- XRP price drops despite strong ETF inflows and market interest.

- Long liquidations drive XRP’s price down, despite ETF growth.

- Growing institutional confidence contrasts with ongoing XRP liquidation pressures.

XRP’s price has seen a significant drop today, now sitting at $1.99, down by 0.69% in the last 24 hours, despite a continued streak of inflows into XRP-related exchange-traded funds (ETFs). The cryptocurrency’s market cap is now $120.89 billion, showing a 0.43% decrease. With a trading volume of $1.99 billion, reflecting a 67.48% rise in activity, the sudden price decline has raised questions among investors.

XRP-related ETFs, including Canary (1XRPC NASDAQ), have shown positive performance, with substantial inflows driving the total net asset value of the US XRP Spot ETF to $1.18 billion, representing nearly 1% of XRP’s total market cap. This consistent ETF activity, highlighted by daily inflows of $20.17 million, should theoretically be a catalyst for upward pressure on XRP’s price. However, the opposite seems to be happening.

Market Liquidations and ETF Inflows Diverge

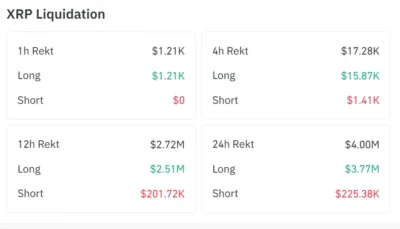

One factor that could explain the price downturn lies in the ongoing liquidation activity. Over the past 24 hours, a staggering $4.00 million worth of XRP positions were liquidated, with $3.77 million coming from long positions.

This liquidation trend has continued over shorter periods, including $2.72 million in the past 12 hours, with most of the liquidated funds from long positions. The market sentiment appears increasingly bearish, with traders who had bet on price increases being forced out, despite the institutional inflows fueling XRP ETFs.

Also Read: Ripple Executive Shares Groundbreaking XRP Strategy at Solana Event

Meanwhile, the XRP Spot ETF is still seeing inflows, and its net asset value continues to grow, indicating strong institutional interest in XRP. However, the broader market dynamics are proving more complex. The surge in liquidations has overshadowed the positive sentiment generated by ETF investments, contributing to XRP’s current price decline.

Investor Sentiment Remains Torn

While institutional investors continue to show confidence in XRP through ETF purchases, retail traders are facing mounting liquidation pressure. The gap between growing ETF inflows and the ongoing liquidation activity is confusing the market.

XRP’s price is currently at $1.99, a modest figure that has fluctuated considerably in the past few hours. This price drop could be attributed to the strong liquidation pressure on long positions, which remains a dominant theme in the market.

For XRP investors, the growing gap between ETF inflows and liquidation-driven price drops signals a volatile environment. The ongoing developments point to the necessity of closely monitoring the interplay between institutional demand and retail liquidation pressures as the market adjusts to these conflicting forces.

Also Read: Pundit: People Say 100 Billion XRP Supply Is Too Much, But Here’s What You Don’t Know