- Massive SHIB exchange outflows emerge as prolonged selling pressure finally slows

- Shiba Inu stabilizes after months of losses as exchange balances decline

- On-chain data supports price consolidation as sellers show clear exhaustion

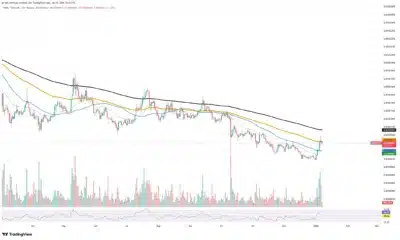

Shiba Inu has entered a calmer phase after enduring months of persistent downside pressure across the broader crypto market. New exchange flow data now shows that selling pressure has stalled, as large volumes of SHIB tokens have unexpectedly moved off centralized exchanges.

Recent figures highlight a decisive shift from prolonged inflows that previously signaled sell-side positioning. Those inflows added constant pressure on price action and limited recovery attempts. However, the sudden emergence of exchange outflows suggests that holders are stepping back from immediate selling.

Consequently, reduced exchange balances often reflect a growing preference for holding rather than liquidation. This change helps ease short-term supply pressure and allows the market to stabilize if demand remains intact.

Also Read: Cardano Futures Explode as Grayscale ETF Speculation Sparks Massive ADA Bets

Exchange Flow Shift Changes the Short-Term Narrative

Recent market data shows that SHIB exchange outflows have overtaken inflows after an extended period of sell dominance. This shift typically indicates that aggressive distribution has slowed, at least in the near term. Hence, the reduction in exchange supply reshapes SHIB’s short-term outlook without confirming long-term accumulation. Selling urgency that previously fueled sharp declines now appears to be easing.

Besides exchange metrics, recent price behavior supports this developing narrative. SHIB rebounded from local lows and reclaimed short-term moving averages alongside improved trading volume. This recovery suggests that sellers are losing momentum rather than buyers entering aggressively. Price movement reflects reduced pressure instead of renewed bullish conviction.

Moreover, the current market structure lacks panic-driven characteristics seen during earlier sell-offs. Trading activity now appears more orderly, pointing toward consolidation rather than continued breakdown.

Network Activity Supports Price Stabilization Efforts

Additionally, on-chain data provides further context for the evolving market dynamics. Active address metrics show that network participation has remained stable, with slight improvements despite recent price weakness. Significantly, sustained engagement during price declines often reduces the risk of deeper structural damage. In SHIB’s case, consistent activity strengthens the argument that recent lows could hold under current conditions.

However, longer-term technical signals still warrant caution where key moving averages on higher timeframes continue to slope downward, confirming that SHIB remains within a broader bearish trend.

Moreover, without a clear rise in spot demand, any upside movement may remain corrective. Continued exchange outflows would be required to maintain reduced selling pressure during price rebounds. Meanwhile, a renewed return of exchange inflows could suggest that recent strength resulted from short covering rather than genuine holding behavior. Such a shift would likely reintroduce downside risks.

SHIB appears to be transitioning from heavy selling into a stabilization phase. Exchange flows, price action, and network participation are aligning more constructively than before, even as confirmation remains limited.

Also Read: Stellar XLM Shaken as Open Interest Crashes 12% Amid Sudden Market Sell-Off