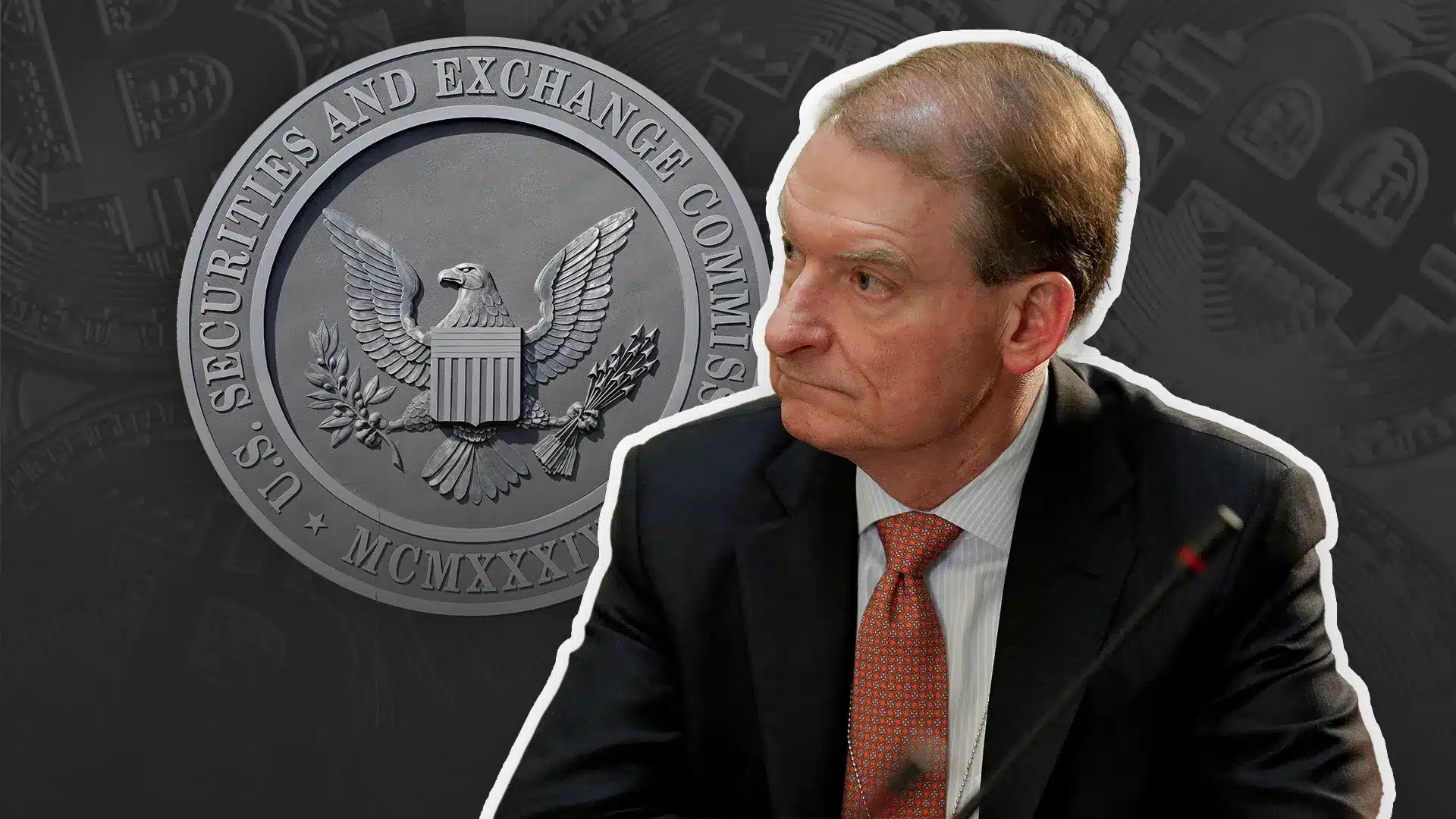

SEC Chair Paul Atkins has openly criticized former Chair Gary Gensler’s approach to cryptocurrency regulation, calling it a direct threat to innovation. According to Atkins, the crypto market urgently needs clear, straightforward rules to unlock its full potential.

Atkins participated in the Crypto Task Force Roundtable to explain how digital assets would provide major advantages through more effective operations and reduced expenditures. The previous administration maintained strict policies that forced genuine players into alternative markets.

In his recent CNBC interview, Gensler maintained that market sentiments powered 99 percent of digital assets. These statements matched his previously demonstrated negative outlook regarding cryptocurrencies.

Besides criticizing Gensler’s approach, Atkins praised Commissioner Hester Peirce for her consistent advocacy for “common-sense” crypto regulations. He highlighted that Peirce, often called “Crypto Mom,” has been a rare voice of reason within the SEC regarding digital asset oversight.

Also Read: Bitcoin Surges Past $94K as Tether, BNB, and Solana Prices Take a Hit

Custody Rules at the Center of Crypto Roundtable Discussions

Meanwhile, the agency’s third crypto roundtable sharply focused on the ongoing debate over custody rules for digital assets. Several participants called for an alternative custody framework tailored specifically for cryptocurrencies.

SEC Commissioner Caroline Crenshaw firmly rejected the proposal to modify custody rules because she considered existing standards the highest possible investor protection standard. She explained that every crypto industry actor needs stringent regulations to protect client assets.

Crenshaw stated that digital assets and blockchain technology create special risks that go beyond the scope of established regulation. After she voiced her opinion to the SEC, the commission faced internal disagreement about crypto’s position in securities law enforcement.

Atkins’ urgent request for modernized regulatory guidelines demonstrates that the SEC might adjust its crypto regulatory methods. He promotes practical guidelines at the SEC because he believes this approach will support new technology development and robust investor protection.

Meanwhile, SEC employees maintain elevated tension levels because of the escalating dispute regarding cryptocurrency regulation policies. Ultimately, Paul Atkins’ robust criticism of previous regulations indicates an increase in equitable and transparent operational direction.

Also Read: Satoshi Nakamoto – Mysterious Creator of Bitcoin: The Visionary Who Launched a Financial Revolution