The U.S. Securities and Exchange Commission (SEC) has postponed its decision on Grayscale’s application to convert its XRP trust into an exchange-traded fund (ETF).

The regulatory body stated that it found it “appropriate” to extend the evaluation period before determining the next steps regarding the proposed rule change.

The decision to delay the ruling comes after Grayscale initially filed for the conversion in late January. The SEC formally acknowledged the filing in mid-February, making it the first XRP ETF proposal to receive recognition from the regulator.

With this extension, the SEC is expected to follow a similar approach for other XRP ETF applications, including those submitted by Canary Capital and 21Shares.

Also Read: XRP Community Reacts to Major SEC Announcement, Saving the Best For Last?

More Delays for Crypto ETFs Spark Market Reaction

Earlier today, the SEC also postponed its decision on Grayscale’s Dogecoin ETF and Canary Capital’s Litecoin ETF. These delays reflect the agency’s cautious approach toward crypto-related ETFs beyond Bitcoin and Ethereum.

The postponements highlight ongoing regulatory scrutiny over cryptocurrency-based investment products. Despite the SEC’s previous approval of spot Bitcoin and Ethereum ETFs, alternative cryptocurrency ETFs face delays and regulatory uncertainty.

More Firms Enter the XRP ETF Market

After facing regulatory challenges, Franklin Templeton has started competing against other firms to create XRP ETFs. The firm’s new application seeks to establish an ETF connected to XRP, leading to additional competition within the industry.

Grayscale continues to lead crypto asset management, but other major finance organizations, including Fidelity and BlackRock, have not approached the SEC to launch XRP ETFs.

BlackRock strongly stated it would not create ETFs for alternative cryptocurrencies except Ethereum, yet it remains unclear if the company will approve XRP ETFs.

Market participants will follow future developments as the SEC extends its time for judgment. The additional time extension from the SEC may negatively influence investor sentiment and regulatory developments in crypto ETF availability.

The regulatory authorities have kept the exact deadline for their final choice undisclosed, so experts predict new information will emerge within the upcoming weeks.

Implication of XRP Price Movement

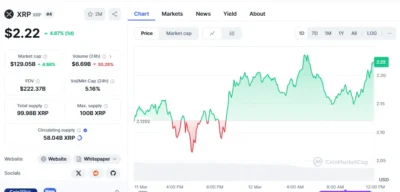

Following the announcement, the price of XRP experienced a decline of 1.2%. This initial drop was a reaction to the regulatory uncertainty surrounding the ETF decision. However, the price rebounded later, climbing to $2.22, marking a 4.87% increase within 24 hours.

Source: CoinMarketCap

Significant news events have historically influenced XRP’s price movement, particularly regulatory decisions and institutional involvement. Positive developments trigger price surges, while delays or setbacks often lead to investor sell-offs and uncertainty.

With the SEC delaying its decision, the short-term outlook for XRP remains uncertain. The postponement could create bearish sentiment, leading to a potential dip in price as investors react to the regulatory uncertainty.

However, the recent price rebound to $2.22 suggests that XRP continues to see strong demand despite the delay, which may help cushion any prolonged downturn. Market volatility may persist in the coming weeks without a clear timeline for ETF approval.

Also Read: Expert Says XRP Just Became a More Attractive Option, Here is Why