The cryptocurrency community is on edge as Pi Network’s mainnet launch draws closer, with its IOU price experiencing sharp fluctuations. Traders and investors are actively monitoring the digital asset’s movements, anticipating a defining moment when PI officially becomes tradable.

The growing anticipation has sparked discussions about potential price trajectories, making this one of the most closely watched events in the crypto space.

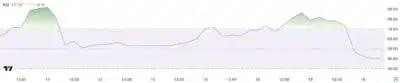

Recent technical indicators suggest that PI IOU is at a crucial point, with market momentum showing signs of weakness. Traders are closely monitoring price action as the digital asset approaches a critical phase where it could either stage a recovery or continue its downward movement.

Also Read: TRUMP Meme Coin Announces Airdrop for Supporters of Official Merchandise

Analyzing PI IOU’s Market Position and Future Potential

According to recent market data, Pi Network’s Directional Movement Index (DMI) reveals potential changes in trend strength. The Average Directional Index (ADX), which measures the intensity of a trend, has declined from 55.8 to 45.2.

A reading above 50 often suggests that a trend is overextended, increasing the likelihood of a slowdown. Although the ADX remains above 25, indicating a strong trend, its decreasing value suggests diminishing momentum.

Further analysis of the DMI components shows that the positive directional index (+DI) has fallen sharply from 55.5 to 23.6, while the negative directional index (-DI) has risen from 3.3 to 16.5. This movement suggests weakening bullish pressure and growing bearish sentiment.

If this trend continues, PI IOU could face increased downward pressure.

Additionally, the Relative Strength Index (RSI) has dropped from 86.2 to 40.5 after spending a day above 70. An RSI above 70 generally indicates overbought conditions, while a reading below 30 suggests oversold levels.

The sharp decline in RSI suggests a significant reduction in buying pressure. However, at 40.5, the asset has not yet entered oversold territory, meaning a potential stabilization or further decline could occur depending on market sentiment.

Source: TradingView.

Price Levels to Watch as PI IOU Approaches Mainnet Launch

The current technical setup indicates that PI IOU remains in a bullish structure based on its Exponential Moving Averages (EMAs), with short-term EMAs positioned above long-term ones. However, the declining EMA lines suggest weakening momentum.

If the downward trend continues, a death cross—a bearish indicator that occurs when a short-term EMA crosses below a long-term EMA—could form, signaling further downside potential.

If PI IOU continues to decline, key support levels to monitor include $53.3. A break below this level could expose the price to further losses, potentially dropping as low as $33.6. Conversely, if bullish momentum returns, the asset may attempt to recover, with resistance levels around $100 serving as a key target.

Market participants remain focused on the upcoming mainnet launch and exchange listings, which could significantly influence PI’s post-launch valuation. As February 20 approaches, volatility is expected to persist, making PI IOU a closely watched asset among traders and investors.

Conclusion

With Pi Network’s Open Network launch just days away, speculation continues to drive price movements. Technical indicators suggest weakening momentum, but the asset remains within a broader uptrend.

Traders are monitoring support and resistance levels to gauge potential price action in the coming days. The market’s reaction to the mainnet launch will ultimately determine whether PI sustains its current valuation or undergoes further price adjustments.

Also Read: Ripple CTO David Schwartz Breaks Silence on XRPL Control Claims – Here’s What He Revealed