’s proposal of an innovation exception signals a significant shift in U.S. crypto regulation. With stablecoin legislation now in place and further policy updates on the horizon, the path appears clearer for institutional adoption and technological advancement in the digital asset sector.

Also Read: WazirX Set to Return $235M After Hack as Final Vote Triggers Payout Plan