- Ripple moved 300,000,000 XRP internally as institutional demand accelerated sharply

- On-chain data showed no exchange involvement despite heightened market momentum

- XRP ETF inflows strengthened as Ripple wallet activity drew attention

A widely shared update on X by crypto analyst Xaif Crypto redirected market focus toward Ripple after a notable on-chain XRP movement. The post highlighted how internal wallet activity aligned with a period of rising prices and growing institutional interest.

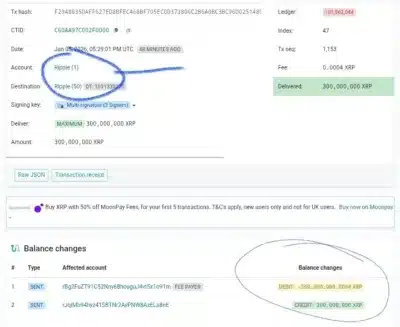

According to Xaif Crypto, Ripple shifted XRP valued at about $663.8m between wallets linked to the company, and the disclosure rapidly intensified discussions around Ripple’s operational behavior. Blockchain data confirmed that exactly 300,000,000 XRP moved in a single transaction on the XRP Ledger, with both the sending and receiving addresses carrying long-standing Ripple labels.

Notably, the transfer did not involve any exchange-linked wallets, as funds moved directly between Ripple-controlled addresses without intermediary routing. Ledger records showed that the entire 300,000,000 XRP reached the destination wallet, while the transaction relied on a multi-signature approval process involving three signers.

On-Chain Details Reduce Sell-Off Speculation

Balance change records reflected a precise debit from the sending wallet, while a corresponding credit appeared on the receiving side without further redistribution. Moreover, the destination address used a destination tag, which analysts often associate with internal accounting and treasury management.

Significantly, both wallets involved have historical ties to Ripple’s infrastructure, a connection that reduced speculation about immediate XRP entering public markets. According to Xaif Crypto, the transaction lacked indicators commonly linked to sell-side activity, as exchange inflows or fragmented transfers typically precede liquidation events.

Also Read: Starknet Faces Fresh Mainnet Outage in 2026 as Network Stability Comes Under Fire

Source: X

Instead, the XRP remained within Ripple’s controlled wallet network after settlement, and observers noted that similar internal reallocations occur regularly.

Institutional XRP Exposure Expands Alongside Transfer

The timing of the transfer coincided with expanding institutional exposure to XRP-linked products, as data tracking US XRP Spot ETFs showed daily net inflows of $46.10m. According to data from Sosovalue, cumulative net inflows across these products reached $1.23b, while total net assets climbed to $1.65b, representing about 1.17% of XRP’s market capitalization.

Market data also showed total value traded across US XRP Spot ETFs reached $72.23m, with several products posting daily price gains exceeding 16%. This activity pointed to sustained institutional participation during the broader XRP price surge, as observers linked the momentum to improving market sentiment.

Ripple’s Treasury Strategy Remains in Focus

Ripple frequently reallocates XRP to manage custody, liquidity planning, and operational balances, and these actions typically occur independent of short-term price movements. Consequently, large XRP transfers can appear dramatic when converted into dollar values, while ledger data reflects asset relocation rather than external distribution.

Additionally, Ripple’s use of multi-signature authorization highlights a security-focused custody framework that usually applies to internal treasury operations. Market analysts also pointed out that similar transfers occurred under different market conditions, which weakens arguments tying the movement directly to price momentum.

The XRP involved already formed part of Ripple’s existing holdings, and no newly issued supply entered circulation through this transaction. Meanwhile, XRP price behavior continued to reflect broader market sentiment and institutional demand, with traders monitoring subsequent on-chain and ETF data for further confirmation.

Also Read: Bitcoin, XRP Surge as Crypto Market Prices Flash Strong Momentum Today