A major Ethereum whale has made headlines after re-entering the market with a $46.5 million ETH purchase just days after offloading double that amount. The move has drawn attention across the crypto space as it coincides with a sharp uptick in Ethereum demand and major withdrawals from centralized exchanges.

According to on-chain data shared by Sentora, over 140,000 ETH worth nearly $393 million was pulled from exchanges within 24 hours. That was the biggest single-day withdrawal in more than a month. The withdrawal was timed similarly to when the price of Ethereum leaped over the $2,760 area, indicating the increasing confidence of investors.

Source: Sentora

The same number of withdrawals was observed on May 12, when ETH cost approximately $2,520. The recent outflow of exchanges seems to represent a move out of short-term trading and into long-term holding.

In the meantime, the whale had just sold 30,000 ETH over the counter via Wintermute for $78.63 million. The same party repurchased a whopping 15,000 ETH the very next day at a total cost of $46.5 million or an average of $2,818 per coin.

Also Read: $1B Tokenized Fund Launches on XRP Ledger, Featured in WEF Report

Ethereum Futures and Whale Activity Point to Strategic Market Repositioning

Data from the @spotonchain analytics account suggests this whale, described as a “smart institution,” made a $6.72 million profit from the earlier sale after holding for only 15 days. The decision to re-enter the market so quickly indicates renewed confidence in Ethereum’s short-term trajectory.

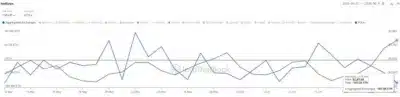

Besides the whale’s daring comeback, Ethereum futures are also warming up. Glassnode reported that open interest on ETH futures has soared to $20 billion, a new record that indicates a rising surge of speculation.

Source: Glassnode

This rise in open interest is driven mainly by traders’ margin to stablecoin-margined contracts such as USDT and USDC. In spite of the recent decrease in the value of ETH by 4.31 percent, the leveraged traders are active and optimistic.

These phenomena, together with whale activity, significant exchange withdrawals, and all-time high futures interest, imply that Ethereum’s market direction may have changed. The accumulation by long-term holders and institutions is in place, and the stage is ready to see a new surge of bullish runs.

Also Read: Wall Street Is All In: Binance CEO Says Crypto Adoption Has Already Begun