- Sonic Labs focuses on long-term growth and token improvements ahead.

- New U.S. expansion and tech upgrades set for big impact.

- Major S token changes promise rewards and deflationary features soon.

Sonic Labs is making a bold shift towards sustainable growth and long-term value, moving away from short-term hype. CEO Mitchell Demeter recently announced that the company is focused on building a solid foundation after spending weeks analyzing its structure and goals. With this new direction, Sonic Labs aims to strengthen its network, grow its user base, and develop lasting tools that will stand the test of time.

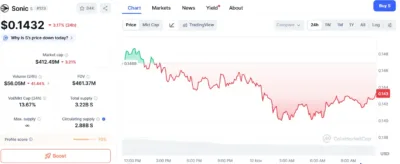

As part of its strategic overhaul, Sonic Labs plans to introduce significant changes to its S token, including features that could make it more deflationary and rewarding for those who hold or build on it. Despite a 3% dip in the token’s value this week, currently trading at $0.14, Demeter reassured stakeholders that Sonic’s finances are strong, with a healthy treasury backing the company’s future.

Key Updates: New Models and Expanding Presence

Sonic Labs is rolling out several critical updates to support its long-term vision. The company is revamping its FeeM model, introducing clearer rewards for builders and validators while leveraging token burns to reduce supply and create a more sustainable ecosystem.

Additionally, Sonic is expanding its footprint in the United States with a new office in New York. This move will allow the company to enhance relationships with U.S. regulators and increase its influence in the region.

Also Read: Coinbase’s M&A Strategy Remains Strong Despite Setback in BVNK Deal

Another significant change comes with the launch of the GMSonic project. This initiative aims to become a global hub for education and community engagement, strengthening the Sonic ecosystem and providing resources to developers and users.

Sonic is also working on improving its technology by adopting Ethereum-inspired upgrades (EIPs) and implementing Sonic Improvement Proposals (SIPs), which will enhance the network’s performance and make it more useful for businesses.

Strategic Focus and Market Outlook

While the S token’s price has seen a slight decline, Demeter emphasized that price alone is not the ultimate goal. Rather, a stable price is a reflection of investor confidence, which in turn attracts more developers and investors. Sonic’s goal is to build a foundation based on strong fundamentals and a consistent vision.

Looking ahead, Sonic Labs faces its next major test: breaking through the $0.21 to $0.22 resistance zone. A successful push above this range could lead to a rally towards $0.27 to $0.30, representing an 80-90% upside.

However, if Sonic fails to break out, a pullback to $0.11 could be in the cards. Much of Sonic’s future performance will depend on broader market trends, particularly the direction of Bitcoin.

Also Read: Coinbase’s M&A Strategy Remains Strong Despite Setback in BVNK Deal