- SEC Chair Paul Atkins introduced “Project Crypto,” signaling a shift away from aggressive enforcement.

- The SEC faces an August 15 deadline to decide whether to continue its appeal in the Ripple case.

- Legal experts are divided on the procedural feasibility of ending the appeal.

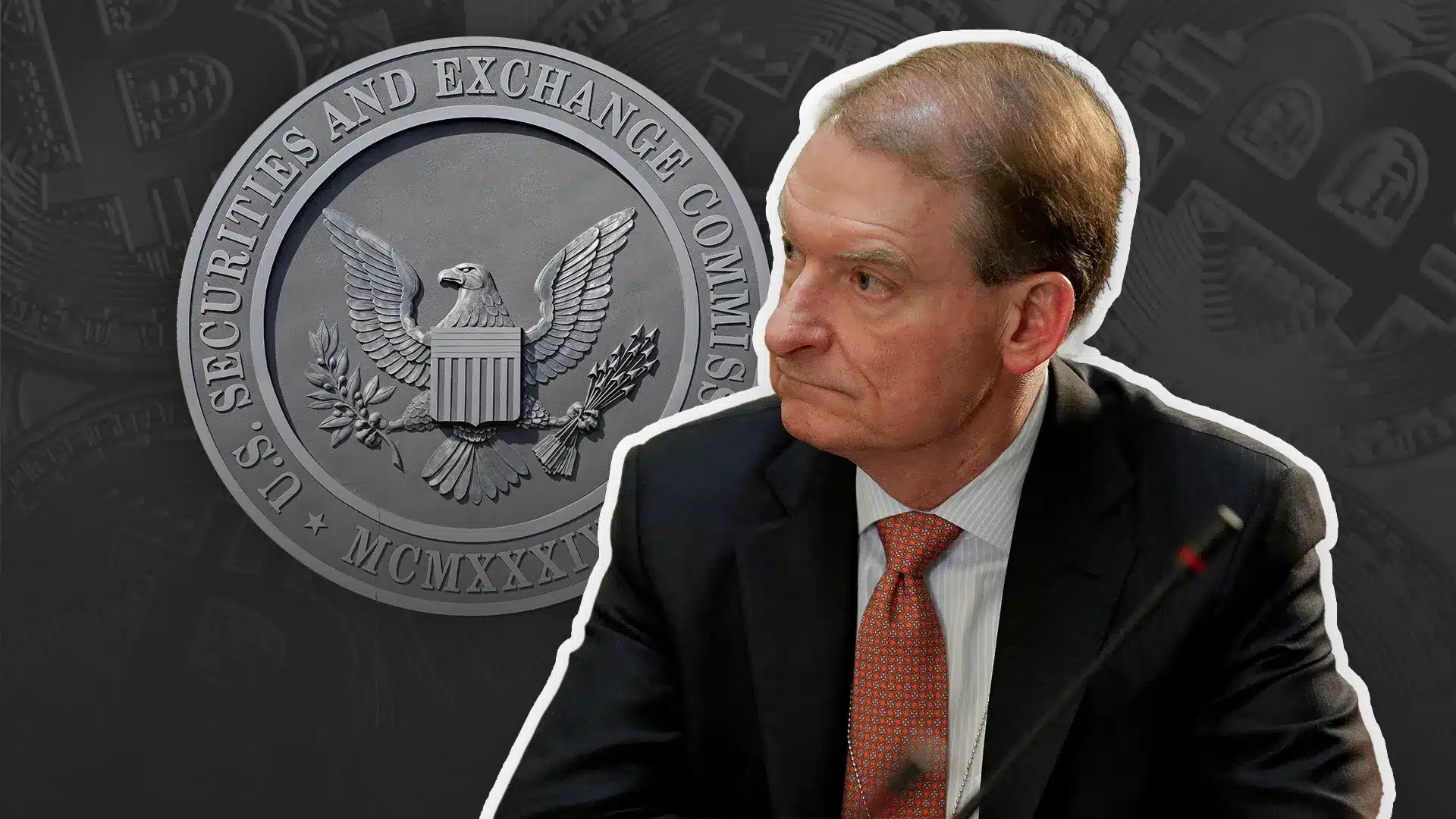

In a high-profile speech on Monday, August 4, SEC Chair Paul Atkins suggested a new direction for the Commission that could signal a potential retreat from its long-standing appeal against Ripple Labs.

Speaking at the America First Policy Institute, Atkins unveiled “Project Crypto,” an ambitious regulatory vision aimed at re-establishing the U.S. as a leader in digital finance.

His remarks have been widely interpreted as a potential softening of the SEC’s stance in its case against Ripple, especially as the agency faces an August 15 deadline to update the Court of Appeals on the status of any settlement.

“Project Crypto” Aims to Reinvent U.S. Regulatory Framework

In a speech that marked a clear departure from his predecessor’s enforcement-heavy approach, Atkins emphasized the SEC’s role in advancing innovation rather than stifling it. “We will make sure the next chapter of financial innovation is written right here in America,” he stated, signaling a renewed push to modernize financial regulation in favor of digital asset development.

Also Read: 40,000,000 XRP in 24 Hours – Here’s Who’s Secretly Controlling

Project Crypto, as outlined by Atkins, is designed to serve as the SEC’s strategic framework for embracing blockchain technology. Central to the initiative is an overhaul of current securities laws to accommodate on-chain financial activity.

Atkins referenced the President’s Working Group on Digital Asset Markets, calling its report “a blueprint” for ensuring U.S. dominance in the global crypto economy.

The language of the speech marked a stark contrast to the tone set by former SEC Chair Gary Gensler, whose enforcement-led strategy drew sharp criticism from the crypto industry for its lack of regulatory clarity.

SEC’s Legal Strategy in Ripple Case Faces Turning Point

The timing of Atkins’s address is critical. The SEC is under pressure to decide whether it will continue its appeal against a key ruling in the Ripple case. In 2023, Judge Analisa Torres determined that XRP’s programmatic sales did not constitute securities transactions, an important legal win for Ripple.

While the agency originally moved to appeal that ruling, speculation has intensified that a reversal may be imminent. The SEC must submit a status update to the Court of Appeals by August 15, detailing whether a settlement has been reached or if the appeal will proceed.

Legal observers say Atkins’s forward-looking speech, which avoided any mention of continuing the Ripple appeal, may indicate a shift in strategy. The absence of any commitment to pursuing the case has fueled hopes that the Commission may vote to withdraw before the deadline.

Legal Community Divided on Procedural Steps

The path to withdrawal, however, remains procedurally complex. Pro-crypto attorney Bill Morgan questioned whether Chair Atkins can marshal enough support from fellow commissioners to formally end the appeal.

“Can Chair Atkins actually get the SEC commissioners to vote to dismiss the appeal in the SEC v. Ripple case and his SEC attorneys to file papers dismissing the appeal?” Morgan asked.

Former SEC enforcement chief Marc Fagel weighed in, noting that a previous vote might not have included provisions for dismissal. “Given the delay, it seems pretty clear that was not the case, so we’re presumably still waiting on another vote,” Fagel explained, suggesting that a second vote is likely required.

The next closed-door SEC meeting is scheduled for Thursday, August 7, presenting a timely opportunity for commissioners to decide on the case. These closed sessions are traditionally used for confidential discussions and votes on enforcement and litigation matters.

Ripple Case Could Define the SEC’s New Crypto Stance

Atkins’s statements not only hint at a more progressive regulatory stance but may also signal signs of the end for one of the crypto industry’s most consequential legal battles. The four-and-a-half-year saga between Ripple and the SEC has been closely watched as a test case for how U.S. law treats digital tokens.

With Ripple’s legal team preparing for any outcome, and investors awaiting clarity, the SEC’s decision in the coming days will carry significant implications for Ripple.

Should the Commission opt to withdraw its appeal, it could mark a pivotal moment in the Biden-to-Trump transition of crypto policy, signaling that the new SEC leadership is ready to pivot from legal conflict to collaborative reform.

Also Read: $10,000 XRP is Bare Minimum Pundit Says – Here’s Why