Cryptocurrency trading offers numerous opportunities for profit, with crypto arbitrage leveraging price differences of digital assets across various platforms to secure gains.

As the crypto market grows more diverse and globalized, arbitrage trading has become a sought-after method for traders looking to capitalize on inefficiencies. This article looks at what crypto arbitrage entails, its types, how it works, and its advantages and disadvantages.

Also Read: XDC Network (XDC) Price Prediction 2025-2029: Will XDC Price Hit $0.35 Soon?

What is Arbitrage in Crypto?

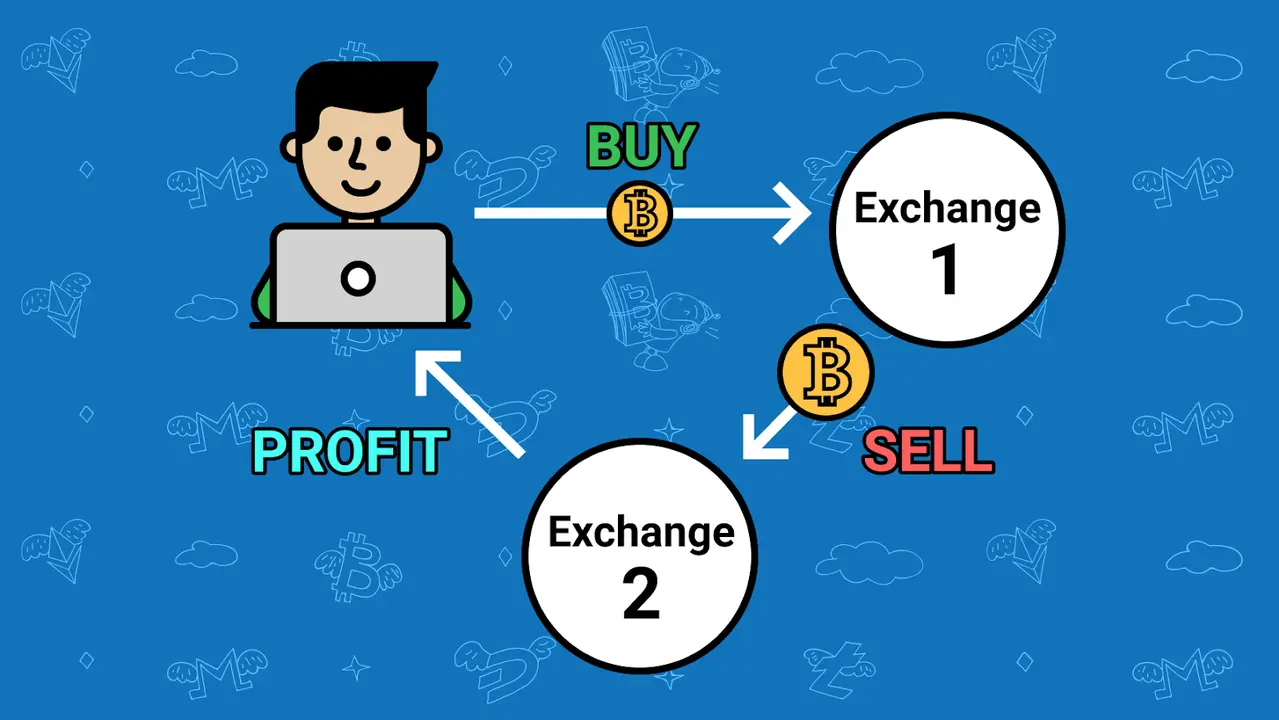

Arbitrage in cryptocurrency denotes purchasing a cryptocurrency at one exchange and then selling it on another at a better price. Liquidity, trading volume, fees, and regional demand differences across various exchanges create opportunities for traders to leverage to secure profits.

Crypto arbitrage can be regarded as a relatively safe approach compared to other types of trading since it isn’t linked to the general tendencies of the market. However, it relies on short-term price discrepancies, making it quite favorable for rather conservative investors adequately.

However, unlike strategy formulation, speed and accuracy are the two significant determinants of strategy implementation performance because these opportunities are often short-lived.

Types of Crypto Arbitrage

Simple Arbitrage

This involves buying an asset on one exchange at a lower price and selling it on another at a higher price. One such basic practice well known as cross-exchange arbitrage entails comparing prices across two different platforms and then promptly making trades.

Triangular Arbitrage

Triangular arbitrage is done entirely within a single exchange, requiring three coins, allowing market makers to benefit from chasing the desired spread between the three assets. This method requires knowledge of markets to a higher level or at least, the use of automated tools for immediate implementations.

Statistical Arbitrage

Mathematical models along with historical analysis and probability calculations are employed to forecast and correct the disparities in prices. Statistical arbitrage as opposed to other types of trading requires probabilities risking which makes it more complicated and presumably more lucrative.

Spatial Arbitrage

Spatial arbitrage is about price anisotropy across exchanges in distinct geographical locations. Although this may mean high earnings in some situations, a typical downside is a delay in exchanging funds between sources and targets that also minimizes profit.

Read Also: Centralized vs Decentralized Cryptocurrency Exchanges

How is Arbitrage Done in Crypto?

The concept of making profits through crypto arbitrage thus requires a unique combination of strategy, velocity, and technology. It starts with trying to discover divergent price levels within different exchange platforms. Businesspeople employ technologies in market monitor to help the traders identify business opportunities swiftly.

The primary reason traders will keep accounts and funds on several trading sites and platforms is to prevent long downtime when it comes to moving money between exchanges. Such an arrangement enables spot business when a price differential is observed.

Automated trading is the key in this aspect, traders use API integration to link their exchange accounts to carry out trades automatically in the shortest time possible.

Another advantage is the potential for quick profits, as arbitrage trades are typically completed in a matter of seconds or minutes, allowing traders to secure returns in a short timeframe.

Another market characteristic is market liquidity which should be high because high liquidity means quick completion of transactions, slashing any risk of missing out on potential lucrative trades.

Benefits of Crypto Arbitrage

Crypto arbitrage has several major and attractive characteristics that are very suitable for traders. The first advantage is that it has low risk in comparison with other trading activities that many people can engage in.

Arbitrage is a much less risky strategy than purely speculative behavior because it is based not on an ability to forecast that stock prices will rise or fall, for instance, but on the ability to profit from existing discrepancies in the market and thus does not rely on market trends.

A third benefit is the ease of making good money if a person invests in the right currencies. Arbitrage trades are usually effected within seconds or minutes, and enable traders to gain returns within that same duration.

Also, it is important to note that this strategy positively affects the general efficiency of the market. In this case, arbitrage trading comes in handy to eliminate or reduce the substantial price differences between the various exchanges to bring a healthy balance within the asset marketplaces.

Disadvantages of Crypto Arbitrage

Despite its benefits, crypto arbitrage comes with its share of challenges, as speed is a critical factor in this strategy, and any delays in executing trades can lead to missed opportunities or financial losses. Traders relying on manual processes or slow systems are particularly vulnerable to this risk.

Conclusion

Crypto arbitrage is a good idea for trading for those who intend to use the opportunity of the market’s imperfection. Therefore by acknowledging the existence of price risk, it is significant for the trader to be familiar with the mechanisms surrounding this risk type, probabilities, and dangers of the price disparity with better certainty.

However, arbitrage trading requires a lot of planning to execute the trades, it requires speed and efficient analytical skills in fee and market management as well. Crypto arbitrage indeed provides a stable way to manage the inconsistent world of cryptocurrencies if one uses adequate instruments and approaches.

FAQs

Is crypto arbitrage legal?

Crypto arbitrage is a legal trading strategy that capitalizes on market inefficiencies.

Do I need advanced tools to start crypto arbitrage?

While not mandatory, advanced tools and automated trading systems improve speed and efficiency.

What is the minimum capital required for crypto arbitrage?

The required capital varies, but starting with a substantial amount can help offset transaction fees.

Can I use any cryptocurrency for arbitrage?

Not all cryptocurrencies are suitable; choose coins with high liquidity and significant price discrepancies.

Also Read: DeXe (DEXE) Price Prediction 2025-2029: Will DEXE Price Hit $50 Soon?