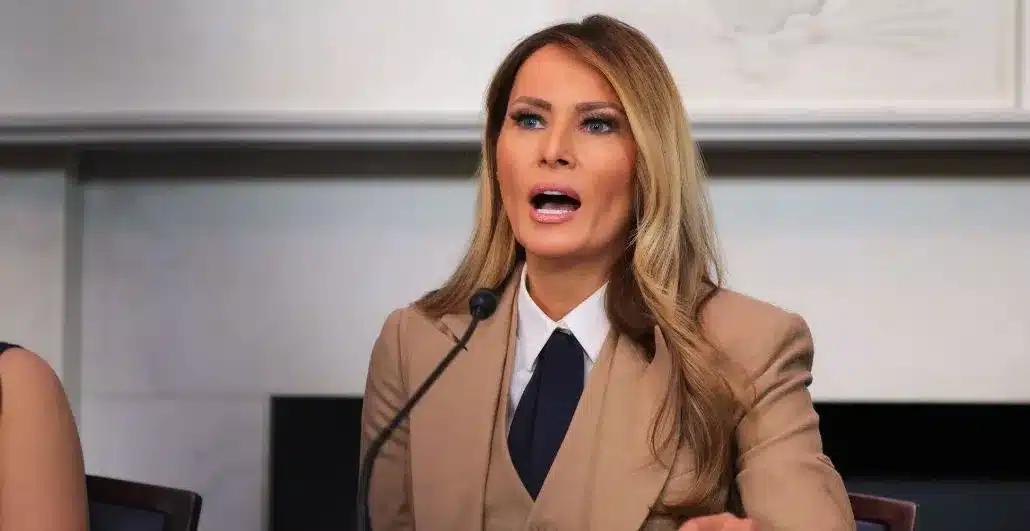

Massive concerns have erupted in the crypto market after the Official Melania Meme token (MELANIA) team quietly sold over $1.5 million worth of tokens. Blockchain tracker Lookonchain confirmed that the team used a Dollar-Cost Averaging (DCA) strategy instead of dumping tokens simultaneously.

Two days earlier, 1.18 million MELANIA tokens were exchanged for 4,230 SOL tokens at a value near $632,000. The MELANIA platform liquidated 2.01 million tokens, which generated $938,000 in revenue during the current day.

Regular token sales have caused market participants to worry about a potential economic downturn. MELANIA’s recent insider token sell-offs resulted in more than 20 percent market growth, yet some investors are concerned about the liquidations.

Also Read: Coinbase Unveils Bitcoin Yield Fund Amid Growing Institutional Interest

Whale Moves Deepen Pressure on Trump’s Memecoin

Investor anxiety is spreading beyond MELANIA as a new whale wallet recently opened a $1.33 million short position against the Official Trump (TRUMP) memecoin, betting its price will decline further.

At the time of writing OFFICIAL TRUMP trades at $14.53 following a minor 1.29 percent drop within the last 24 hours. Its market capitalization has reached nearly $2.91 billion, highlighting persistent trader interest despite growing bearish sentiment.

Analysts view large short positions as signs that major players are bracing for further weakness across politically linked tokens.

MELANIA’s Future Faces Uncertainty as Sell-Offs Continue

While MELANIA has shown short-term resilience, its future outlook remains uncertain under the weight of insider selling. Current trading places the token at approximately $0.442, reflecting a 4.56% percent daily drop and a market cap of about $243.16 million.

There has been no official update from the MELANIA team regarding future sales. However, their continued DCA method suggests that more token liquidations could be on the horizon.

Ongoing selling activities by insiders and mounting trader concerns may soon test the token’s ability to maintain its recent price levels.

Also Read: Shiba Inu Approaches Critical Technical Breakout as Golden Cross Formation Nears