- Stellar posts strongest July ever with 75.7% monthly surge.

- XLM doubles past quarterly records despite recent short-term decline.

- Six-year green streak continues as Stellar defies bearish market trends.

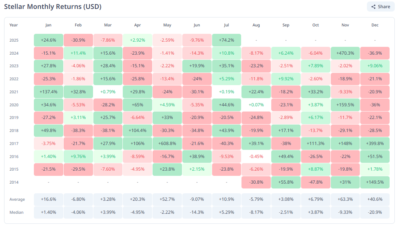

Despite a 13.46% dip in the past seven days, Stellar (XLM) remains on a notable bullish trajectory. The digital asset surged significantly in July, recording a monthly growth of 75.7%, marking its strongest performance for the month since inception.

According to data from Cryptorank, XLM’s July returns have far exceeded its historical averages. Its rate of growth has surpassed the usual 11% gain experienced every July, with its realisation of over six-fold growth. This performance would help Stellar finish this month strong, continuing a streak of green monthly closes for six straight years.

Also Read: Ripple CTO Rips Into Forbes Over Support for Convicted FTX CEO SBF

XLM also registered good momentum in Q3 2025, with an increase of 74.8 percent. That is the strongest quarterly performance in the asset. In the past, its best quarters were in 2016 and 2018, when it had 34.5%. Its recent values have almost doubled its past peaks, and this further strengthens its bullish implications.

Source: Cryptorank

XLM Performance Surges Beyond Historical Trends

Stellar reached its highest price of $0.4469 during its recent bounce, but despite the gain, it has retreated. It is currently valued at $0.4154 and has lost 1.73 percent in the past 24 hours. This fall was preceded by a technical refusal at the level of $0.52 resistance, which resulted in a temporary stop in the upward movement towards it.

The latest rally has not only set monthly and quarterly records but also signaled increased investor interest. XLM’s performance marked a better performance through the month of July compared to most of the assets that were affected by the larger market pressures.

In addition, the asset’s ability to maintain such expansion during recent volatility highlights a change in market dynamics regarding Stellar. Analysts argue that investor confidence in the asset’s long-term potential contributed to this performance in part.

The current decline in comparison to its all-time high is not unusual as market corrections cause it, but the results obtained in July and Q3 place Stellar among the highest-ranking assets during the current quarter. Further opposition at the most important positions will be very important to its short-term trajectory.

With July nearing its end, all indicators suggest Stellar is poised to close the month in profit. Its standout performance this quarter continues to separate it from other assets experiencing bearish momentum.

Also Read: BONE Powers SHIB Burns and Community Governance Behind the Scenes