- SEC Chair Atkins signals friendlier stance on cryptocurrency regulation.

- Project Crypto aims to modernize laws and move markets on-chain.

- Analysts describe initiative as transformative roadmap for digital finance.

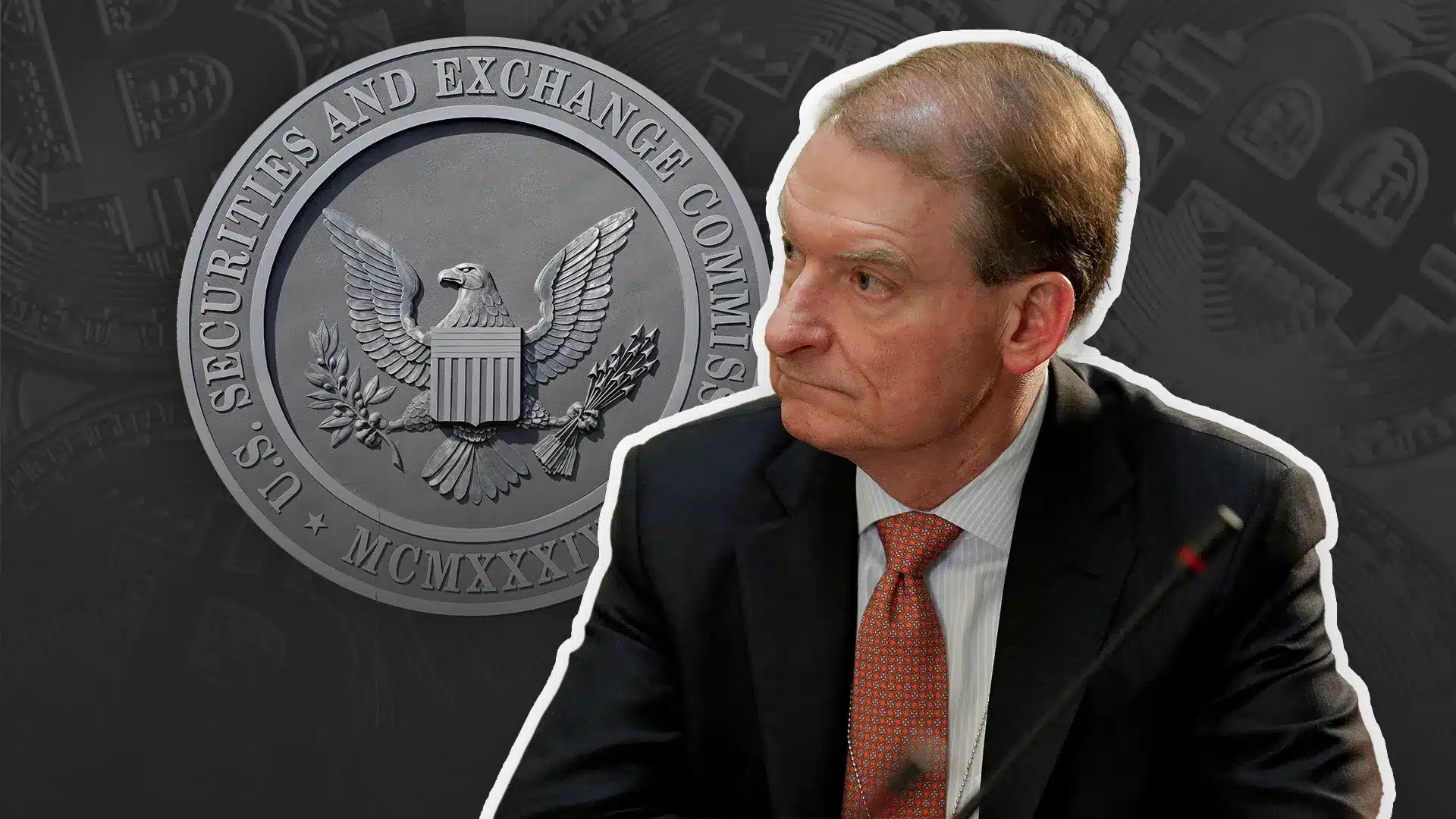

U.S. Securities and Exchange Commission Chair Paul Atkins has expressed a more favorable view toward cryptocurrency oversight, stating that only a small number of tokens should be classified as securities.

At the Wyoming Blockchain Symposium, Atkins clarified that a token by itself is not necessarily a security. Instead, the defining factor is its manner of structure and presentation to the population.

Atkins states that only a few tokens qualify as securities. These comments represent a change in attitude toward the views of the previous Chair, Gary Gensler, according to whom most crypto assets were regarded as securities. This distinction is indicative of a shift in attitude within the SEC as the latter revisits the role of digital assets in the regulation of the financial sector.

Also Read: Trump’s Words Spark XRP Buzz as Ripple Targets SWIFT’s Dominance

Project Crypto and Future Market Vision

The comments came soon after the SEC unveiled Project Crypto, a policy initiative designed to modernize securities laws for blockchain-based markets. According to Atkins, the program will aim to migrate traditional assets like stocks, bonds, and currencies to digital platforms. This is an expression of a vision in which financial markets are progressively being run on blockchain technology.

Bernstein analysts hailed Project Crypto as the most revolutionary vision of any SEC chair. They proposed that the plan might transform Wall Street’s regulatory structure and propel the convergence of traditional and digital markets. In the same manner, Bitwise CIO Matt Hougan cited the project as a five-year roadmap to investors, stating that it shows how assets will move on-chain.

SEC’s Changing Attitude Toward Innovation

Atkins stressed that the SEC is now focused on encouraging innovation rather than blocking it. He underlined the necessity of developing rules that allow new technologies to develop while ensuring the market is not exposed to risk. His message is part of a wider attempt to balance oversight and development in digital finance.

After the symposium, Atkins wrote on X that the SEC needs to establish a framework to protect crypto markets against regulatory setbacks. He added that partnership with Congress and other bodies would also be essential to facilitate the long-term use of blockchain in the financial systems.

Atkins’s words demonstrate a change of policy in the SEC, as there is less resistance toward digital assets. His stance suggests that U.S. markets are moving toward a framework designed to support blockchain adoption while maintaining regulatory stability.

Also Read: Celsius Network Unleashes $220M Crypto Payout as Creditors Eye Big Recovery