Polygon (MATIC) price has declined by 17% in the last 30 days. While the token has had a series of recoveries, its price action in recent weeks has been nothing short of underwhelming. Amidst this development, Pawfury (PAW) is emerging as a presale project that’s capturing the attention of savvy investors. With its promise of high returns and seemingly predictable patterns, Pawfury stands out in the volatile crypto landscape, offering a refreshing alternative to established tokens.

Pawfury (PAW) – The New Emerging Star

Pawfury (PAW) has emerged as a new star in the cryptocurrency market. Its innovative features, strong community support, and practical utility make it a compelling investment. With its presale dynamics Pawfury (PAW) offers substantial benefits to its holders. As adoption grows, this coin is poised for significant gains, highlighting its potential for long-term success. The robust backing from its community and continuous development efforts ensure that Pawfury (PAW) remains at the forefront of the crypto market, attracting investors seeking high returns in a rapidly evolving landscape.

Presale is Live Now – Join Now for a Chance to Benefit with PAW

Investor Rewards in Pawfury’s Multi-Stage Approach Pawfury’s presale ensures fair token distribution and investor benefits through its multi-stage structure. Early participants enjoy lower token prices, thanks to the incremental pricing model. This strategy not only creates excitement but also draws in capital, boosting liquidity and market stability.

To celebrate its success, investors can now enjoy a 10% bonus on their first purchase on Pawfury using the promo code “EXTRA10X” for a limited time.

Presale is Live, Learn More About Major Benefits

Investor Behavior: Mass Exodus and Its Impact on MATIC

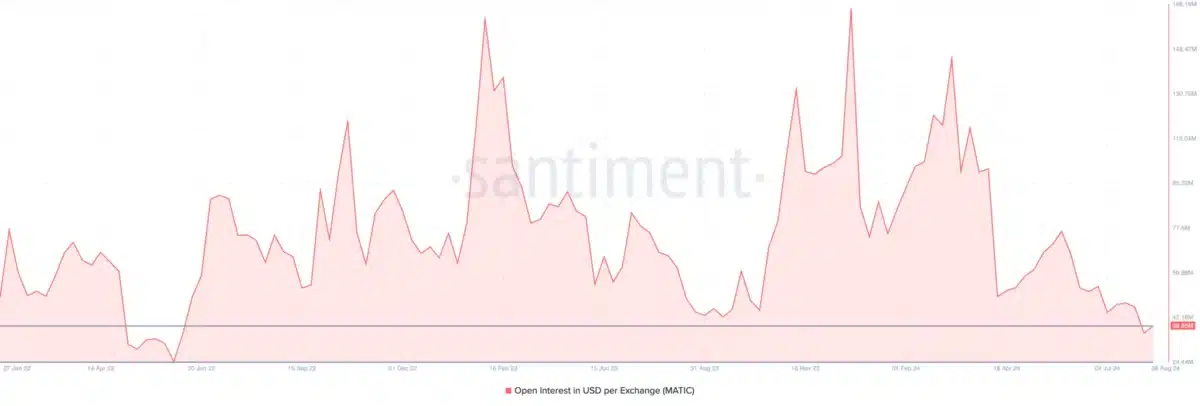

According to Santiment, Polygon’s prospects remain bleak. One reason for this is the Open Interest (OI), which is the value of all outstanding contracts in the market. At press time, the OI per exchange was $38.85 million.

Polygon Open Interest. Source: Santiment

As seen below, the last time the metric reached this level was in June 2022 – specifically during the bear market. For the unaccustomed, a rise in OI indicates that traders are increasing exposure to a cryptocurrency by allocating more liquidity to contracts related to the token.

In most cases, this increase in net positioning drives a jump in price. However, a decrease in Open Interest suggests that traders are taking money out while potentially impacting price negatively.

From a trading perspective, the fall in this value indicates an increase in aggressive sellers. If it remains unchanged, this could drag the price of the Polygon native token further down.

Price Action: MATIC’s Current Value and Historical Context

At press time, MATIC changed hands at $0.42, representing an 85.51% decrease from its all-time high. Considering the current market condition, this decline is supposed to be a “buy the dip” opportunity.

Source: TradingView

However, the broader market does not seem to view it that way, according to data from IntoTheBlock. As of this writing, the blockchain analytics platform shows that the number of Cruisers and Traders has declined.

Cruisers are those who have held a cryptocurrency between the last 30 days to 12 months. Traders, on the other hand, are those who held within the last 30 days.

Conclusion

Polygon’s recent performance, marked by a 17% price decline and open interest hitting bear market lows, paints a challenging picture for the once-popular layer-2 solution. The mass departure of investors, evidenced by declining numbers of Cruisers and Traders, suggests a shift in market sentiment that could further impact MATIC’s price negatively.

In this context, emerging projects like Pawfury offer an intriguing alternative for investors seeking new opportunities in the crypto space.

Pawfury’s presale structure, with its staged approach and bonus incentives, presents a contrast to the volatility seen in traded cryptocurrencies like MATIC. As the market continues to evolve, investors should approach all opportunities with thorough research and risk assessment.