The ongoing legal dispute between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs continues to generate debate. Investors and legal experts are closely monitoring the case as speculation grows regarding a potential resolution.

According to a recent 36crypto report, the SEC’s latest closed-door meeting, conducted under the Sunshine Act, covered enforcement actions and litigation settlements. While the meeting specifics remain undisclosed, many believe the Ripple case was discussed.

This speculation is fueled by the SEC’s recent approach to crypto-related enforcement, which has shown signs of shifting.

Also Read: SEC Ignores Ripple Lawsuit, Dismisses Yet Another Crypto Case: What’s Next?

SEC’s Enforcement Stance Shows Signs of Change

Several developments in recent weeks suggest the SEC may be altering its approach to cryptocurrency regulation. The agency has either dropped or paused investigations into multiple crypto firms, including Coinbase, Uniswap, Gemini, and Robinhood Crypto.

Additionally, the Binance lawsuit has been placed on hold for 60 days, and Consensys reached a settlement resulting in the dismissal of its case.

While some legal experts view these moves as part of a broader regulatory adjustment, others remain skeptical. Former SEC attorney Marc Fagel argues that expectations of a significant retreat by the SEC may be overstated.

However, pro-XRP attorney Bill Morgan believes the agency’s position has weakened since Judge Analisa Torres ruled in 2023 that XRP itself is not a security.

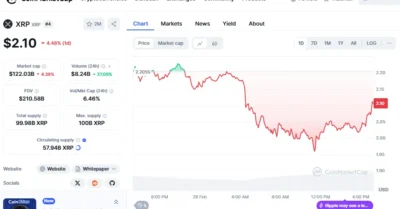

Meanwhile, the market has reacted to the ongoing regulatory uncertainty. XRP saw a decline of 4.48% in the past 24 hours, bringing its price down to $2.10.

The cryptocurrency experienced volatility throughout the day, peaking at approximately $2.2055 before dropping below $1.95 at its lowest point. Trading volume remains high, increasing by over 27% to $8.24 billion.

Source: CoinMarketCap

Political Pressure for Crypto Clarity Increases

Calls for clearer regulatory guidelines have also intensified. U.S. Senator Cynthia Lummis, a prominent advocate for cryptocurrency legislation, recently emphasized that most digital assets do not meet the criteria to be classified as securities under the Howey Test.

She also stated that the U.S. lags behind other nations in establishing comprehensive crypto regulations.

Lummis’ remarks align with Judge Torres’ ruling, which classified XRP transactions as distinct from traditional securities offerings. With growing bipartisan support for regulatory reform, the chances of an SEC policy shift appear to be increasing.

These legal and political factors will likely shape the next phase of the SEC’s case against Ripple.

As developments continue to unfold, market participants are awaiting further clarity on whether the SEC will reconsider its stance or proceed with its enforcement efforts against Ripple. The outcome of this case could have significant implications for the broader cryptocurrency industry.

Also Read: Here is Why XRP and the Global Crypto Market is Crashing