Crypto commentator 24hrscrypto has provided an insider’s look into how the SWIFT banking network, the global messaging system used by over 11,000 financial institutions, generates massive revenue through transaction fees. Notably, this comes shortly after SWIFT’s Chief Innovation Officer, Tom Zschach, seemingly took a jab at XRP, likening it to a ‘fax machine.’

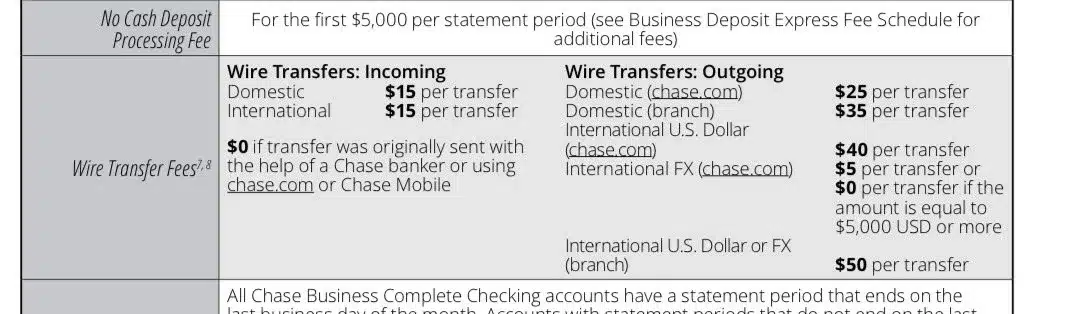

According to the analyst, who claims to have worked both directly and indirectly with SWIFT systems, the network’s fee structure is built on friction rather than efficiency. “They charge around $17.50 just to send a wire, and the receiving bank often takes another $17.50,” he explained. “That’s about $35 gone before the money even moves.”

He noted that while the exact fees vary by institution, the process often includes additional “investigation” charges if a transaction goes missing — a system that benefits banks through complexity and delay. “This is how the legacy system profits — not through efficiency, but through friction,” he added.

Ripple’s Technology Removes the Friction

24hrscrypto highlighted how Ripple, the blockchain payments company behind XRP, is directly challenging SWIFT’s model by enabling instant, low-cost cross-border settlements. Ripple’s technology allows value to move in seconds with transaction costs measured in fractions of a cent, effectively removing one of the banking sector’s most profitable revenue streams.

Also Read: Ripple’s Banking License Application Major Update: Details

People don’t realize how big of a game SWIFT really is. I’ve worked directly and indirectly with them, so let me break it down for you…

SWIFT is owned by the banks.

They charge around $17.50 just to send a wire, and the receiving bank often takes another $17.50. That’s about… https://t.co/Ti84SuGjDF pic.twitter.com/9rDYPcYCRn

— 𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 (@24hrscrypto1) October 4, 2025

“Ripple is stepping in to remove that friction entirely,” he wrote. “Once settlement happens in seconds and costs drop to fractions of a cent, banks lose one of their biggest revenue sources.”

Despite this disruption, the analyst argues that banks are already adapting to the inevitable shift toward blockchain-based finance. Rather than resisting the technology, institutions are beginning to accumulate digital assets that will power the new financial infrastructure.

“They’ll make up for lost fee revenue the only way they can — by accumulating the very digital assets that power the new financial system,” he said. “They’ll lose billions in traditional transfer fees, but they’ll position themselves to gain from the future appreciation of those assets.”

Billions in Fees at Stake

To illustrate the scale of the issue, 24hrscrypto pointed out that even a few banks generate enormous sums through wire transfer fees alone.

He described seeing three specific banks profit significantly from such charges — suggesting that, on a global scale, the traditional system’s inefficiency has become a trillion-dollar opportunity for disruption. “Only three banks,” he noted. “Now imagine doing this at scale — running the world economy charging these fees.”

Source: 24hrscrypto/X

The Coming Financial Shift

The analyst’s insights highlight a turning point in global finance: as blockchain technology matures, the world’s largest financial institutions are being forced to evolve.

SWIFT’s dominance is being challenged by faster, cheaper, and transparent networks like RippleNet — and while the legacy players may lose billions in transaction fees, they are already hedging their losses by investing in the future of finance. As 24hrscrypto put it, the game is far from over; it’s simply changing players.

Also Read: Egrag Crypto’s XRP Pinkish Square Analysis Update – Here Are Short-Term Targets