- Ripple’s lawyer hails Trump’s crypto report as regulatory breakthrough.

- Report supports CLARITY Act, urges strong crypto market structure rules.

- August 15 court update could shift Ripple-SEC legal battle.

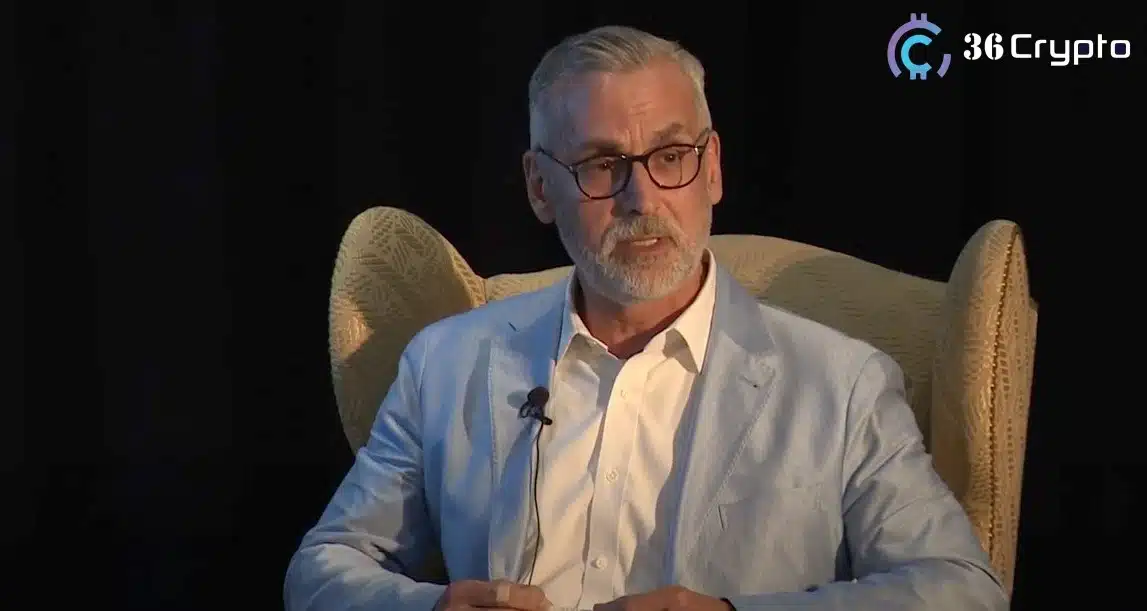

Ripple Labs’ Chief Legal Officer, Stuart Alderoty, has praised the White House’s newly released digital assets report, calling it a “blueprint for action” that could accelerate long-awaited regulatory clarity in the crypto industry. President Donald Trump released the 160-page document of the Working Group on Digital Asset Markets on July 30, and Alderoty currently describes it as comprehensive, helpful, and direct.

According to the official statement made by Alderoty on X, the report pressures Congress and federal agencies to respond urgently just after the enactment of the GENIUS Act.

Released on July 30, the report supports the CLARITY Act, pushes for clear crypto market structure rules, and underscores the need for stronger consumer protections and national security measures. He praised the administration’s current efforts because they are the most pro-crypto yet in the industry.

Also Read: XRP Set for Imminent Bullish Reversal? New Chart Pattern Ignites Hope

Among the key suggestions in the report is that the SEC and CFTC should clarify digital asset classification and custody requirements. This is consistent with the current state of the judicial proceedings Ripple has taken, which has overlooked the nature of XRP during its several-year tussle against the SEC.

The new policy would give Ripple a stronger hand when discussing whether XRP should not be considered a security, a subject the company has been arguing against for a long time.

Ripple Positioned to Benefit as Market Framework Takes Shape

Ripple’s stablecoin, RLUSD, which has a market capitalization of around $577 million, is well-placed to gain from the report’s rejection of a central bank digital currency in favor of privately issued stablecoins. Responsible innovation and reasonable oversight remain the company’s message, in line with the themes presented in the report.

SEC Chairman Paul Atkins also expressed a wider vision of the document, supporting a sensible model to safeguard investors and maintain the U.S. as a world leader in capital markets.

Key Court Update Approaches in Ripple vs. SEC Lawsuit

As regulatory momentum builds, Ripple’s legal case also enters a crucial phase. On August 15, Ripple and the SEC are expected to file a joint status report concerning the appeal process. Their collective application to suspend proceedings had previously been granted by the court on condition that an update on their status was to be provided.

Marc Fagel, a former SEC lawyer, pointed out that this is not a final deadline, which may bring out fresh perceptions of ongoing talks.

Also Read: Bitcoin Accumulation Surge Signals Possible Breakout Beyond $120,000