Every year, more and more institutional investors – hedge funds, large corporations and banks – are showing interest in crypto. This growth in interest can be attributed to several factors, including the successful launch of the Bitcoin ETF and the potential approval of the Ethereum ETF.

In addition, crypto assets provide investors with many opportunities to diversify their portfolios, reduce risks, and find new sources of income.

However, to trade effectively, institutional investors need access to reliable and secure cryptocurrency services that meet their requirements. In this article, we will look at the five best cryptocurrency exchanges for institutional investors in 2025 and the key criteria they use to choose trading platforms.

How Crypto Exchanges are Adapting to the Needs of Institutional Investors

With the growing interest in cryptocurrencies from institutional investors, exchanges are actively expanding their offerings by introducing services such as market making and liquidity services to meet their needs.

Among the benefits of institutional trading services, one of the main advantages is access to pools with high liquidity. While cryptocurrency exchanges depend on the activity of individual traders to provide retail services, institutional services directly connect market participants with liquidity providers, i.e. financial institutions.

As a result, large transactions can be executed without significantly affecting the market price. In addition, the platforms offer a wide range of trading tools that allow for the implementation of complex trading and hedging strategies.

Traders have access to various order types, including market, limit, stop-loss, and take-profit orders, which help them to implement their trading plans more accurately. Additionally, many platforms support algorithmic trading, which allows traders to automate the process and execute trades according to predefined parameters.

How to Choose a Crypto Exchange for Institutional Trading: Key Criteria

Choosing a platform for institutional trading is an important step for every investor. Therefore, there are several key factors to consider when choosing a cryptocurrency exchange:

- Liquidity and trading volume. Exchanges with high trading volume usually offer better conditions, as high liquidity allows transactions to be executed without significant market fluctuations, which is important for investors.

- Security. To ensure maximum asset protection, cryptocurrency exchanges should implement robust security mechanisms such as cold storage, multifactor authentication, and regular security audits to minimise the risk of loss.

- Advanced trading tools. Access to high-quality APIs with extensive capabilities, collocation, and sub-accounts allows for more complex strategies and risk control in a volatile market.

- Trading fees can vary significantly from exchange to exchange. For institutional investors, the fees must be low and commensurate with the volume of their transactions. Exchanges focused on institutional trading often offer special conditions for such clients.

- Trading infrastructure. Platforms that can process large volumes of transactions without delay ensure efficiency and continuity of trading, which is essential for large investments.

- Customer support is essential. Institutional clients often have specific requests, so prompt and professional support is an important prerequisite for long-term and successful cooperation with an exchange.

- Accessibility. Most exchanges focus on serving large clients, which can be difficult for smaller institutions or new companies looking for the right level of support.

- Speed of request and onboarding processing. Some global exchanges often have a large volume of requests, which can cause delays in processing or even no response to some requests.

Ranking of Top Crypto Exchanges Offering Institutional Services

As institutional investors are increasingly exploring the crypto market, choosing the right platform is crucial. In particular, Finbold recently published a rating of the top cryptocurrency exchanges that offer services for institutional investors. Let’s have a closer look at them and compare them by key criteria.

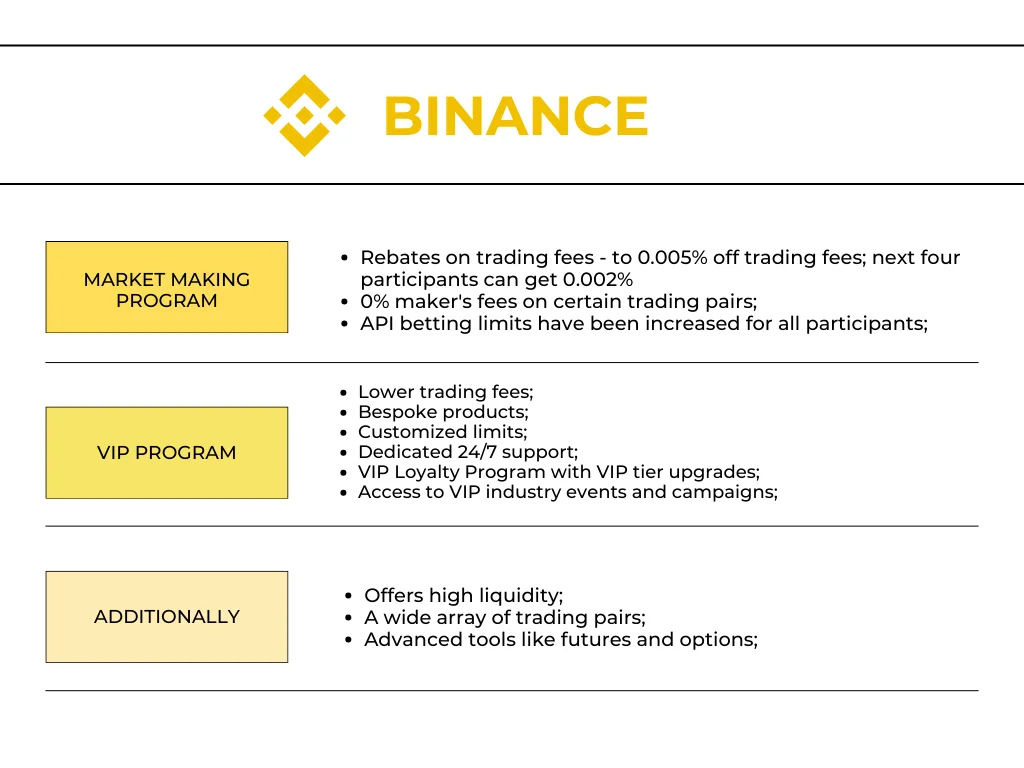

1. Binance

Binance is the largest exchange by trading volume, offering comprehensive solutions for institutional clients.

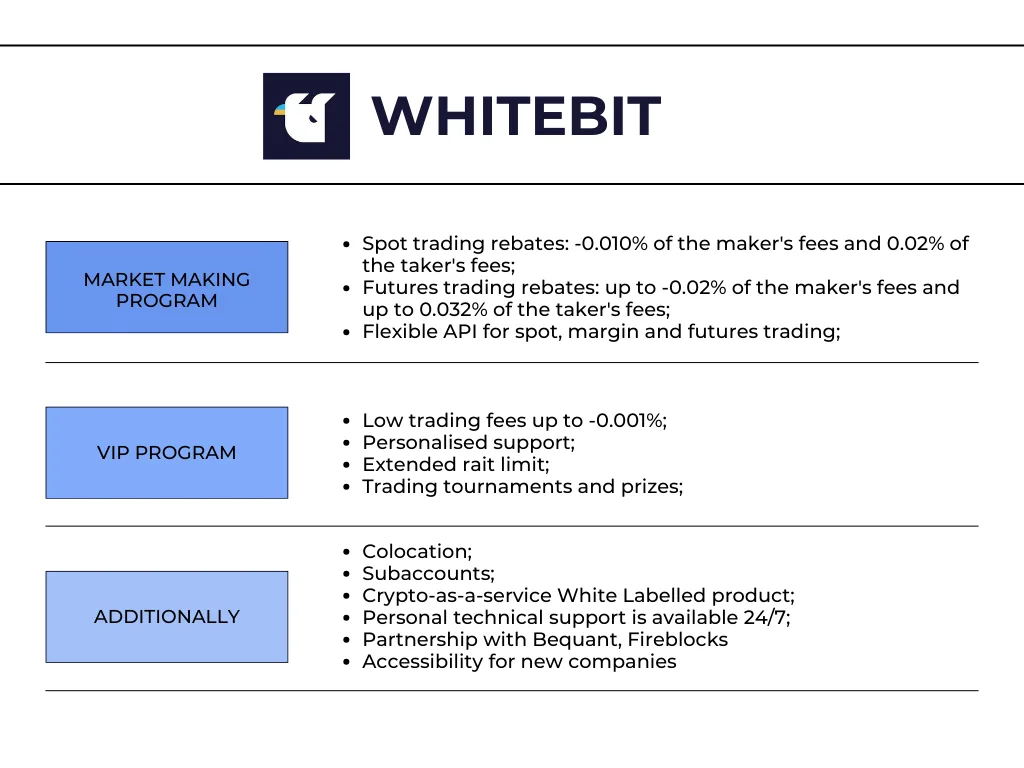

2. WhiteBIT

WhiteBIT stands out for its transparency and wide range of services for institutional traders. In the ranking, it is the only exchange that openly demonstrates the entire pool of services for institutional traders.

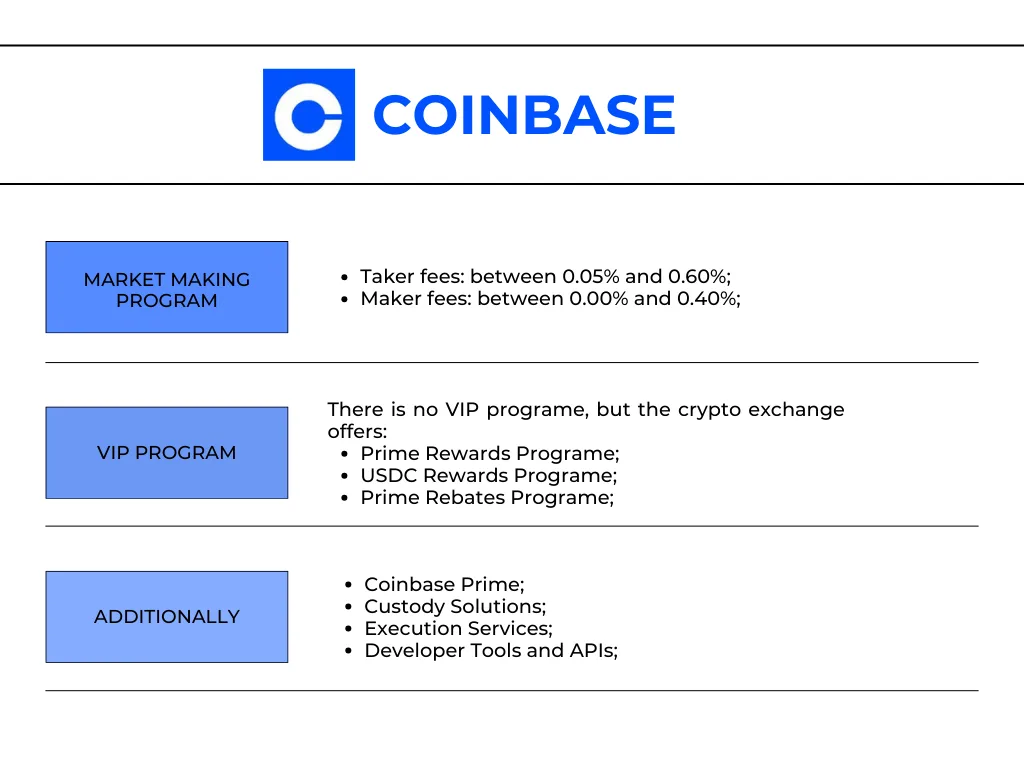

3. Coinbase

Coinbase, thanks to its strict compliance with regulatory requirements, is the best choice for institutions looking for a secure trading platform.

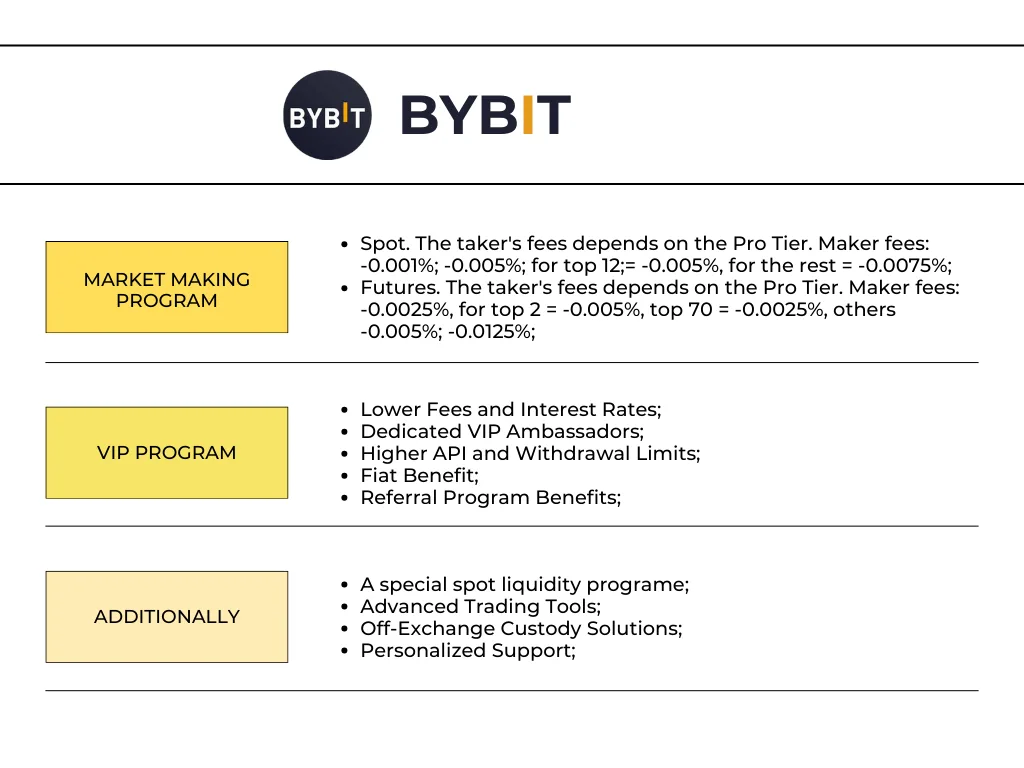

4. Bybit

Bybit has established itself as a leader in the derivatives market and is therefore popular with traders seeking to hedge their positions effectively.

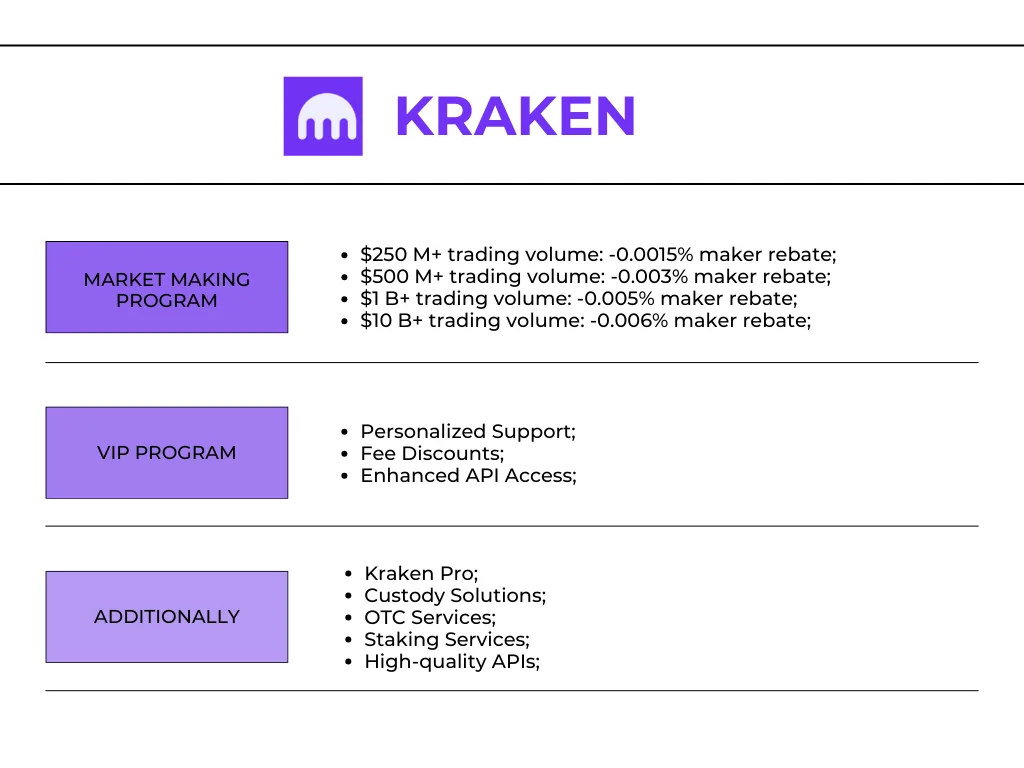

5. Kraken

Kraken is known for its transparency and emphasis on security, making it an ideal choice for institutions that pay particular attention to risk management.

Each of these exchanges has its own unique benefits, so the choice depends on your organisation’s needs. It is important to determine whether you prioritise high liquidity, regulatory compliance or personalised services.