The recent development within the U.S. Securities and Exchange Commission (SEC) has significantly fueled speculation regarding the ongoing Ripple (XRP) lawsuit. The regulatory body announced the dissolution of its Crypto Assets and Cyber Unit, replacing it with the Cyber and Emerging Technologies Unit (CETU).

This decision has raised questions about the SEC’s evolving stance on crypto enforcement and its potential impact on Ripple’s legal battle.

The CETU, led by Laura D’Allaird, will focus on fraud within blockchain technology and crypto assets. With this restructuring, many in the XRP community question whether the SEC may shift its priorities, potentially leading to a withdrawal of its appeal in the Ripple case.

Also Read: Is it Advisable to Invest in XRP at Current Price?

How the SEC’s Decision Affects Ripple’s Legal Battle

The SEC’s move to restructure its enforcement unit has fueled speculation that its regulatory focus may be shifting away from cases like Ripple’s. Some legal analysts suggest this could indicate a potential withdrawal from its appeal in the XRP lawsuit, which would have significant implications for Ripple and the broader crypto market.

Adding to the speculation, the SEC has yet to make any major statements regarding the future of its case against Ripple. The XRP community remains on high alert for any signals that the agency may change its approach, especially in light of the newly formed CETU and its priorities.

XRP Price Movement in Response to the SEC’s Actions

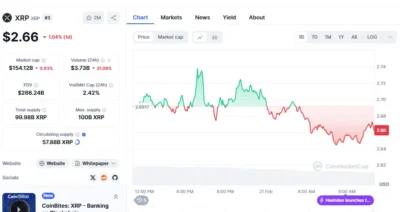

Following the SEC’s announcement on Thursday, February 20, XRP’s price dropped by 1.75%, partially erasing a 6.90% gain from the previous day. XRP closed at $2.6901, underperforming the broader crypto market, which posted a 1.52% increase.

The uncertainty surrounding the SEC’s strategy contributed to market volatility. Over the past 24 hours, XRP has continued in a downward trend, trading at $2.66 on Friday, February 21. A 31.06% decline in trading volume suggests reduced investor confidence, with traders awaiting further clarity on the SEC’s next steps.

Analysts believe that developments in the Ripple lawsuit and potential progress in approving an XRP-spot exchange-traded fund (ETF) could significantly impact price trends.

Source: CoinMarketCap

Grayscale’s XRP ETF Filing Adds to Speculation

The recent listing of Grayscale’s XRP-spot ETF filing in the Federal Register has further intensified speculation. The Federal Register serves as the official journal of the U.S. government, meaning that the SEC must now review and decide on the application by October 18, although a decision could come earlier.

An XRP-spot ETF could drive institutional investment and increase market liquidity if approved. Analysts predict such a decision could push XRP past its all-time high of $3.5505. However, if the SEC rejects the application, XRP may experience further declines, potentially dropping below $1.50.

As the SEC’s restructuring unfolds and its approach to crypto enforcement becomes clearer, traders and investors will closely monitor regulatory actions. Whether the SEC withdraws its appeal in the Ripple case or approves the XRP-spot ETF, both events could profoundly impact the asset’s future.

Also Read: Big News For Ripple: First XRP ETF Launched Into Market