- Shiba Inu whales moved billions without shaking the market.

- Heavy SHIB outflows hint at whales securing tokens, not selling.

- Price stability amid massive transfers suggests bullish sentiment remains intact.

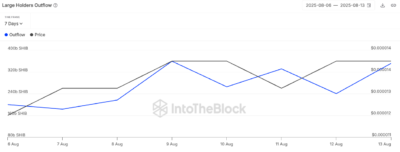

Shiba Inu saw one of its most active trading sessions in recent weeks as large holders significantly increased token movements. According to IntoTheBlock, between August 12 and 13, major wallets shifted 351.6 billion SHIB, up from 240.13 billion the day before. This marked a sharp 40 percent rise in outflows within just 24 hours.

Price Holds Steady Amid Whale Activity

Such heavy movements typically suggest tokens are headed to exchanges for selling or being moved to cold storage. Nonetheless, the market value of SHIB did not waver much as it was maintained at about $0.000014 during the transfers. Such stability is indicative of the increased probability of whales locking down their positions in personal wallets instead of getting ready to dump the market.

Also Read: Ripple CTO Says Blockchain Adoption Expands as XRPL Maintains 13-Year Lead

At the same time, the price movement of SHIB was characterized by the push to $0.00001425, a dip to $0.00001360, and a gradual climb to $0.00001380. The absence of sharp falls or panicked selling confirmed the notion that any supply was being soaked up by the buying demand.

Potential Short-Term Targets Emerging

Market analysts observe that with the current momentum, the SHIB might target the $0.00001420 and the $0.00001430 range.

A bounce off those levels could carry gains to the area of $0.00001480.On the bearish side, the breakdown of the $0.00001360 support may lead to a fall towards the $0.00001320 level.

Source: IntoTheBlock

Whale Moves Without Market Shake-Up

The most notable factor is that some of the largest Shiba Inu holders made major transfers without sparking volatility. Such a scenario of low volatility and a lot of whale activity is a precursor to a spike in trading activity in the cryptocurrency market.

SHIB’s recent whale-driven outflows, paired with steady pricing, suggest that large holders may be shifting assets into long-term storage. The subsequent few sessions could determine whether this calm under heavy activity signals a breakout or a test of support levels.

Also Read: Massive 320,000,000 XRP in 72 Hours – What’s Going On?