The Bitcoin halving will take place in a few days, but despite this, the crypto industry continues to delight us with news not only about the main cryptocurrency but also about new projects, activities, and scandals. How did another week go in the cryptocurrency world, and how is the industry preparing for the upcoming Bitcoin halving? These and other topics are discussed in today’s article.

Hacker Sentenced to 3 Years in Prison for Stealing Over $12M

Last year, security engineer Shakeeb Ahmed was arrested on fraud and money laundering charges after federal officials said he stole $9 million from a DEX based on Solana that turned out to belong to Crema Finance. In December, the hacker pleaded guilty to one count of computer fraud.

As it turned out, Ahmed stole more than $12 million from two different decentralized cryptocurrency exchanges (DEX) set up on Solana. A federal judge recently sentenced him to three years in prison and three years of supervised release. He will also have to forfeit $12.3 million and pay $5 million in restitution as part of his sentence.

Prosecutors had demanded that the fraudster be imprisoned for up to 4 years, noting that the maximum term provided by law is five years. However, according to the sentencing memorandum filed last week, Ahmed acknowledged his involvement by pleading guilty and returning the proceeds of the hacking attacks and is therefore entitled to a “slightly lesser sentence than the Guidelines.”

Ahmed’s defense lawyers insisted on no prison sentence, arguing that he not only admitted his responsibility but also voluntarily disclosed information about the Nirvana Finance hack to prosecutors.

“Shakeeb already had been indicted for the Crypto Exchange hack, and the government had offered Shakeeb a deal to plead guilty to that hack. Although Shakeeb knew that disclosing another hack would result in additional consequences, and could take his favorable plea deal off of the table, Shakeeb voluntarily came forward anyway.” the defense filing stated.

In a statement, U.S. Attorney Damian Williams noted that Ahmed’s plea was “the first-ever conviction for hacking a smart contract.”

“No matter how novel or sophisticated the hack, this Office and our law enforcement partners are committed to following the money and bringing hackers to justice. And as today’s sentence shows, time in prison – and forfeiture of all the stolen crypto – is the inevitable consequence of such destructive hacks,” he said.

Read Also: Interview With James Bachini on Combating Phishing Attacks in Crypto

Corruption Scandal Around Ethereum

Investigative journalist James O’Keefe has published a sensational exposé linking Ethereum and its founders Vitalik Buterin and Joseph Lubin to a high-profile corruption scandal. The report was covered in detail in a YouTube video by Simply Bitcoin, and its content resonated with the cryptocurrency community.

The accusations came from a former advisor to Ethereum, Steven Nerayoff. He claims that the founders of Ethereum engaged in fraudulent activities that exceed the scale of the infamous FTX scandal, including collusion with corrupt US government officials and manipulation of the blockchain for personal gain. The actions reportedly resulted in billions of dollars in financial losses and potential securities law violations.

The former advisor cites horrific cases of intimidation and coercion by federal authorities, including meetings with FBI representatives. Nerayoff argues that such tactics underscore the threatening power dynamics and risks faced by those who choose to speak out against major players in the tech and financial industries.

The key point of Nerayoff’s accusations is the issue of Ethereum centralization, especially after it transitions to the proof-of-stake model. Ethereum’s move to the proof-of-stake model has raised questions about its integrity and vulnerability to manipulation.

“Morgan Stanley in a report stated that ETH has become more centralized by shifting to proof of stake as only four companies manage 60% of the validators. If you believe there’s no second best, well you’re goddamn right because looking at Ethereum, we see centralization fraud and well blatant securities violations,” said Simply Bitcoin.

If proven true, these allegations could have large-scale consequences for Ethereum and lead to a loss of trust in the blockchain.

Growth of Stablecoin Market Capitalization

The market capitalization of stablecoins is growing, emphasizing that traders believe that the price of Bitcoin will also rise. According to a report by KuCoin Research, the increase in stablecoin inflows is related to the upcoming Bitcoin halving, which will happen very soon.

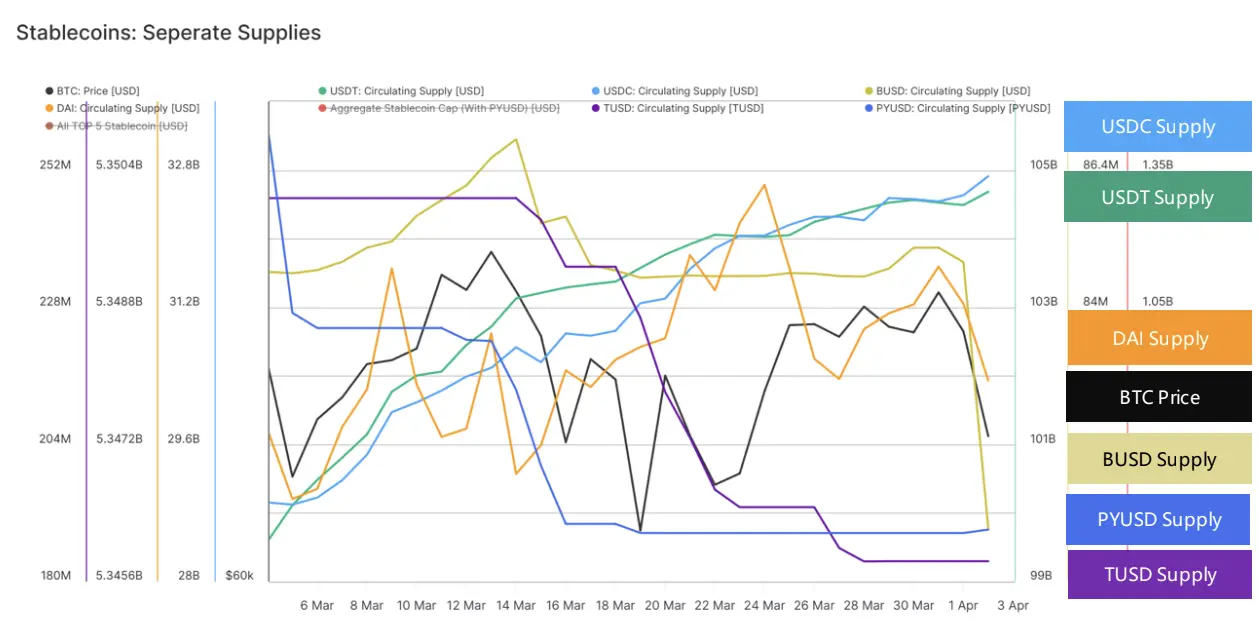

The report describes that Tether and USD Coin continue to grow, reflecting the increased interest in crypto assets among users. At the same time, the issuance of Binance USD, True USD (TUSD), and PayPal USD (PYUSD) has decreased, but the two largest stablecoins by market capitalization continue to enter the market.

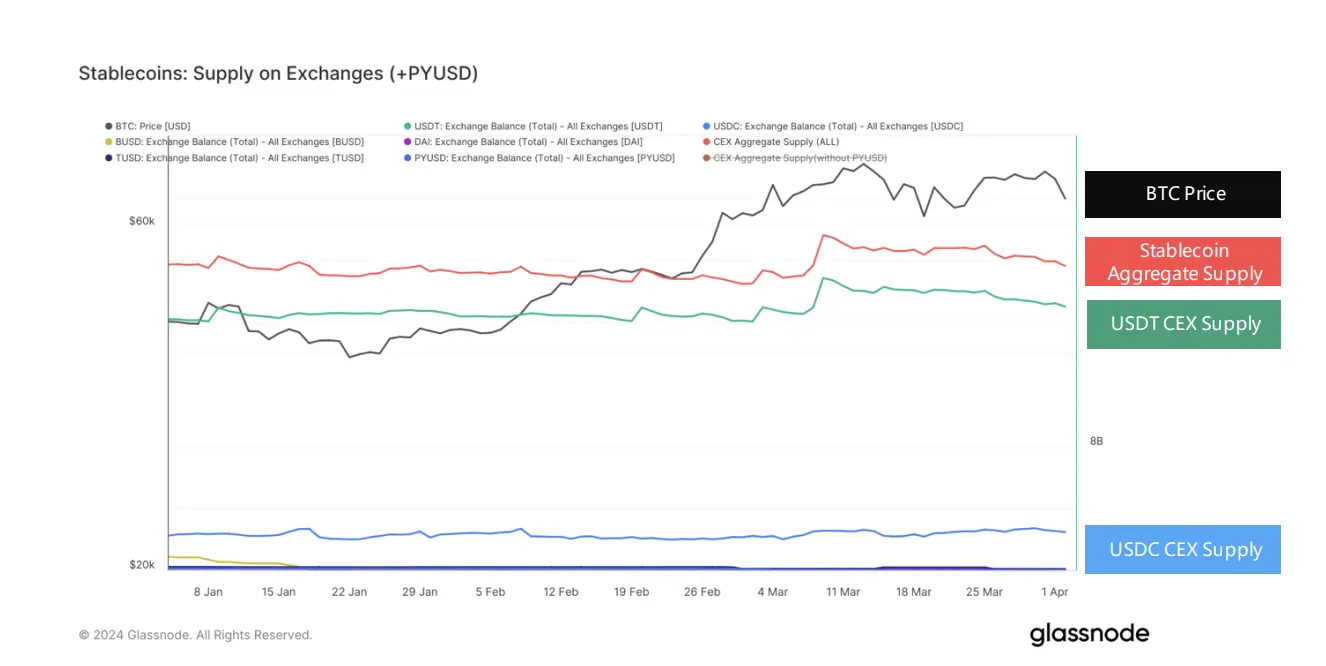

The growth of stablecoin volumes on exchanges and their market capitalization have historically been considered good indicators for determining traders’ positioning in the market.

KuCoin Research analysts note that “The issuance of USDT increased by 5.825 billion in March, and USDC issuance increased by 3.803 billion, showing a significant increase compared to the previous month.”

Source: KuCoin Research

The increase in the balance of stablecoins was observed in early March, even before Bitcoin reached new historical highs. Glassnode analysts note that Tether recorded the largest inflow of funds to the exchange on March 3, increasing by 192% from $806.2 million to $2.466 billion as of March 5.

“During this period, compared to other stablecoins, the correlation between USDT in CEX and BTC’s price was higher.”

Source: KuCoin Research

Glassnode reports that the total balance of stablecoins on all exchanges has increased from $19.7 billion on April 7 to the current value of $20.34 billion. This figure indicates that traders are preparing to open new positions, expecting Bitcoin to resume its upward trend.

The growth of stablecoin volumes on exchanges and their market capitalization have historically been considered good indicators for determining traders’ positioning in the market.

Bitcoin halving is an important event for the industry that the crypto community is looking forward to. That is why several crypto exchanges, such as OKX, WhiteBIT, Binance, and others, organize various activities offering crypto users to win various prizes.

Read Also: The Impact of Web3 on the Gaming Industry

Investments in Blockchain Games Fell by 57%

The blockchain gaming industry faced a difficult start to the year as venture capital investments dropped by almost 60% to $288 million, indicating investor caution.

According to DappRadar, the sector managed to raise $288 million in funding in the first quarter, which is 57% less than in Q4 of 2023.

“The focus of these investments has largely been on web3 games and infrastructure. This surely highlights a period of foundational building aimed at enriching the web3 gaming ecosystem.” writes Sarah Gergelas, blockchain analyst at DappRadar.

She also notes that there were only two prominent deals during this period that shaped the investment landscape: Parallel Studios and Gunzilla Games.

In March, Parallel Studios raised $35 million with the support of Distributed Global, The Operating Group, VanEck, and others. Gunzilla Games also raised $30 million for its upcoming project Off the Grid. Despite investors’ doubts, the influx of investment in new game development and technological progress “shows that there is a lot of hope for the future,” Gerhelas said.

New Project By Tether CEO

Paolo Ardoino, CEO of Tether, announced in his X that the company is in the process of opening up access to its tokenization platform to the community. The platform plans to revolutionize the tokenization environment with its unique capabilities, the statement said. It will be completely noncustodial, allowing users to have full control over their assets. In addition, it will support multiple blockchains and asset types to meet a wide range of user needs.

According to Ardoino, one of the platform’s features is that it offers a high degree of personalization. Users will be able to tailor their experience to their specific needs, making the platform truly user-centered. In addition, the platform will become a brand that has the technical features of Tether technology with USDT support.