- A trader opened a $1.2M 20x long on XRP on Hyperliquid at $2.1264, signaling bullish conviction and early profits.

- A separate 4.8M XRP withdrawal from Upbit to a private wallet sparked whale speculation, often associated with off-exchange positioning.

- Together, the leverage and on-chain activity suggest heightened smart-money interest, though analysts caution no guarantee of sustained upside.

Market watchers are closely monitoring a high-profile XRP trade after analyst Xaif Crypto highlighted a significant leveraged position on Hyperliquid. According to the shared data, a trader opened a 20x long position on 564,285 XRP at an entry price of $2.1264, bringing the total position value to approximately $1.20 million.

At the time of the report, the position was already in profit, showing an unrealized gain of about $9,608, representing roughly a 16 percent increase. The trade details indicate the position remains comfortably above its liquidation price, suggesting the trader entered with a clear risk buffer rather than an immediate high-risk gamble.

The visibility of such a large, leveraged position has fueled speculation among market participants, particularly as XRP continues its early pump in 2026.

Trading Data Highlights Conviction and Timing

The Hyperliquid data shared by Xaif Crypto shows the position fully allocated to the long side, with no corresponding short exposure. The trade size, leverage, and early profitability point to strong conviction in upward price movement rather than a hedged or market-neutral strategy.

Analysts note that while leveraged positions do not guarantee directional accuracy, they often reflect expectations tied to future appreciation, anticipated catalysts, liquidity shifts, or technical setups. In this case, the timing of the trade coincided closely with unusual on-chain activity involving a large XRP transfer.

Also Read: Bitcoin, XRP Surge as Crypto Market Prices Flash Strong Momentum Today

🚨 BREAKING: $XRP

A trader on Hyperliquid just opened a 20× long on 564,285 XRP at $2.1264 entry.

💼 Position value: $1.20M

📈 As of now, unrealized profit: $9,608.65 (+16%) pic.twitter.com/iQHSlekTFS

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) January 5, 2026

4.8 Million XRP Transfer Sparks Whale Speculation

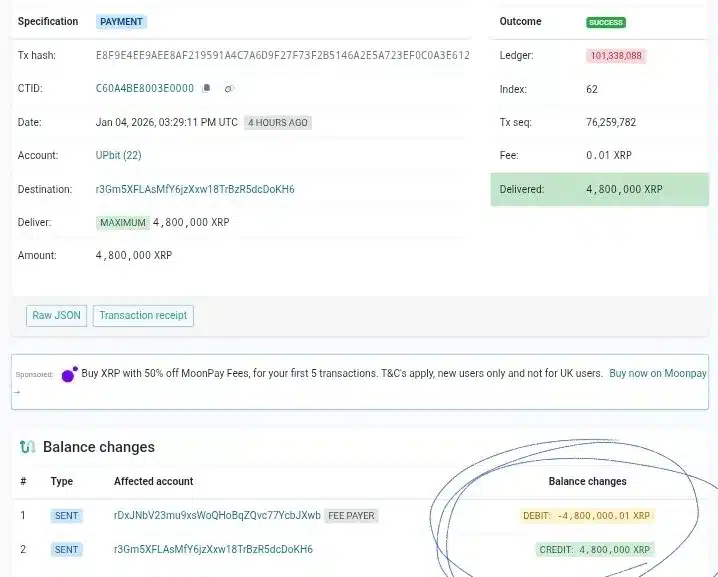

Adding to the intrigue, Xaif Crypto also highlighted a separate on-chain transaction involving a movement of 4.8 million XRP from Upbit, one of South Korea’s largest cryptocurrency exchanges by volume. Blockchain data shows the transaction was successfully settled on the XRP Ledger with a network fee of just 0.01 XRP.

The transfer moved the full 4.8 million XRP to a private address, prompting speculation that a whale or institutional entity may be repositioning assets off-exchange. Such withdrawals are often interpreted as a sign of longer-term holding intentions, although they can also be linked to liquidity management, custody changes, or over-the-counter activity.

Source: XRPScan

Low Fees Underscore XRPL Efficiency

The transaction data also drew attention to the XRP Ledger’s efficiency, with the entire multimillion-dollar transfer completed at a negligible cost. Analysts frequently point to this feature as a core reason XRP remains attractive for large-value transfers, particularly when compared with higher-fee blockchain networks.

This aspect has renewed discussion around XRP’s utility narrative, especially as large holders continue to demonstrate confidence in the network for moving significant value.

Market Interprets Signals With Caution

While the combination of a large leveraged long position and a multimillion-XRP exchange outflow has energized XRP-focused traders, analysts caution against drawing definitive conclusions.

Whale movements and high-leverage trades can align by coincidence, and neither guarantees sustained price appreciation on their own. However, together they signal heightened activity among sophisticated market participants at a time when XRP price movement is under close watch.

For now, the market appears to be watching whether this convergence of leverage and on-chain movement precedes a broader shift in momentum or remains an isolated event within an otherwise range-bound environment.

Also Read: XRP Jumps 9% as ETF Inflows and Short Liquidations Ignite Market Recovery