- Ripple CTO critiques Bitcoin replication; blockchain offers unique verification advantage.

- Bitcoin’s fixed supply highlights its value amid ongoing gold debate.

- Zhao challenges Schiff, emphasizing Bitcoin’s instant verification over gold’s struggles.

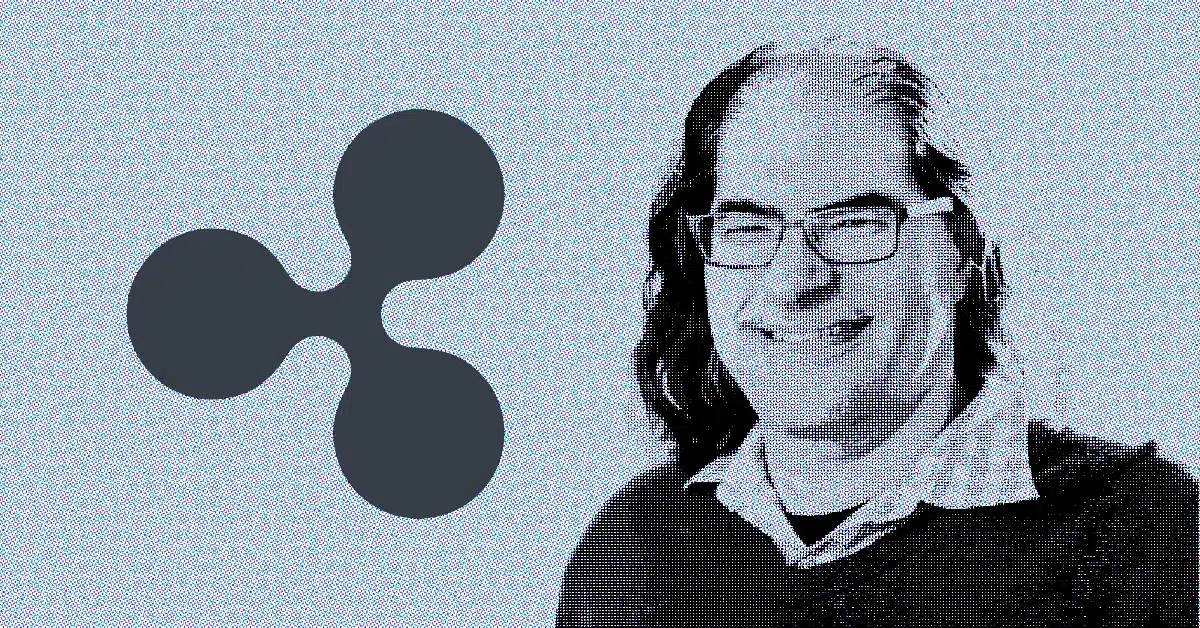

The ongoing debate around Bitcoin’s value and legitimacy continues to generate significant attention across the crypto community. Ripple’s (CTO), David Schwartz, recently joined the conversation following an intriguing discussion at the Binance Blockchain Week in Dubai.

The debate reached a new level of intensity when Binance founder Changpeng “CZ” Zhao engaged in a public showdown with Bitcoin critic Peter Schiff, sparking a conversation about Bitcoin versus gold.

During the event, Zhao seized an opportunity to challenge Schiff’s criticism of Bitcoin by presenting a gold bar and asking Schiff to verify its authenticity. However, Schiff hesitated, stating he would need specialized tools to confirm the gold’s legitimacy.

Also Read: Dogecoin Futures Open Interest Declines as Market Faces Downtrend

Zhao, in turn, highlighted the instantaneous verification process that Bitcoin transactions undergo, contrasting this with the difficulties associated with verifying gold in real-time.

This exchange led to a wider conversation within the crypto community about the viability of replicating Bitcoin. In response to an online query asking how long it would take to recreate Bitcoin, Schwartz offered his perspective. He pointed out the flaw in the question, questioning how something could both be “new” and “exactly the same.”

Schwartz also pondered the implications of replicating Bitcoin, explaining that the true value of Bitcoin is not just in its physical form but also in its fixed supply and blockchain verification.

Bitcoin’s Fixed Supply and Unique Value Proposition

Schwartz’s input directly addressed a common misconception in the crypto space—that Bitcoin could simply be replicated, much like any other digital asset. As Schwartz explained, the fixed supply of Bitcoin means there will only ever be 21 million coins in circulation.

Currently, about 19.96 million Bitcoin are in circulation, with just over one million left to be mined. This scarcity is a key factor in Bitcoin’s value proposition, ensuring its status as a unique digital asset.

The phrase “1 BTC = 1 BTC” remains a crucial reminder in the crypto world that the value of Bitcoin is tied to its fixed nature and scarcity, rather than fluctuations in fiat currencies. Unlike gold, which still faces challenges in verification, Bitcoin transactions are verified instantly on the blockchain.

The process of creating replicas of Bitcoin does not affect its value because its supply is capped, and the authenticity is assured by the blockchain technology that underpins it.

The debate between gold and Bitcoin has sparked fresh insights into the evolving nature of digital assets. As technology progresses, Bitcoin continues to stand out for its robust verification process and the inherent limitations of its supply.

Also Read: XRP Is Heading Toward a Critical Level, Here’s What’s Happening and What Comes Next