- Truth Social’s ETF includes Bitcoin, Ether, Solana, Cronos, and XRP.

- Trump Media files ETF to track top-performing digital crypto assets.

- XRP climbs to $2.33 after ETF filing sparks market interest.

Trump Media’s Truth Social has submitted a formal registration with the U.S. Securities and Exchange Commission for a new crypto-based exchange-traded fund.

The ETF, titled “Truth Social Crypto Blue Chip ETF,” is designed to follow the performance of several significant digital assets, including Bitcoin, Ethereum, Solana, Cronos, and XRP.

According to the prospectus filed, the ETF assets will allocate 70 percent of the total assets to Bitcoin, 15 percent to Ether, and 8 percent to Solana. Cronos and XRP will take 5 percent and 2 percent, respectively.

These allocations are in custody and can not be modified without an amendment and consent to the regulations.

The fund is a business trust registered in Nevada and sponsored by Yorkville America Digital. Instead of registering as an investment company, it will operate outside the Commodity Futures Trading Commission’s oversight, avoiding classification as a commodity pool.

Also Read: Ripple CEO to Explain XRP to Banking Committee – Here’s His Full Testimony

Also, the ETF shall be listed on the NYSE Arca after all the approvals have been obtained. Shares will be issued and redeemed in units of 10,000 through selected broker-dealers.

This framework assists in ensuring that the prices of the ETF are linked closely with the underlying value of the stock in the market.

Dual Crypto ETF Filing Shows Growing Interest from Trump Media

This development follows an earlier S-1 registration filed by Truth Social for a dual-spot ETF covering Bitcoin and Ether. That separate filing proposed a 75 percent allocation to Bitcoin and 25 percent to Ether, with Crypto.com acting as the asset custodian.

The SEC has asserted that the application has been formally reviewed and has started looking at it.

Trump Media’s entry into the field of ETFs evidences a more fundamental approach to introducing digital asset exposure in traditional investment channels. With its new basket-based ETF, the company plans to offer crypto exposure while giving investors diversified exposure by allowing them to access a regulated market.

The ETF provides an easier way for retail and institutional investors to invest in the crypto economy without handling assets directly. Upon its approval, it should raise interest in both financial and crypto-oriented markets.

XRP Price Movements Reflect Renewed Market Activity

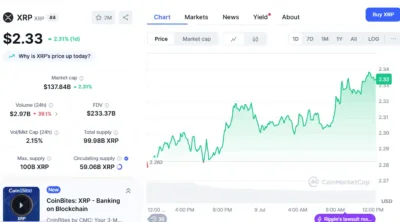

Following the ETF filing, XRP recorded a noticeable upward shift in price, now trading at $2.33 with a 2.31% increase over the past 24 hours.

Source: CoinMarketCap

XRP’s market capitalization rose to $137.84 billion, supported by a circulating supply of 59.06 billion XRP. Despite a 39.1% drop in trading volume, which stood at $2.97 billion, XRP traded between $2.282 and $2.34, showing resilience and renewed market interest.

Also Read: Bitcoin Recovers to $108,734, ETH at 2,621 as TRX Slips 0.1% After Drop