At first glance, crypto trading tournaments may seem like just another entertainment for traders. However, their popularity has a much deeper meaning – the impact on the market, the behaviour of participants, and the overall state of the industry.

Today, they have become a powerful tool in the hands of cryptocurrency exchanges: tournaments help attract new users, maintain liquidity, and stimulate activity on the platforms, especially during periods of low volatility. But why are these competitions not only an element of entertainment but also part of a marketing strategy?

The Psychology of Trading Tournaments: How Competitions Change Traders’ Strategies

Trading tournaments are competitions between traders where participants try to achieve the highest profit in a limited time. As a rule, they are held on cryptocurrency exchanges and have different formats: from classic ones with prizes for the highest profit to tournaments where participants demonstrate their skills in specific trading strategies.

Such tournaments not only provide an opportunity to improve your skills but also motivate participants to compete for prizes. In some cases, these are individual competitions, and sometimes they are team competitions, where everyone has their own role and specific goals to achieve. Most often, they are organised to attract new traders, increase the number of active users and maintain interest in trading activity on the platforms.

In particular, participation in tournaments is not only a chance to earn prizes and reputation, but also a way to test your resilience and ability to make quick but strategic decisions. During competitions, traders start behaving differently than usual, and emotional involvement plays a key role here.

The atmosphere of tournaments changes the approach: the thirst for risk increases, and there is a desire to act more aggressively and change strategies. This is explained by the effect of competition – the desire to take the lead or get to the top of the ranking pushes traders to make bold, sometimes impulsive decisions.

Often, this means increasing positions, the number of trades, and being less cautious – even if such steps would be atypical for everyday trading.

Analysing traders’ behaviour during tournaments allows us to draw important conclusions about their psychological attitudes. More risky strategies indicate emotional stress, while more conservative approaches may indicate an attempt to control emotions in a competitive environment.

Tournaments as a Marketing Tool: The Strategic Approach of Crypto Exchanges to Audience Expansion

Turning to the marketing side of trading tournaments, it is worth noting that cryptocurrency exchanges have actively turned them into a powerful tool for expanding their audience and increasing their presence in the information field.

The very fact of holding such tournaments creates a natura,l newsworthy occasion that helps not only to maintain the interest of existing users but also to attract new ones.

To achieve maximum effect, exchanges use comprehensive promotion strategies:

Tournament marketing strategies not only help to increase the reach and number of impressions on social media but also actively build a positive image of the platform, attract new users, and contribute to the development of cryptocurrency ecosystems.

Through a combination of active campaigns, strategic partnerships, and interactive elements, crypto exchanges create deep engagement in their products and services, which ultimately leads to an increase in the popularity of both tournaments and the platforms themselves.

As Vincent Liu, CIO of Kronos Research, notes:

“Trading tournaments can effectively attract retail participants and drive a surge in trading volume. At the same time, market makers are incentivized to increase their activity or provide additional liquidity, enhancing overall market depth and efficiency. This dual impact strengthens both retail engagement and institutional participation, making tournaments a valuable tool for ecosystem growth.”

Let’s have a closer look at real-life cases.

In April this year, the crypto community witnessed several major trading tournaments organised by leading industry players.

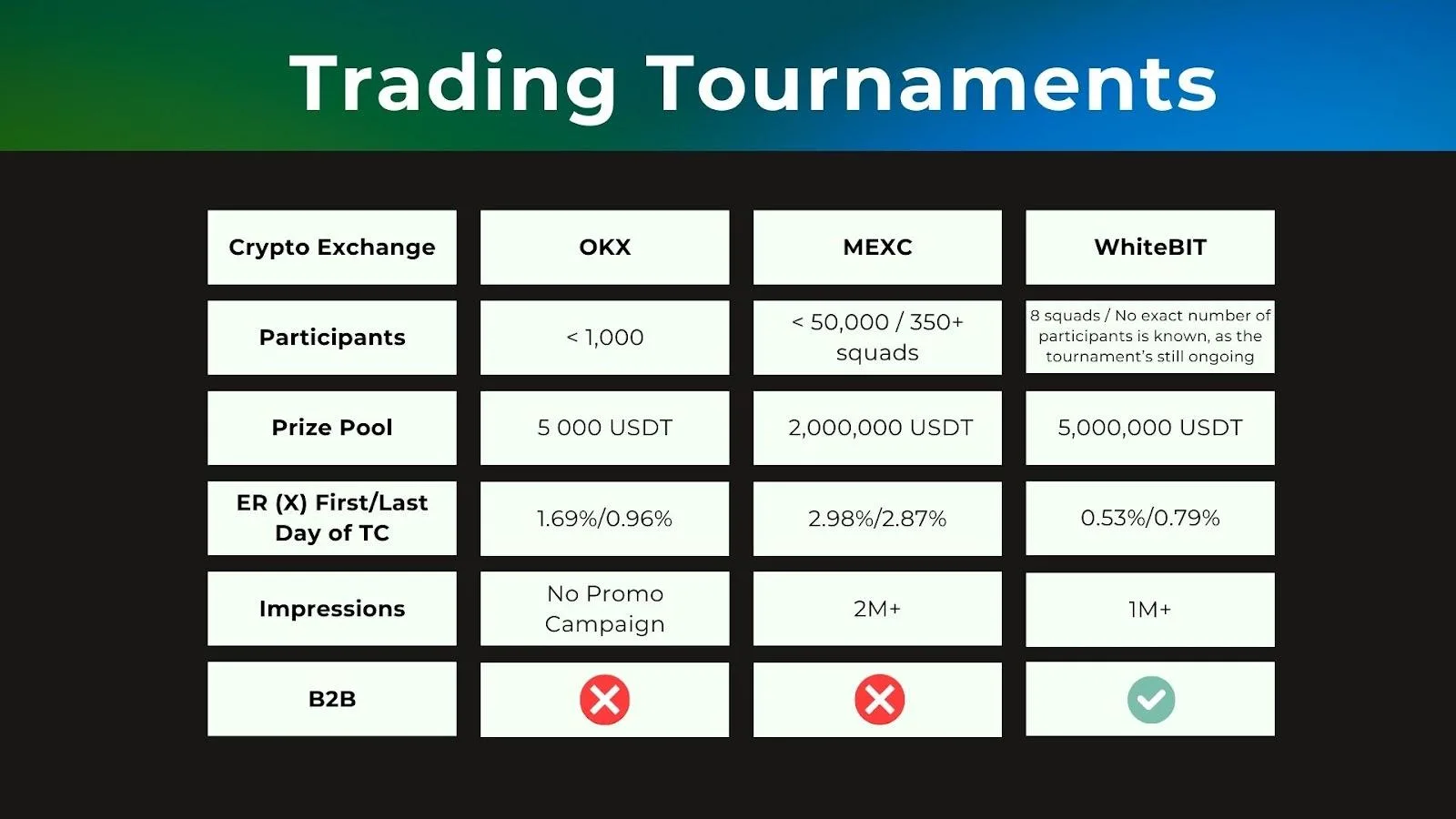

Having analysed tournaments on several cryptocurrency exchanges according to several key criteria, the following conclusions can be drawn:

This time, OKX focused on affiliated users, refraining from actively promoting the tournament on its social media. Other exchanges, on the contrary, chose a strategy of large-scale presence – in particular, MEXC actively promoted the tournament through social platforms, media, and daily updates of ratings with the announcement of winners.

WhiteBIT stood out with a particularly comprehensive approach to organising the tournament: in addition to classic promotion tools, the exchange used a partnership with TradingView, engaged eight leading traders as team captains, and made the competition open to the public, which could be watched online.

Comparing the approaches, it can be noted that the WhiteBIT tournament has a clear B2B vector, while other participants focused mainly on retail rather than institutional clients.

These features also affected the results of key metrics.

The prize pool of the OKX tournament did not exceed 5,000 USDT, and the number of participants was less than 1,000, which is a rather modest result for a month-long event.

Due to the absence of a promotional campaign, the coverage remained insignificant, and the level of engagement on social media decreased by 0.73% compared to the first day of the competition. Despite a marked increase in activity on the futures market, the overall effect of the campaign was minimal.

The MEXC, on the other hand, achieved more impressive results: the tournament attracted around 50,000 participants, over 350 teams, and set a prize pool of 2,000,000 USDT. The total reach exceeded 2 million, but social media was unable to maintain a stable level of engagement, and by the end of the tournament, engagement dropped by 0.11%, indicating some gaps in the marketing strategy.

WhiteBIT demonstrated the most balanced and effective approach. The tournament with a prize pool of 5,000,000 USDT exceeded expectations even before it ended. The campaign’s reach exceeded one million, and social media activity grew by 0.26%.

As a result, the exchange managed to create an event that was far ahead of others in terms of scale, engagement, and effectiveness in achieving its goals at the intersection of B2B and B2C.

As a result;

Trading tournaments have become an important tool not only for traders but also for cryptocurrency exchanges, which use them to attract new users and increase activity. As a result, these competitions have become an important part of the ecosystem, allowing not only to improve trading skills but also to form new marketing strategies for market development.