- Over 4.6 trillion SHIB staked, signaling rising investor confidence.

- Massive token lockups spark fresh hopes of price breakout soon.

- Circulating supply drops as staking surges across Shiba Inu ecosystem.

Shiba Inu has witnessed a significant spike in investor activity, with over 4.6 trillion SHIB tokens now staked on decentralized finance platforms. The large volume of locked tokens highlights growing investor confidence in a potential SHIB price rally despite recent market declines.

Shibburn reported data indicates that 4,646,715,230,750 SHIB tokens worth more than $58.7 million were staked. This huge surge in staking indicates a more profound change in investor behavior as the holders decrease the circulating supply to produce demand pressure on the price.

This tendency helps create the deflationary model of the token, which can become an alternative to burning tokens. At the current point, approximately 584 trillion SHIB have been mined, but regular staking practices have gradually decreased this figure. With supply winding down, expectations on the SHIB community are shifting towards the positive or bullish.

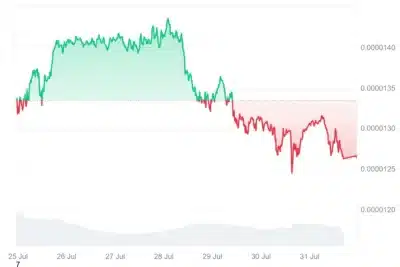

At the time of writing, SHIB is priced at around $0.00001263, and it has dropped by 9.07 percent in the last seven days, according to CoinMarketCap. Amid this decline, stake activity has been on the increase with long-term investor confidence that the token will perform.

Source: CoinMarketCap

Also Read: Ripple CTO Defends XRP as Kraken Eyes $15B IPO Amid Powell Controversy

Massive Token Lockups Drive Speculation of Price Breakout

The surge in SHIB staking suggests that investors are positioning themselves ahead of a possible market reversal. Holders are locking up tokens, thus reducing supply and, perhaps, relieving sell pressure, which may lead to a price recovery in case of an increase in demand.

Moreover, the given staking activities correlate with the overall mission of making the Shiba Inu ecosystem more powerful. Investors seem determined to help the project develop while betting on a large market swing, which is a sign of growing confidence in the token’s future direction.

Along with constant SHIB burning mechanisms, staking has led to a prediction of a deflationary effect. Most holders consider it a prelude to a robust future price reaction, particularly when the use of the ecosystem utilities gathers pace.

While price action has remained muted, the growing staking volume offers a clear signal. Investors are not merely sitting, but are also actively driving down the supply with an aim to affect performance in the future.

The recent boom in SHIB staking is one of the milestones in the token’s history, as more than 4.6 trillion tokens are already locked in smart contracts. As investors take bold positions, market watchers are closely tracking SHIB’s next move amid tightening supply and rising optimism.

Also Read: Coinbase to Launch ‘Everything Exchange’ With Stocks, Bets, and Tokens