Crypto.com has announced plans to delist Tether (USDT) and several other digital assets for customers in the European Union. This decision aligns with upcoming Markets in Crypto-Assets (MiCA) regulations, which enforce stricter compliance standards.

The exchange has started notifying users, urging them to take action before the upcoming deadlines.

Also Read: Another XRP Crash Coming? See This Analysis

Delisting Timeline and Affected Assets

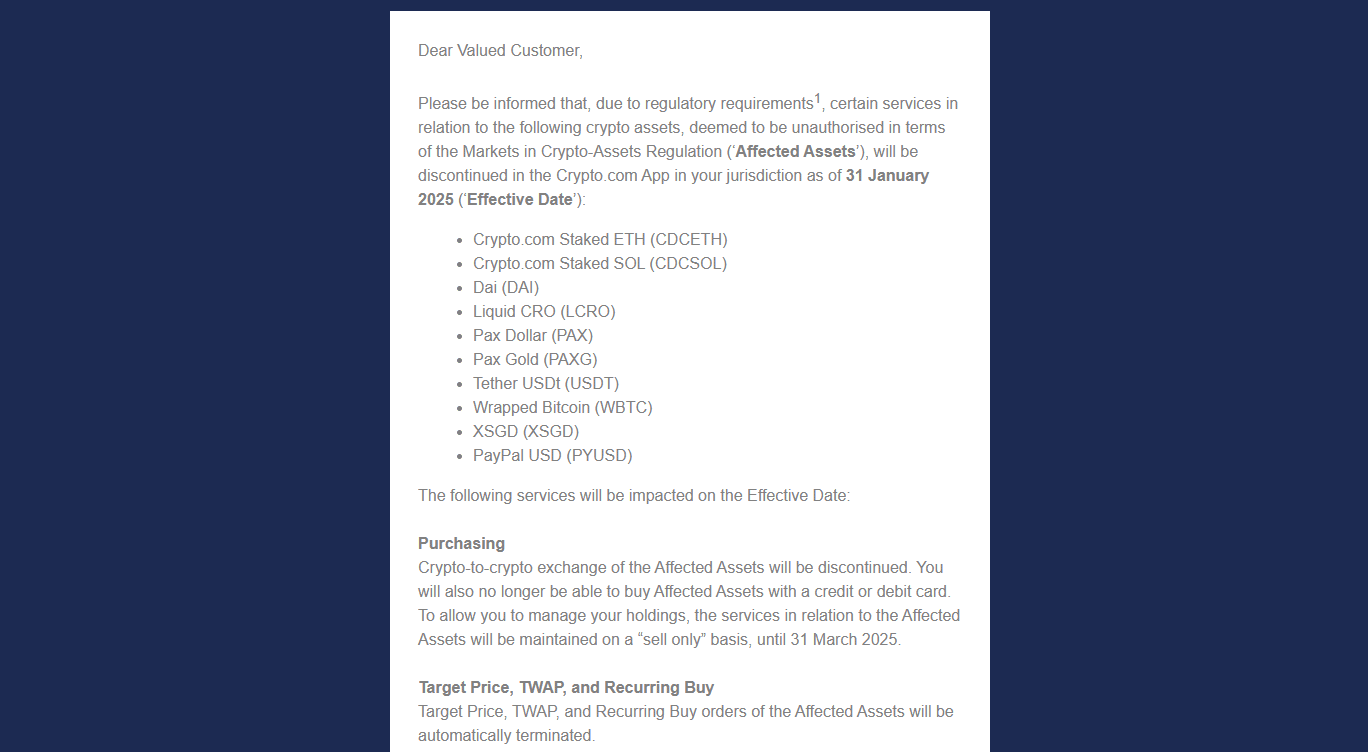

Crypto.com plans to remove USDT and other affected assets from its platform during various stages of 2025. On January 31, 2025, Crypto.com will stop enabling acquisition, staking, or exchange transactions for these assets.

The trading functions Target Price, TWAP and Recurring Buy will no longer be available as Crypto.com makes its asset platform changes. On March 31, 2025, customers will permanently lose access to selling and withdrawing all tokens stored in their Crypto.com accounts.

All unclaimed balances at Crypto.com will be converted into USD-backed stablecoins by default. Users need to inspect their investment portfolios beforehand to avoid conversion pressure or liquidity problems according to the company guidance.

Crypto.com has removed numerous coin types from service through delisting including DAI, PAX, PAXG, WBTC, XSGD, and PYUSD. Changes at Crypto.com stem from rising EU regulatory controls on stablecoin operations. The MiCA regulations establish new norms for digital assets throughout European markets regarding their issuance and circulation.

Source: @warmar_crypto

Crypto.com’s MiCA Compliance and EEA Expansion

Crypto.com, Bitpanda, and OKX obtained regulatory approval under EU MiCA, enabling their continued operations across the region. The licenses permit these service providers to deliver digital assets with full compliance with updated regulatory measures.

The regulatory standards of Crypto.com have been strengthened as the company extends its operations across Europe. The MiCA passport allows approved exchanges to conduct operations across all European Economic Area countries without gaining extra local government approval. OKX has unveiled its strategy to bring OTC, spot, and automated trading to its platform. Crypto.com’s website and mobile platform continue to improve features for users within specific regions.

Crypto.com hasn’t revealed the complete range of services it intends to provide to European Economic Area market customers. The exchange will continue to extend its product offerings after they meet MiCA regulatory requirements. The platform adheres to strict regulatory compliance standards while providing European customers with a seamless transition experience.

Impact on Users and Industry

The delisting of USDT and other assets underscores the EU’s efforts to regulate stablecoins under a clear legal framework. These changes may push European traders toward other compliant digital assets.

Some investors might shift toward alternative platforms that continue offering USDT outside MiCA’s jurisdiction. Crypto.com has emphasized the importance of regulatory compliance as part of its long-term growth strategy.

The company continues working with regulators to meet evolving industry standards. This move signals a broader shift in how crypto exchanges operate under tightening global regulations.

With regulatory scrutiny increasing across major cryptocurrency markets, exchanges, and service providers continue to adjust their strategies to align with evolving compliance requirements. The upcoming changes on Crypto.com highlight the growing influence of regulatory bodies in shaping the future of digital asset accessibility within the European financial landscape.

Also Read: See How Much XRP Ripple Co-Founder Has Dumped This Year